- Services

- Business Structural Advice and Asset Protection

- Aged Care and CentreLink Services

- Company Maintenance and ASIC Assistance

- Estate Planning and Death Benefits

- Financial Hardship and Cashflow Management

- Portfolio Administration Service

- Life Insurance Advice & Claims Assistance

- Premium Investment Portfolio Service

- Retirement Advice and Planning

- SMSF Administration Services

- Self Managed Super Fund (SMSF) Set Up

- Shares and other Investment Advice

- Super Advice

- Super Consolidation and Lost Super Assistance

- FAQ's

Your ultimate financial goals will significantly impact your ultimate lifestyle ambitions.

- Where you are now;

- Where you want to be in the future given your risk profile;

- How to build Assets and other Investment Advice;

- Investment recommendations, portfolio management and stockbroking;

- Superannuation and Personal Insurance;

- Retirement lifestyle and income; and

- How you want your assets disposed of when you pass away.

Our Approach

Wherever you are in your financial journey, you deserve the best financial advice: it will make all the difference.

We offer an exclusive client experience. We know that every client is different, so we don’t adopt a one-size-fits-all approach. We work with you to help you recognise your true intent, your goals, aspirations and all the factors that might hinder those outcomes.

We provide advice to help you protect yourself and your family and plan for your future.

We know that one of the keys to success is flexibility as you move through the stages of life. We will regularly meet with you to update you and help make any variations if your personal circumstances change.

We’re different, and that makes all the difference.

At AustAsia Group, we can assist you with Structural advice, including determining the correct ownership structure, business structure advice, and ensuring your assets are protected if something were to happen. Careful consideration needs to be made as several factors go into determining what structure is right for you. The right structure is crucial to succeeding in an increasingly complex business environment.

Asset Protection Services

Asset protection is a major factor to consider when deciding on your business structure. With structures such as sole traders or partnerships, it is more complex to separate business assets from those of your own. In contrast, utilising a company structure can afford greater asset protection as it clarifies the separate assets of the business from your personal assets. This is particularly important if the business becomes unable to pay its creditors to ensure your personal assets are not at risk. Our consulting team are experts in this area and will assist you with providing such advice.

See also The 4 Principles of Business Structure & Asset Protection

Company Registration Services

AustAsia Group can set up the structure you then proceed with. From the ASIC registration of the company, to the ABN application for the related trust, we can do it all for you. Our teams will work together to complete the set up of companies, units trust, discretionary trusts, child maintenance trusts, as well as assistance with upgrades of the existing deed and company constitutions to make sure everything is up to date with legislation. If this is something you believe AustAsia can assist you with, please contact us.

Aged Care can be complex with industry regulations, dealing with Centrelink, processes and costs. With this major life change occurring, completing confusing paperwork is the last thing you want to be doing.

We specialise in helping you with your parents and/or personally.

At AustAsia Group, we can assist you with:

- Reviewing assets and completing the complex Centrelink aged care forms;

- Reviewing aged care costs. There are many types of fees you may be asked to pay, including accommodation payments, basic daily fee, means-tested care fee, and other extra service fees;

- Constructing a detailed cash flow budget, identifying income streams available and expenses for the next 12 months. This provides you with a full picture of your finances – including anticipated aged care expenses;

- Assisting in selecting the optimal fees package based on your needs your cash flow;

- Consolidating bank accounts from multiple institutions into one central bank account, then have all income sources paid into this account, so all expenses can be paid from this single account, to keep things simple;

- Dealing with medical bills and any other expenses;

- Structuring your financial affairs to minimise future means-tested care fees; and

- Providing investment advice, if needed.

The ongoing administration for a company is something AustAsia Group can help with. Being your ASIC Registered Agent and Registered office, means we can act as intermediaries between you and ASIC, helping you meet your regulatory and lodgement obligations.

We handle a large number of companies, so we are familiar with the requirements of the Corporations Act and dealing with ASIC in general, so you don’t fall foul of the ASIC, which can often result in harsh penalties.

