Estate Planning and Asset Protection

Most people would be more than happy to receive an inheritance. However, for those who have put in place asset protection strategies or who could be facing any form of litigation, directly receiving an inheritance can cause significant unnecessary difficulties.

People in financially high risk occupations, such as professionals, business owners and company directors, will often prefer not to receive inherited assets directly in their own names.

One solution is to ensure appropriate estate planning strategies are implemented via the wills of people likely to leave an at risk individual assets.

For example:

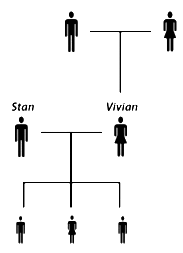

- Vivian owned and ran (via her directorship of the trading company) a design business.

- She had deliberately ensured that most of her assets were in her husband’s (Stan’s) name. At least this way, if the business went bad, their home and savings would be protected.

- Unfortunately, when Vivian’s parents died, she received the family beach house directly into her name.

- Though the business was doing well, its future success was not guaranteed.

- To protect the beach house from any future litigation, Vivian transferred it to a trust – and paid $280,000 stamp duty.

This stamp duty expense (and any capital gains tax, legal and accounting fees) could have been avoided if Vivian’s parents had included a TDT in their wills.

Testamentary Discretionary Trusts

A Testamentary Discretionary Trust (TDT) is a trust established in someone’s will. It comes into existence only when the person dies. A Lineal Descendant TDT is a trust established in someone’s will for the benefit of their lineal descendants.

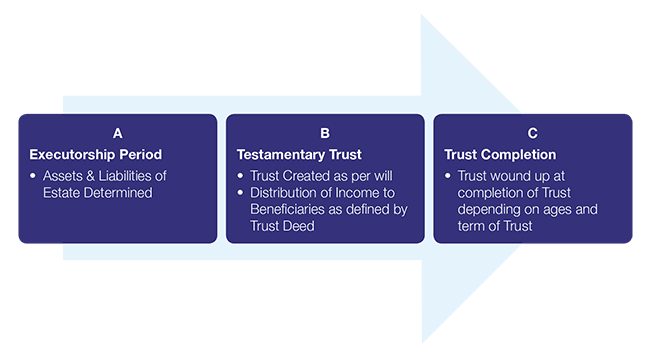

- Let’s assume that someone dies at point A.

- The executor’s job involves finding all the assets, paying out any debts and usually, at point B, distributing what’s left to the beneficiaries.

- If there is a TDT, part or all of what’s left remains in the estate and is distributed later – at any time between point B and point C, depending on the terms of the will. Point C can generally be up to 80 years from point A.

- A will can establish more than one TDT.

Who controls the assets

Whoever is named in the will as trustee controls the TDT’s assets. Like any trust, a TDT can be as flexible or as fixed as desired. The trustee can be given full discretion or no discretion as to who should receive income and capital from the TDT and when they should receive it.

The trustee is often the same person who was appointed as executor, and can also be a beneficiary. For example, a parent can establish a TDT for each child’s inheritance. Each adult child can be the trustee of their own trust, and may also be an executor.

Why are they used

TDTs can be used for a variety of purposes, including:

- To protect inheritances from a beneficiary’s relationship breakdown;

- To protect inheritances from a beneficiary’s bankruptcy creditors;

- To minimise tax – both income tax and capital gains tax;

- To protect a beneficiaries government-sourced pension or other benefits;

- To care for children and people with mental disabilities; and

- To protect spendthrift beneficiaries from themselves.

Using TDTs to split income with young children

As an estate planning strategy, TDTs can be of benefit:

- For families with small children;

- Where extra income would be needed to support the surviving family members should a parent die; and

- Where minimising and having flexibility in relation to tax planning is important.

How do TDTs work

As mentioned above, a TDT is simply a trust established by someone’s will.

Rather than all the deceased’s assets being distributed by the executor upon death, some or all of the assets remain in trust for the benefit of a specific group of beneficiaries named in the will.

Trust income distributed to children, of any age, will be taxed at adult rates rather than the penalty rates that normally apply to minors’ unearned income from a standard (non will-created) trust.

The trustee can have full discretion as to who receives trust income and capital, or restrictions can be provided.

For example:

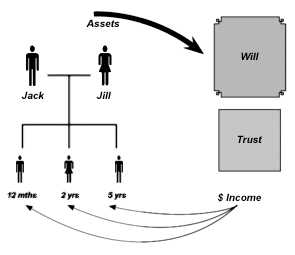

- Jack included a testamentary trust in his will.

- When he died, Jill used the trust to distribute income to herself and the three children.

- Jill was the trustee.

