- Services

- Bridging Finance

- Business Finance

- Debit Consolidation

- Equipment Finance (Personal & Commercial)

- First Home Buyers

- Home Loans

- Low Doc Finance and Non-Conforming Loans

- Non-Conforming Loans and Credit Impaired

- Overdrafts

AustAsia Finance Brokers Pty Ltd (Finance Brokers license #385068) is an accredited member of the Finance Brokers Association of Australia.

Our Finance team will review your personal and business situations to formalise a strategy that will maximise the effectiveness of your financing arrangements.

We can arrange finance for:

- Individuals – Residents & Non-Residents

- Investors

- Sole Traders

- Partnerships

- Companies

- Trusts – including investment trusts

- Self Managed Superannuation Funds (SMSF’s)

Our loan experts have the knowledge to help you with your financial affairs, to reduce your risk profile and to get you the lowest interest and fees on your loan. Plus we will formulate a repayment plan tailor-made to your circumstances.

At AustAsia, we can call upon the specialists from our Tax Division to ensure that your finance is also tax effective.

Accredited with over 40 Lenders

We can assist with a wide variety of finance purposes, including:

- Purchasing owner-occupied residential properties

- Purchasing owner-occupied business properties

- Purchasing investment residential and business properties

- Purchasing new cars

- Refinancing existing loans to new lenders

- Redrawing funds on your existing loans for investment and other purposes

- Commercial/Business Loans/Overdrafts

- Purchasing/Leasing business vehicles and equipment

- Development Finance

If you have found the perfect new home before selling your existing one, talk to the AAG Finance team about Bridging Finance to cover you until your home sells.

Bridging Finance, or bridging loan, is a short term loan to purchase a new home, even if you still have a mortgage on the existing property.

Our Brokers can help you find the best type of bridging loan to suit your circumstances by ensuring you understand the pros, cons, and risks associated with each before signing up.

How it works

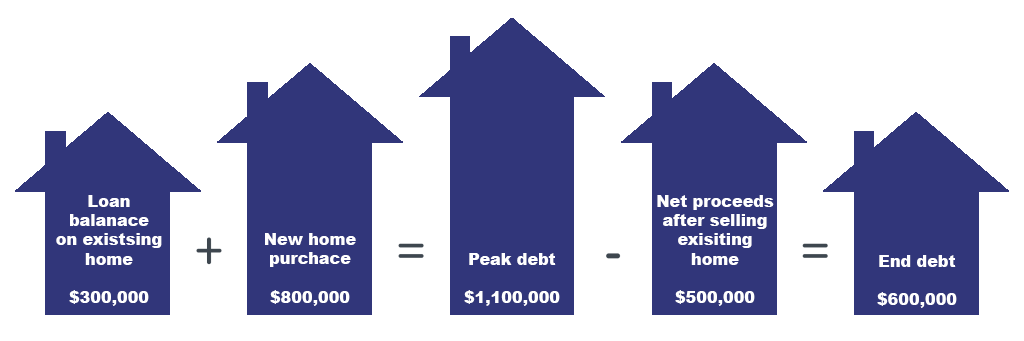

For example, if you still owe $300,000 on your mortgage, and the cost of the new house is $800,000, you will have a short term loan with a peak debt of $1,1000,000. During the bridging period (the time until your house sells), your loan repayments are likely to change, which could be repayments on the peak debt or just the interest. All the net proceeds from the sale of your existing home go directly to the loan. So if the net proceeds are $500,000, the End debt on the loan becomes $600,000. The loan then operates as a normal mortgage with standard repayments.

For commercial loans, there are solutions for small, medium and large-scale business operations. At AustAsia Group, we work with the major banks and non-bank lenders to provide you with a suitable commercial loan to meet your needs. Whether you’re a sole trader, small family business, mid-tier or large organisation, we’re here to help. Be it starting a new business venture, expanding your existing business or looking at alternative funding options to compare to your current lender.

No matter what you’re looking for, we can assist you with finance and ensure that you have an effective tax and asset protection strategy in place. At AAG, we want to make sure that your overall financial position has been considered.