Registered Office Services

We provide the following services:

- Maintain your company’s corporate registry details on ASIC, using EDGE approved software;

- Download ASIC Company Statements, ASIC Invoices and Company Minutes/Resolutions;

- Ensure that the company statement has been reviewed and the company remains solvent each year;

- Lodge any changes to company details, as advised by you, and prepare all related ASIC documents during the year at no additional cost;

- As we are the Company’s Registered Address, we ensure that you comply with ASIC’s Registered Office requirements, such as:

° Our office is open the hours as required by ASIC; and

° We provide storage for the Company’s Register (including all required ASIC documentation). - Reduce your company’s administrative burden and help you avoid ASIC late fees and penalties; and

- Liaise with ASIC as and when required.

Frequently Asked Questions

What is a Registered Office Address?

An Australian company must have a registered office that is open during business hours. A Registered Office must receive correspondence and does not need to be the same as the company’s principal place of business, but it cannot be a post office box.

What is an ASIC Registered Agent?

An ASIC Registered Agent facilitates and streamlines the submission of documents for lodgement to the registers maintained by ASIC and the receipt of notifications from ASIC about the annual review obligations of registered Australian companies. An ASIC registered agent is the person registered Australian companies authorise to submit documents to ASIC, and may receive notifications on behalf of the company and/or provide other administrative services to businesses.

Estate Planning is more than just about having a Will. We recommend you have a good estate plan in place to ensure the management of your complete financial affairs executed effectively. This is something our Legal team can assist you with.

When putting your estate plan together, your super also needs to be reviewed to make sure you have nominations in place to make sure your super be distributed how you want it to. As the trustee of the fund manages your super, the trustee will be distributing your Super. Whether you have a Self Managed Superfund or Retail/Industry/Wrap Super account, you need to make sure you have an updated nomination in place on your Super account.

Estate Planning Services

At AustAsia Group, we can assist you with:

- Discuss with you the options for your Supers Binding Death Nomination (BDN);

- Help with all documents you require to update or amend your current nomination;

- As SMSF specialists, we can assist you with incorporating sophisticated estate planning, including specific bequests, lumps sums, and reversionary pensions for your SMSF funds.

As your Superannuation fund may become one of your biggest assets as you get older, making sure it is going to the right people in the most tax-effective way is very important.

Sometimes life can be tough, especially if you have experienced financial stress due to unexpected life events such as redundancy, reduction of income, illness or injury, relationship separation or disease outbreak. You are not alone. We can help in a range of situations by helping you manage your financial stress and get you back on track.

When times get tough

At AustAsia Group, we can assist you with:

- Reviewing your current debts and liaising with the relevant parties to lodge hardship applications, get payment holidays, set up payment plans and consolidate your debts;

- Negotiating with creditors to get a reduction in the amount that you owe. We are very successful in getting the creditors to accept a lesser amount in full and final settlement of the debt, which can save thousands of dollars;

- Reviewing your cash flow and monthly budget so you can see where you are at now, and what is coming in the future to help you plan;

- Setting up a central bank account in your name, to be managed by AustAsia Group, which can then be used to pay expenses and receive income;

- Consolidating all other bank accounts from multiple institutions into this one central bank account to make it simpler;

- Monitoring your income and expenses to make sure everything is received and paid on time; and

- Work with you to improve your credit rating to improve your future financial health.

Let AustAsia Group assist you, so you can get on with enjoying life and start planning for your future.

Portfolio Administration Services

Have you had enough of chasing statements relating to your investments or simply do not have time to administer your portfolio? Then AustAsia is here to help. Managing your investments can be time-consuming with having to receive multiple documents from registries, tracking shareholdings, making sure you are receiving dividends into your bank account and working out your cost bases.

At AustAsia Group, we can:

- Change the address for your investments to be here at AustAsia Group so that we receive all your correspondence and paperwork;

- Collect and record investment information (share trades, dividend and interest payments etc.);

- Send you any corporate actions (entitlements and share purchase plans) with the key information so you can make it easier for you to make a decision. We will take care of all the relevant paperwork and lodge directly with the share registry;

- Supply you with regular reports which help you monitor your investments and portfolio valuation to meet your needs;

- Assist with providing all information directly to your accountant.

This means that you continue to maintain control over your investment decisions whilst outsourcing the professional administration of your portfolio to AustAsia Group.

