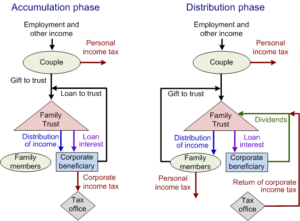

The ATO is increasingly paying attention to trusts’ ability to distribute income to the most tax-advantaged entities.

The ATO is increasingly paying attention to trusts’ ability to distribute income to the most tax-advantaged entities.

For example, capital gains are generally better for individuals, as they get a 50% tax discount on capital gains. In contrast, franked dividends can go to companies, as they usually have a similar rate of tax.

It’s important to be aware that the ATO now mandates that Trust Distribution Resolutions be finalised and submitted before 30 June. This means that a Trust must distribute all of its income each financial year, or else the Trustee will be liable to pay tax on the income.

Consider the scenario where a Trustee of a Trust neglects to make a resolution to distribute the income of the Trust before the end of the financial year. In such a case, the Trustee could face an assessment by the Australian Taxation Office (ATO) on the Trust income at the highest marginal tax rate of 47%. This is a stark contrast to the intended beneficiaries, who would typically be taxed at significantly lower rates. It’s crucial to note that due to the ATO’s increased audit activity, there has been a heightened focus on such compliance items.

Trustees should resolve to distribute the current year’s income on or before the financial year-end (30 June) to ensure the beneficiary is presently entitled to trust income. To do this, you will need to:

1. Review your Trust Deed

2. Review your projected income for the year ending 30 June, and

3. Prepare your Trust Distribution Resolution for your Family Trust and execute it as the Trustee.