- She was able to receive $64,000 tax free each year for herself and the children.

Why use a lineal descendant TDT

A lineal descendant TDT is established for a person’s lineal descendants – that is children and grandchildren, and on down a lineal family tree. A properly drafted lineal descendant TDT can assist in keeping an inheritance out of the reach of the Family Court where a beneficiary is involved in a family law property dispute.

Protect inheritances from the in-laws

Many parents are concerned that the inheritance they leave to their children could end up in the hands of a former son-in-law or daughter-in-law if their child’s marriage breaks down.

If a child receives an inheritance in their own name, that inheritance will generally be intermingled with the child’s other assets (e.g. by paying off a house mortgage) and thus will become ‘matrimonial property’ available for distribution by the Family Court.

However, if a child’s inheritance is distributed to a lineal descendant TDT under a will, those assets can be kept apart and protected from direct distribution (even if income from the assets is reinvested within the TDT from time to time).

How successfully the assets are protected depends on how the will and lineal descendant TDT are drafted and the circumstances at the time of the relationship breakdown.

For example:

- When Mary died she left her only son Jack an inheritance of $800,000.

- Jack had been married to Jill for 10 years at the time. They separated shortly after.

- Jack and Jill’s matrimonial property amounted to $1,200,000 after the mortgage was taken into account.

- In determining the property settlement, the Court took into account Jack’s inheritance. However, because of the terms of the lineal descendant TDT that held those funds, they were not available for distribution to Jill.

- Jill got $700,000 (that is, slightly more than half the matrimonial assets) rather than the $1,000,000 she might have otherwise received. In other words, Jill received approximately half of the matrimonial property but no part of Jack’s inheritance.

Summary

| Advantages | Limitations |

| The Trustee and Appointor control the assets held by the Trust. | TDT structures are complex and difficult to administer resulting in substantial costs of running the trust. |

| A TDT is built to look after the family and non-family beneficiaries with the income and capital to be distributed in a specified way, rather than at the complete discretion of the Trustee. | Specific requirements built within the TDT may be difficult to draft and implement. |

| Income streams can be created from a TDT by overcoming some difficulties. | Income and Capital gains must be distributed annually or the TDT pays tax at the top marginal rate. The TDT must make timely decisions as to income and capital gains to minimize tax rates. |

| A Trustee of a TDT is capable to look after capital and income beneficiaries differently – i.e. each type of beneficiary receiving a different type of benefit from the Testamentary Trust. | Income distributed from a TDT is subject to beneficiaries’ marginal tax rate. |

| In certain circumstances capital gains tax benefits to the TDT and the beneficiaries. | TDT must be wound up no later than 80 years from the date of establishment unless otherwise provided in the terms of the Will. |

| Assets remain protected from creditors of beneficiaries and government sourced pension or other benefits. | |

| In circumstances of matrimonial disputes, subject to the Court’s discretion, may provide an effective sheltering of assets. | |

| Minor beneficiaries taxed like an ordinary taxpayer rather than penalty rates. | |

| Part of the TDT can house a deceased’s superannuation benefits. Depending on the use of the superannuation benefits, tax benefits may apply. |

Conclusion

A properly drafted TDT provides a number of significant benefits for the family left behind after a person dies. Unfortunately, any ‘second chance’ ability to get assets into a TDT after death is quite limited – and usually very costly.

Normally, anyone who is aiming to build wealth during their lifetime, and to provide for their family after their death, should consider putting in place a TDT (or lineal descendant TDT) under their will. A properly drafted TDT can generally create a ‘set and forget’ structure that provides peace of mind now, while still accommodating the needs of evolving family dynamics in the future.

Need more information?

If you have any questions or need more information, please contact us.

Important information and disclaimer

This publication has been prepared by AustAsia Group.

Any advice in this publication is of a general nature only and has not been tailored to your personal circumstances. Accordingly, reliance should not be placed on the information contained in this document as the basis for making any financial investment, insurance or other decision. Please seek personal advice prior to acting on this information.

Information in this publication is accurate as at the date of writing, 18 October 2017. Some of the information has been provided to us by third parties. Whilst it is believed the information is accurate and reliable, the accuracy of that information is not guaranteed in any way.

Opinions constitute our judgement at the time of issue and are subject to change. Neither the Licensee nor any member of AustAsia Group, nor their employees or directors give any warranty of accuracy, nor accept any responsibility, for any errors or omissions in this document.

Any general tax information provided in this publication is intended as a guide only and is based on our general understanding of taxation laws. It is not intended to be a substitute for specialised taxation advice or an assessment of your liabilities, obligations or claim entitlements that arise, or could arise, under taxation law, and we recommend you consult with a registered tax agent.