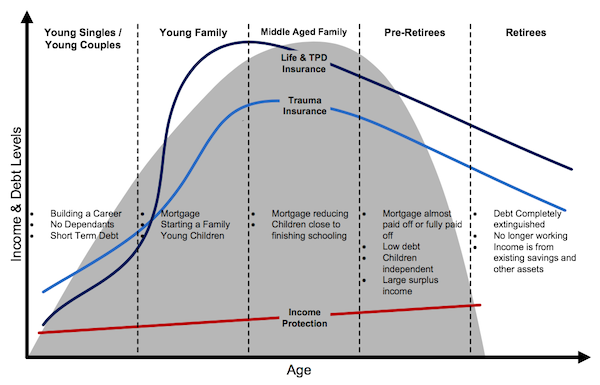

To have or not to have, that is the question.

Get the insurance cover that suits you.

Making an insurance claim

During the tough time of any unexpected events, AAG can assist you with:

- Review your insurance policy and ensure you are entitled to claim on your current insurance policy;

- Liaise directly with the insurer and request any required paperwork;

- Liaise directly with the hospital and request any medical reports or other documents to support the claim;

- Complete claim paperwork and lodge the claim on your behalf;

- Constantly monitor the claim process and keep you informed

- Follow up with the insurer if needed;

FAQ’s

What is Income Protection?

Income protection replaces the income lost through your inability to work due to injury or sickness. There is generally a waiting period between 15- 60 days on this insurance, depending on the level of cover and premiums paid. Income protection will only cover a maximum of 75% of your gross income for a maximum period of 2 years.

What is Trauma Cover?

Trauma provides cover if you are diagnosed with a specified illness or injury. These policies include the major illnesses or injuries that will significantly impact your life, such as cancer or a stroke. It is also referred to as ‘critical illness over’ or ‘recovery insurance’.

What is Total and Permanent Disability Cover (TPD)?

TPD pays a lump sum to assist with rehabilitation costs, debt repayments and future living costs if you are totally and permanently disabled. TPD is often bundled with life cover. It is important to note that TPD is usually offered in 2 definitions, ‘own’ or ‘any’. TPD ‘own’ means that you cannot work again in your usual or own occupation. TPD ‘any’ means that you cannot work in any occupation. For this reason, TPD ‘own’ cover is more expensive.

What is life/death cover?

Also known as ‘term life’ or ‘death cover’, life cover, as the name suggests, pays a set amount of money when you die. This money will go to the people you nominate as beneficiaries on your policy.

Retiring in comfort doesn’t happen by accident. It requires planning and strategic arrangements. For this reason, at AustAsia Group, we encourage our clients to think long-term and plan for the end game, even while still in their healthiest and most productive years.

Forward Planning and Strategic Services

We do this by asking the following two simple questions:

- When do you want to retire?

- What lifestyle do you want to enjoy when you retire?

Then we listen to what you say, what your vision for retirement is, and help you plan to make it possible. Some of the ways we assist in retirement planning include:

- Assessing your access to Centrelink payments;

- Helping you pay less tax;

- Investigating a transition to retirement pension;

- Advising on shares and investment properties – what should you keep, what you should buy and what you should sell;

- Advising on whether you should keep your current house or downsize, investing the surplus of funds into your superannuation;

- What about gifting?

- Asking questions you might not otherwise think of, like:

Do you need to consider an Aged Care Facility for you or your loved ones?

Download our brochure on Aged Care Planning & Assistance [PDF]

Having a retirement plan in place is vital to make your golden years align with your lifestyle vision. And the sooner you start, the easier it will be. Contact us today to talk to one of our highly qualified advisors.

Having a Self-Managed Super Fund (SMSF) doesn’t mean having to do everything yourself. However, selecting the right advisor is crucial. At AustAsia Group, we can provide knowledgeable guidance on all aspects of SMSFs, ensuring that your retirement savings are well-managed, and diversified, in the manner most appropriate for your long-term goals.

SMSF Administration

Once set up, we can assist you by:

- Developing SMSF strategies that will help you achieve your specific retirement goals;

- Rolling over your current super into your new SMSF;

- If your existing Life and TPD insurances are transferable, we can help transfer these to your new fund, so your SMSF can pay the premiums;

- Providing specific investment advice, helping you with the ongoing management of your investments and advising you when changes are necessary to ensure you maintain the right investment mix;

- Managing all administrative functions;

- Preparing financials and attend to all accounting functions; and

- Ensuring that you continue to meet the rules and regulations of a complying SMSF on an ongoing basis.

An SMSF is one of the many options available when building for the future. It isn’t for everyone, but for many that already have their own SMSF, they wouldn’t have it any other way.

