We will focus on the American consumer for demonstration purposes.

What are tariffs?

Tariffs are taxes on imported goods designed to protect domestic industries, reduce trade deficits, generate revenue, & provide leverage in trade negotiations (as we are seeing now), but do they work?

How do they work?

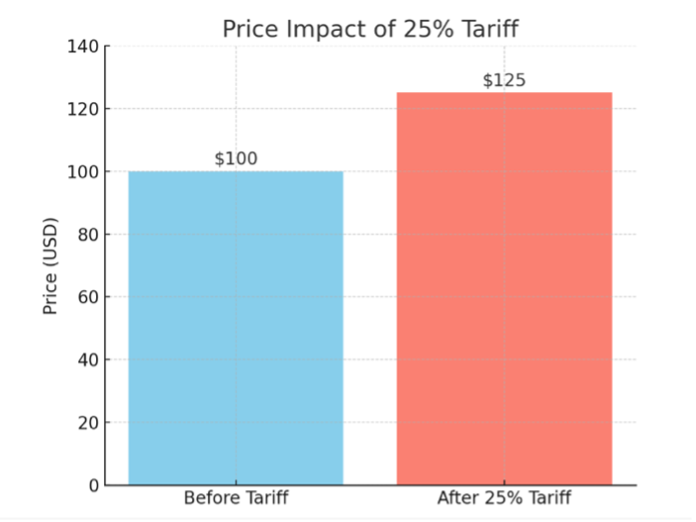

If a $100 good faces a 25% tariff, it now costs $125 before it hits the shelves.

So, the US government collects $25 (the tariff), and the US consumer now pays $125 for the same good that previously cost $100.

Consumers usually pay the extra cost, but sometimes the importer will absorb some of it. So, they may pass $20 onto the consumer & absorb the $5 themselves, which will lower their profit.

But you get the idea….

Most studies of Trump’s tariff increases during his first administration conclude that the tariffs were entirely borne by either U.S. households through increased consumer prices or corporate profits.

Currently, there is an opportunity for companies to pass the full $25 to the consumer and attribute any price increase solely to the tariff.

The point is…. The country exporting to the US does not pay the tariff. The US government collects the tariff & the cost is borne mainly by the US consumer.

Do tariffs work?

1. To protect domestic industries?

✅ Yes, in the short term – they can shield local industries from cheaper imports and temporarily boost local production.

⚠️ But – without long-term innovation and investment, protected industries can become stagnant and rely solely on tariff protection to be viable.

So, inefficient industries are propped up instead of being improved.

So, inefficient industries are propped up instead of being improved.

2. Reduce trade deficits

❌ Not reliably – trade often shifts to other countries instead of shrinking overall.

US-China tariffs lead to trade rerouting, not elimination.

3. Create local jobs

⚖️ Mixed – jobs are supported in protected sectors (e.g. steel), but other industries that rely on those goods (e.g. car manufacturing) may lose jobs due to higher costs.

4. Generate government revenue

✅ Yes – tariffs do raise billions in revenue. However, this cost is ultimately borne by local businesses and consumers.

5. Leverage in trade deals

✅ Sometimes – tariffs can push other countries to negotiate. However, retaliation and global instability are common side effects.

6. Support long-term economic growth

❌ Rarely – tariffs usually reduce trade, slow growth & increase costs. Historically, prolonged use has harmed economies more than benefited them.

Conclusion

Tariffs may achieve short-term policy goals or provide leverage, but they carry long-term risks & unintended consequences.

They work best as a temporary measure, not a permanent economic solution.

Further Reading: The expected impact of Trump’s tariffs