June 2019 has been a good month for share investors, who prefer to be richer rather than poorer.

And who do we have to thank – the usual suspect, Donald Trump.

Many market commentators are saying that there could only be two drivers of such significant buying in the US, and both were in play.

Those two things were some positive comments on trade negotiations from Chinese and Mexican officials and even Jay Powell, the US central bank boss, got into the act, saying that if needed the Fed would cut interest rates!

Some are tipping up to tip three rate cuts in the US this year. These people could be on the money if the Trump trade war re-ignites or gets worse.

That’s why the US stock market is making record highs and has helped Australian stocks along the way, according to Peter Switzer.

In spite of these records, slower global growth fears have already hurt the likes of FedEx and UPS – these are bellwether companies for global growth.

Trump’s fingerprints are over both of these stories, with the threat of trade war the shared link to rate cut stories here and the US, and the Dow rising on the prospect of possibly lower rates and trade talks turning a little more positive.

Peter Switzer further explains that “higher resource prices that feed into stock prices for mining companies are linked to world economic growth. And right now, investors have to watch Donald Trump as the key determinant of global growth, resource prices, the course of stock markets and how our wealth could be affected, according to some pundits.”

Remember, stock prices not only affect our superannuation balances, but they can also reflect what’s going on in a company.

If Donald trumps China and our best trading partner grows more slowly, jobs will be lost here, business growth will be hit, our economy will slow down, and we could wind up in the recession.

This is one reason why our central bank has cut rates (and is likely to continue) and why Jay at the Fed is saying he’d do it too, to save the US, and even the global economy, from recession.

Not so good for retirees or those relying on income from cash products.

“You have to remember that a slower world economy will affect resource prices, which will hit and hurt us”, said Peter Switer.

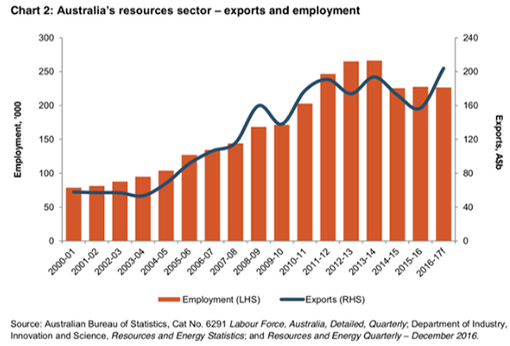

He shows in for the chart below how jobs and the health of mining and exports generally have a link here in Australia. This is why it’s important to us for China and the US to resolve their differences. This was an important topic of discussion between President Trump and our own PM Scott Morrison at the recent G20 meeting in Osaka.

Peter Switer summarised it up nicely when he said, “we have to face facts, we’re in the hands of Donald Trump. At the moment, his fingerprints are all over the biggest market-moving drivers.”

In writing this report, we have sourced information from the following providers, including but not limited to:

Aberdeen Standard Investments, AMP Capital Markets (including Dr Shane Oliver, Chief Economist and Head of Investment Strategy), ANZ Capital Markets, Australian Bureau of Statistics, BetaShares, Bloomberg, Business Insider, Colonial First State, Commonwealth Bank, IRESS, Livewire Market Watch, Macquarie, Morningstar, Montgomery Investment Management, Peter Switzer, Reserve Bank of Australia, Russell Investments and VanEck.

Important information and disclaimer

This publication has been prepared by AustAsia Group, including AustAsia Financial Planning Pty Ltd (AFSL License No 229454) and AustAsia Accounting Services Pty Ltd (Registered Tax Agent No 7587 3005).

AustAsia Accounting Services Pty Ltd – Liability limited by a scheme approved under Professional Standards Legislation.

Any advice in this publication is general only and has not been tailored to your circumstances. Accordingly, reliance should not be placed on the information contained in this document as the basis for making any financial investment, insurance, or other decision. Please seek personal advice before acting on this information.

Information in this publication is accurate as at the date of writing, 10 July 2019. Some of the information may have been provided to us by third parties. Whilst it is believed the information is accurate and reliable, the accuracy of that information is not guaranteed in any way.

Opinions constitute our judgment at the time of issue and are subject to change. Neither the Licensee nor any member of AustAsia Group, nor their employees or directors give any warranty of accuracy, nor accept any responsibility, for any errors or omissions in this document.

Any general tax information provided in this publication is intended as a guide only and is based on our general understanding of taxation laws. It is not intended to be a substitute for specialised taxation advice or an assessment of your liabilities, obligations or claim entitlements that arise, or could arise, under taxation law, and we recommend you consult with a registered tax agent.