Whether you are wondering if it is right for you, or need better advice and management of your existing fund, at AustAsia Group, we’re here to help.

SMSF Services

An SMSF is one of the many options available when building for the future. It isn’t for everyone, but for many that already have their own SMSF, they wouldn’t have it any other way.

Whether you are wondering if it is right for you or need better advice and management of your existing fund, at AustAsia Group, we’re here to help.

In a Self-Managed Superannuation Fund (“SMSF”), you set up and, most importantly, manage your own Superfund to maximise and control your retirement benefits. An SMSF is best suited for those looking for maximum control and transparency over their Super assets, and for those who are prepared to accept the responsibility of being trustees and work at managing the investment.

So how do you start your own SMSF?

At AustAsia Group, we can assist you to:

- Decide whether an SMSF is right for you;

- Set up and administer your SMSF;

- Understand your responsibilities and obligations; and

- Design and implement your unique investment strategy.

Advantages and Disadvantages

The main difference between SMSFs, and other super funds (like industry and retail funds), is that SMSF members are also the fund’s trustees. The trustee structure can be either corporate trustee individual trustee.

| Advantage | Disadvantage |

|---|---|

| Greater management control and flexibility | Greater responsibility |

| More investment choices, transparency on fees and investment returns | Harsh penalties for breaches |

| Using an SMSF in your overall investment strategy | It can be time-consuming |

| One fund for the family | Could be higher operating costs for low balance |

| More choices when receiving a pension | |

| Greater estate planning certainty and flexibility | |

| Potential Tax Savings |

AustAsia Group are SMSF Specialists

We are SMSF Specialists and manage over 180 SMSFs. We pride ourselves on our expertise and our ability to work closely with our clients. We also hold an Australian Financial Services License issued by the Australian Securities and Investment Commission. So, we are qualified to assist you with setting up your own SMSF, providing investment advice, and other ongoing services.

We will be there for you every step of the way. From setting up the fund, including deeds, minutes, bank accounts, ABN and TFN, corporate trustee and rollovers, to investing your super monies with regular reviews along the way.

If an SMSF is something you would like some further information on, please contact us.

Frequently Asked Questions

Superannuation is still the most tax-effective way to save to prepare for retirement. But, like any long-term investment, the fund has to be managed now.

Proper financial planning and strategy is essential in making it grow from something small in the present into a sizeable nest egg in the future.

Our expert team will help you to achieve that.

Superannuation Services

We can assist you with:

- Helping you develop definable and achievable retirement goals;

- Providing advice and insight on your existing funds;

- Helping you find the right products for you right now;

- Giving you a selection of investment options, each one tailored to achieving your goals within your tolerance for risk;

- Advice on salary sacrificing for tax optimisation and wealth-building;

- Assisting with consolidating your superannuation into one fund if you currently have multiple super accounts;

- Assisting with finding “lost super”; and

- Regular reviews of your superannuation strategy and fund performance.

Superannuation is an essential ingredient of your long-term wealth and one that is frequently overlooked, so let us help you.

If you have several super accounts due to changing jobs over time, and you can’t seem to track them all down, you have come to the right place for advice.

You may not be sure exactly what you have and what specific insurance is offered. In the meantime, you are unnecessarily paying multiple fees and charges, which would deplete your super, and then eventually reduce the pension available for your future retirement.

Super Consolidation Services

To consolidate your super accounts, AustAsia Group will be here to help you out with:

- Comparing the fees, charges and features amongst several super providers and recommend the most competitive one for you;

- Set up/retain a Super account to be the central place to manage your super;

- Rollover fully or partially your multiple super accounts into the central super account.

- Review your current overall financial situation and prepare relevant insurance quotes or organise the transfer of insurance ownership if applicable; and

- Review the investments within your super.

Lost and Unclaimed Super Services

With new legislation requiring Super funds to report and transfer inactive low-balance super accounts to ATO starting from 1 July 2019. you may have some super that is sitting with the ATO. If your super fund has not been able to contact you, or they haven’t received any contribution or rollover funds in the last five years, they will report you as a lost member to ATO, and your super may be transferred to ATO afterwards as unclaimed super.