Commercial Finance Services

Our highly experienced Finance Team would love the opportunity to assist you with any of your commercial finance needs, be it:

- Business acquisition

- Starting up a business

- Purchasing commercial premises – owner-occupier & investment

- Financing working capital – including Invoice Finance

- Debt consolidation

- Management buyouts – provide funding to purchase a business by management and staff

- Professional services buyouts/buy-ins – Funding to buy out an existing partner or buy-in to an existing professional firm, such as accounting practice, solicitors, financial planning businesses.

- Review & refinancing of existing facilities

- Bridging finance facilities

- Development finance

- Debtor finance

- Overdrafts

Apply for a Loan

Debt consolidation is bringing multiple debts, such as store and credit cards, into one personal loan. One personal loan with regular repayments is often easier to manage. All this is designed to save you money with fewer account fees and a competitive interest rate.

Life Happens

Sometimes circumstances beyond your control can result in a short term problem in your cash flow. Before you know it, this grows into a bigger problem making it increasingly harder to resolve, and resulting in negative information affecting your credit rating.

At AAG finance, we understand that it is often not your fault, and all you need is an opportunity to fix it.

We have seen this before. We understand how to explain Your Story to the lenders, and we have the lender relationships to get you a Fair Go.

So before taking out a personal loan to consolidate your debts, talk to someone from the AAG Finance team and have your situation reviewed holistically and obligation-free.

We will help you work out what you can repay and select the most appropriate solution to ensure you will save money and help you clear your debts.

After all, we all deserve a second chance.

Why use AustAsia Finance Brokers?

The short answer: Because we will save you time and money!

Finance lenders offer a large range of options that may or may not suit your circumstances or match your requirements. Perhaps a loan has an attractive rate, but only for an introductory period, or maybe only if you agree to a longer-term period, which may or may not be suitable to you. Some may require a balloon payment at the end etc.

Some lenders may offer better rates than what they advertise, depending on how they assess your risk profile, and some loans may only be available via finance brokers like ourselves.

Since we work directly with over 40 lenders, including banks, independent or private finance companies and more, we can offer you a choice of finance solutions tailored to suit you and ensure you receive the best rate you can at the same time.

And the best part of all of this is that there is no charge to you for our service, as the lenders pay us for our trouble.

So give us a call for a no-obligation proposal. You may just be surprised at what we can do to help you.

AustAsia Finance Brokers comply with the Federal Government’s Best Interest Duty, ensuring that we always prioritise your best interests in everything we do.

Whether you’re a business owner or individual, we can help you finance all your vehicle and equipment requirements. Not only will we arrange finance, we’ll also ensure that from an accounting and tax perspective, you have the most appropriate product and facility in place to optimise your tax position.

Our diverse panel of lenders means we have access to a variety of products, helping to ensure that we’ll be able to provide you with the most competitive and suitable facility.

Benefits of Financing Equipment

We believe, that depending on your needs and circumstance, there can be a number of benefits to equipment finance, such as:

- Fast approval and settlement times;

- Finance for 100% of purchase price, including GST;

- No security taken from residential or commercial properties – stand alone facility;

- Fixed interest rates and repayments for the life of the loan;

- Repayment terms can be adjusted to suit nature of business/cash flow requirements – seasonal industries;

- Leaves cash flow available for other opportunities;

- Import finance available to fund overseas purchases.

Equipment that can be Financed

What sort of items can I finance under an equipment finance facility?

- Shop & office fit outs;

- Motor vehicles, boats, caravans – new & used;

- Medical equipment;

- Plant, equipment & machinery;

- Aircraft;

- IT equipment i.e. computers, printing, software etc.;

- Manufacturing equipment;

- Farming & agriculture equipment;

Why use AustAsia Finance Brokers?

The short answer: Because we will save you time and money!

Finance lenders offer a large range of options, that may or may not suit your circumstances or match your requirements. Perhaps a loan has an attractive rate, but only for an introductory period, or maybe only if you agree to a longer-term period, which may or may not be suitable to you. Some may require a balloon payment at the end etc.

Some lenders may offer better rates than what they advertise, depending on how they assess your risk profile, and some loans may only be available via finance brokers like ourselves.