At AustAsia Group, we can:

- Register ourselves as your tax agent, then liaise with ATO on your behalf;

- Complete relevant forms required by ATO to search for lost super/get unclaimed super back;

- Follow up with ATO on the progress and follow up for you;

- Monitor your Super accounts in the future and keep in touch.

Once you retire, your superannuation may be your biggest asset. Ensuring it is all in one place will give you peace of mind that you know your super is being taken care of.

If this is something you would like some more information on, please contact us.

What is an ASIC Registered Agent?

An ASIC Registered Agent facilitates and streamlines the submission of documents for lodgement to the registers maintained by ASIC and the receipt of notifications from ASIC about the annual review obligations of registered Australian companies. An ASIC registered agent is the person that registered Australian companies authorise to submit documents to ASIC, may receive notifications on behalf of the company and may provide other administrative services to businesses.

What is a Registered Office Address?

An Australian company must have a registered office that is open during business hours. A Registered Office must receive correspondence and does not need to be the same as the company’s principal place of business, but it cannot be a post office box.

What is life/death cover?

Also known as ‘term life’ or ‘death cover’, life cover, as the name suggests, pays a set amount of money when you die. This money will go to the people you nominate as beneficiaries on your policy.

What is Total and Permanent Disability Cover (TPD)?

TPD pays a lump sum to assist with rehabilitation costs, debt repayments and future living costs if you are totally and permanently disabled. TPD is often bundled with life cover. It is important to note that TPD is usually offered in 2 definitions, ‘own’ or ‘any’. TPD ‘own’ means that you cannot work again in your usual or own occupation. TPD ‘any’ means that you cannot work in any occupation. For this reason, TPD ‘own’ cover is more expensive.

What is Trauma Cover?

Trauma provides cover if you are diagnosed with a specified illness or injury. These policies include the major illnesses or injuries that will significantly impact your life, such as cancer or a stroke. It is also referred to as ‘critical illness over’ or ‘recovery insurance’.

What is Income Protection?

Income protection replaces the income lost through your inability to work due to injury or sickness. There is generally a waiting period of between 15- 60 days on this insurance, depending on the level of cover and premiums paid. Income protection will only cover a maximum of 75% of your gross income for a maximum period of 2 years.

What are the Advantages of a Self Managed Super Fund?

| Considerations | Background and Explanation |

|---|---|

| 1. Management Control and Flexibility | An SMSF provides superior management control and flexibility over your superannuation entitlements. As you are the Trustee of your SMSF, you have effective control over the operations, investment selection, and overall management of the SMSF, even if some of these activities are outsourced.

You are able to implement specific investment strategies that are tailored to your requirements and needs. Whilst there are set regulations and investment criteria that must be considered and adhered to, you essentially have control over the underlying investment selection of your superannuation entitlements. |

| 2. More Investment Choice | An SMSF can invest in most assets, similar to any other investors. Shares, commercial property, property syndicates, developments, residential property, managed funds, bonds, cash on deposit, mortgages and term deposits are examples. Further investment examples are artwork, antiques and other collectible assets, as long as they provide for the members’ retirement. |

| 3. Using An SMSF in your Overall Investment Strategy | Due to its tax advantage status, an SMSF may enable you to undertake different strategies outside of Super. Super may be invested in capital growth-oriented assets to utilize the 10 per cent Capital Gains Tax concession while investing in income providing assets to assist your current needs. Using a personal gearing strategy (outside of your Super) can further enhance this approach. Using a gearing strategy, you may receive a full tax deduction on the interest you pay and are only taxed 50 per cent of the nominal gain if the assets are held for 12 months or more. |

| 4. One Fund for the Family | You can set up a fund for yourself and up to three other people and consolidate your super balances. This could enable you to invest in higher-value assets than if you set up a fund with fewer members, achieve greater estate planning flexibility, and reduce fund costs. |

| 5. No Contribution Fees | When you make superannuation contributions to your SMSF, you do not pay any contribution fees. Likewise, you do not pay any exit fees when you withdraw funds from the SMSF. Whilst an SMSF will pay investment fees for the actual investment of the superannuation entitlements; there are no contribution fees payable. This can result in a reasonably significant saving for your superannuation. |

| 6. Tax Savings | With SMSFs, you can take greater control over the timing of tax events, such as starting a pension without triggering capital gains tax, when your superannuation assets move into the pension phase. You may also have the option of transferring assets that you own into your SMSF.

Other tax advantages include:

|

| 7. Flexibility When Receiving A Pension | The advantage of receiving a pension from your super fund is that a part of your pension is typically tax-free. The ATO recognises that as you have used your own funds to contribute to your superannuation fund, your investment is returned to you over the life of the pension.

Once the superannuation fund is paying a pension, the fund becomes exempt from tax. As such, all income and capital gains that the fund makes are not subject to tax. You pay tax when you draw out your superannuation pension each year. When you draw a pension from your superannuation fund, you can use an allocated pension. This means that your superannuation is allocated over your life expectancy. You are required to draw down a minimum pension and a maximum pension each year. You can also draw a lump sum or a combination of the two. Your circumstances at the time of withdrawing your pension need to be considered before withdrawing any funds either as a pension or a lump sum. The management control and flexibility generated through an SMSF continues to provide benefits when you commence drawing a pension. An SMSF provides flexibility and control over the investments utilised to provide a pension and how the pension is drawn. From 1 July 2007, if you are over 60, any pension that you draw from superannuation is tax-free. As a result, there is more reason to keep your options flexible and enable you to take a tax-free pension upon retirement. New announcements were made in the May 2016 Federal Budget that may limit the value of assets held in your pension account to $1.6m. This is not yet law, so it may not be passed. |

| 8. Greater Estate Planning Certainty and Flexibility | You can nominate who you would like to receive your super when you pass away without having to meet some of the constraints that apply to other super funds. |

What are the Disadvantages?

While an SMSF can offer greater opportunities to take control of your retirement savings, there are some potential disadvantages you should also consider:

| Considerations | Background and Explanation |

|---|---|

| 1. Higher Costs for Lower Balances | Although SMSFs generally only become cost-effective if the fund has $200,000 or more invested, especially if you outsource and pay for most or all of the fund administration. However, if you want to invest in direct property, an SMSF is the only vehicle for super funds. |

| 2. Greater Responsibility | When you set up an SMSF, you and any other fund members will generally need to be trustees (or directors of the corporate trustee) and be responsible for meeting a range of legal and other obligations. |

| 3. Harsh Penalties for Breaches | The Australian Tax Office has the authority to impose various treatments to deal with SMSF trustees who have breached super laws. These include:

|

| 4. Time Consuming | You will need to have enough time, knowledge and skills to manage your own super and meet your legal and other obligations. |

What are the Restrictions?

| Considerations | Background and Explanation |

|---|---|

| 1. Membership Restrictions | The law requires an SMSF to have less than five members and that all members must be trustees or directors of a corporate trustee. No member of the fund can be an employee of another member of the fund unless the members concerned are relatives. An arm’s length employee of a company, which contributes to the SMSF (in respect of its controllers), cannot be a member of the same fund as the company’s controllers. |

| 2. Investment Restrictions | Existing legislation requires that all financial transactions occur as they would if they were being conducted at arm’s length. The appropriateness of SMSF investments is now a key area of regulation, and the investments of an SMSF must consider the needs of the Fund’s members and their Risk Profile. Legislation has been passed to prevent people from putting inappropriate investments into their SMSF to avoid paying their marginal tax on investment earnings. Inappropriate investments may include the purchase of equipment for leasing back to the business. For example, a dentist leasing dental chairs and equipment from an SMSF would, in our opinion, not be providing for retirement benefits. |

| 2.1 Related Parties and Relatives | Your SMSF must invest for the sole purpose of providing for your retirement. Exiting investment rules meant that the fund is unable to:

|

| 2.2 In-House Assets | Government legislation limits Super funds from having more than five per cent of the market value of the funds invested in ‘in-house’ assets. The major exception is where a fund acquires premises used for business purposes. This may mean that an SMSF may invest in commercial, industrial or retail property. ‘In-house’ includes:

|

What are the Risks Associated with SMSFs?

| Considerations | Background and Explanation |

|---|---|

| 1. Responsibilities and obligations for SMSF trustees associated with running an SMSF | SMSF trustees need to comply with several obligations under the superannuation and taxation laws, as well as the trust deed. For example, there may be various consequences—for example, loss of taxation concessions—if an SMSF trustee fails to comply with their obligations. Even if one trustee is less actively involved, all trustees are equally liable for the fund’s compliance with the superannuation and tax laws.