Since we work directly with over 40 lenders including banks, independent or private finance companies and more, we can offer you a choice of finance solutions that are tailored to suit you, and ensure you receive the best rate you can at the same time.

And the best part of all of this is that there is no charge to you for our service, as we are paid by the lenders for our trouble.

So give us a call for a no-obligation quote, you may just be surprised at what we can do to help you.

AustAsia Finance Brokers comply with the Federal Government’s Best Interest Duty, ensuring that we always prioritise your best interests in everything we do.

Whether you’re looking to buy or build your first home, we’re here to help. At AustAsia Group, we can help you obtain finance and determine whether you’re eligible for any Government Grants and assist with any associated applications.

We believe in working with our clients to help them achieve their financial goals. So, whether you’ve got a deposit available or are looking to implement a strategy to help get you into your first home, we’d love to hear from you.

We understand that everyone’s position is unique and work with you to ensure their financial needs are met. Our diverse panel of over 40 lenders means that we can invariably find a solution tailored just for you no matter what your situation is.

We understand that buying your first home can be a daunting time – that’s why we’re here to help. We’ll work with you, from determining how much you can borrow and what your loan repayments are likely to be, to lodging an application, obtaining finance approval and ensuring a smooth settlement. Not only will we help you get into your first home, but we’ll also ensure you’ve got the most suitable structure and strategies in place.

Not sure if you’ve got enough for a deposit?

There are several options available for people looking to purchase a property who might not have a 20% deposit. These include:

- Family Guarantees

- Lenders Mortgage Insurance

- First Home Super Saver Scheme

Home Loan Services

Below are just some of the many ways and loan types we can assist you with:

- Investment Loans

- Compare Loans

- Fixed-Rate Loans

- Variable Rate Loans

- Refinance Loans

- Bad Credit Loans

- Split Loans

- Online Lenders

- Construction Loans

- Interest Only Loans

- Non-Bank Lenders

- Line of Credit Equity Loans

- Low Doc Home Loans

- Professional Package Loans

- Non-resident lending – for people living and/or working overseas

- Servicing or security guarantees

- Non-conforming loans

- Low deposit home loans

- Bridging loans

- Tax effective loans

- Debt consolidation

Buying a House

If you’re looking to purchase a house in the future or have recently put an offer in on a property – we’re here to help. Our diverse panel of lenders means we can assist you in finding a lender and product that suits your individual needs. We’ll work with you to determine how much you can borrow, the size of deposit you’ll need, the most suitable lender & product as well as the best overall loan structure. We’re here to help you every step of the way, from finalising an offer, choosing a lender, preparing and lodging an application all the way through to settlement.

Click here to see our guide on how we can help to Find the Right Home Loan for you.

Refinancing

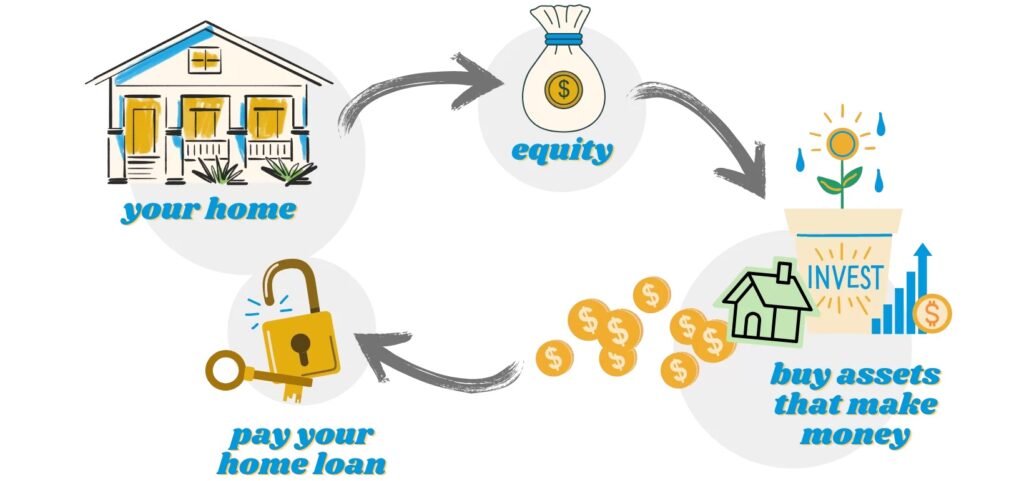

Are you sure you’ve got the most competitive and suitable loan? Banks are constantly changing rates, products and policies. So too are your needs and circumstances, which is why we believe it’s essential to keep an eye on your Home Loan.

Reviewing your home loan can save you thousands of dollars a year in interest payments, money in your pocket instead of the banks, or maybe for that dream holiday, like Rhonda & Ketut…

We can help you check that you’re getting the most competitive rate and ensure that your loans are still structured in the most tax-effective manner. We often find that as people’s employment and income circumstances change, they don’t consider how it might affect their existing loans. That’s where we can help. Our experienced team will not only review your loan in terms of rate and product but also check that from a tax perspective; you’ve got the most effective structure.

Helpful Guides

If you are self-employed or have irregular income, we can help you apply for a low-doc loan or a non-conforming loan if buying a house. Our diverse panel of lenders means we have access to a variety of products, helping to ensure that we’ll be able to provide you with the most competitive and suitable facility.

Low-Doc Loans

As the name suggests, low-doc loans require less documentation to substantiate income in the application process. These facilities tend to be best suited to investors, contractors or self-employed borrowers. As a result of the less stringent income verification requirements, low-doc loans carry a greater perceived risk by lenders. Consequently, they tend to attract high than average interest rates, application fees and limitations on the maximum Loan to Value Ratio (LVR).

What income verification do I need?

Typically, a borrower would need a combination of the following documents to evidence their income:

- Proof of ABN and/or GST registration

- Business Activity Statements (BAS)

- Business Account transaction statements

- Accountant’s letter

- Personal tax returns

Non-Conforming Loans

Non-confirming home loans are designed to assist people who don’t meet the standard lending criteria of major banks and lenders. Non-confirming loans are similar to a standard home loan in that they can be used for owner-occupied or investment purposes. Depending on the lender and product, they can offer the choice of fixed or variable repayments, offset accounts, redraw facilities and the option of making extra or lump sum payments. The main difference between a non-conforming and a standard home loan is the interest rate and fee structure. Due to the increased perceived risk by lenders, these loans tend to attract higher interest rates and fees.

Who do they assist?

Non-confirming loans can assist people in a variety of circumstances, such as:

- People with poor/adverse credit history

- Self-employed

- Unstable or irregular income

- New migrants

- People/businesses with tax debt

- Retirees

- People who have recently changed employment or started a new business

- People looking to consolidate existing debt – personal loans, credit cards etc.

If you have been refused a loan because you do not fit a bank’s standard loan criteria due to having impaired credit, the AAG Finacial team assist you with applying for a Non-conforming Loan.

Our Finacial team can help with any of these types of circumstances:

- Started a new business or are self-employed and do not have sufficient proof of income

- Have an outstanding debt with the ATO

- Bad credit history or have previously been declared bankrupt

- Considered high risk due to events such as divorce, long term/serious illness or failed business

- Do not have the required deposit, or you are using money from a gift or inheritance

Our Financial Brokers will help you with your financial affairs to reduce your risk profile to get you the lowest interest and fees on your loan, and formulate a repayment plan.

When your business bank account balance gets low and you have bills that can not be put off, having an overdraft facility will give you access to pre-approved credit whenever required. This means you will not worry about payments not being honoured because of insufficient funds or receiving large fees from the bank. At Aust Asia Group, we can set up an overdraft account that suits your requirements.

How does it work?

If your bank account has a balance of $500, and you make a purchase of $750, $500 will be taken from the savings account, and $250 will be taken from the overdraft account. When you deposit money into your account, the overdraft will be paid off first, then the rest of the funds will go to your account. So, for example, you deposit $1000 into the account, after the $250 overdraft is repaid, $750 will go into your account.

AustAsia Finance Brokers are accredited with over 40 lenders that enable us to find a loan to suit your situation with the best possible rates.

Business Specialists and Advisers in

Our Finance Team