The Australian Taxation Office (ATO) requires new trustees to make a declaration that they understand their responsibilities and obligations as an SMSF trustee, including to:

Trustees must understand that they remain responsible for managing the fund even if they outsource some or all of their responsibilities to external service providers. |

| 2. Risks associated with an SMSF | |

| a) Lack of insurance for SMSFs | Unlike APRA-regulated funds, SMSFs do not come with insurance. The potential loss of insurance benefits resulting from switching from an APRA-regulated fund to an SMSF is an important issue. SMSF trustees should consider whether it is appropriate to take out separate life insurance for members, including income and total and permanent disability cover, as part of the fund’s investment strategy. Although taking out this insurance will be at an additional cost to the SMSF, the risk of not having appropriate insurance may leave members worse off in retirement. |

| b) Other risks associated with an SMSF structure | There may be risks, for example, associated with:

|

| 3. The need to develop and implement an appropriate investment strategy for an SMSF | Developing and implementing an appropriate investment strategy is a serious responsibility for SMSF trustees. The trustee will ultimately remain responsible for the fund’s investment strategy even if they seek investment advice from an adviser.

Trustees must understand:

|

| 4. The time commitment and skills needed to run an SMSF effectively | Trustees can use external research or advice to develop their financial knowledge over time. Still, they remain ultimately responsible for ensuring that investment decisions are made and implemented according to the SMSF’s investment strategy. |

| 5. The costs of managing an SMSF | The costs associated with managing an SMSF are potentially significant. They should be considered to make an informed decision about whether an SMSF structure is a suitable superannuation vehicle for them. The costs of managing an SMSF include:

Please see Appendix H for more details and examples of the costs. |

| 6. The need to consider and develop an exit strategy for an SMSF | Trustees and members need to consider and develop an exit strategy for the SMSF in situations, for example, where the compliance requirements become too onerous or costly for the SMSF trustee.

It is important to be aware of the process for winding up an SMSF and the likely costs associated with that process. |

| 7. The laws and policies that affect SMSFs are subject to change | The taxation and superannuation laws and policies that apply to SMSFs may be subject to continual change, including changes to legislation and regulatory policies and standards. |

How do I set up an SMSF?

You tell us, and we do the rest. Prior to this decision, we will discuss and consult with you to ensure an SMSF is right for you and the objective(s) you are trying to achieve.

We will handle the process, summarised here, and provide you with all documentation:

- Agree on the SMSF set up cost;

- Agree on a name for the new Fund;

- Set up the Fund and a Company as Trustee.

(Sample Name. XYZ Super Pty Ltd AS TRUSTEE FOR XYZ Super Fund); - Apply for ABN and TFN for the Fund;

- Set up a new bank account for your SMSF;

- Appoint us as the adviser so we can access your current fund details and review your current super’s position, including life insurance;

- Organise rollover paperwork for both super and life insurance;

- Organise new life insurance if the existing life insurance is not transferrable;

- Receive the rollovers from the other funds;

- We will provide you with some investment options for your money and start investing (Cash/Term Deposits, Shares; and/or Property);

- Once your fund is set up, we will provide you with a Complying Fund Letter to give to your employer, so future SG Levy contributions (currently 9.5%) are paid directly into your new SMSF.

How can AustAsia Group Help You?

We are SMSF Specialists. We have over 180 SMSF clients and pride ourselves on our expertise and our ability to work closely with our clients.

Through AustAsia Accounting Services and AustAsia Financial Planning, AustAsia can assist you in developing your investment strategy to satisfy the investment requirements governing SMSFs. We can assist in restructuring your business affairs so that you may hold your business premises in your super fund, invest in managed funds (includes share, bond, property and cash funds and a range of diversified funds), property syndicates, direct shares and a variety of other investments. They can complement your existing investments or form the core of your super fund.

AustAsia Financial Planning holds an Australian Financial Services License issued by the Australian Securities and Investment Commission. We are licensed, qualified, and experienced in recommending and implementing Superannuation and investment strategies.

AustAsia Accounting Services is a registered tax agent, and is experienced and qualified to help you meet the legal requirements of an SMSF, including record keeping, preparing annual reports for the fund, and attending to the legislative requirements of auditing, tax returns and the compliance return.

If you would like to investigate this super option further, please contact us.

AAG Case Studies

Business Specialists and Advisers in

Our Wealth Management and Protection Team