Economic success → Collect more taxes.

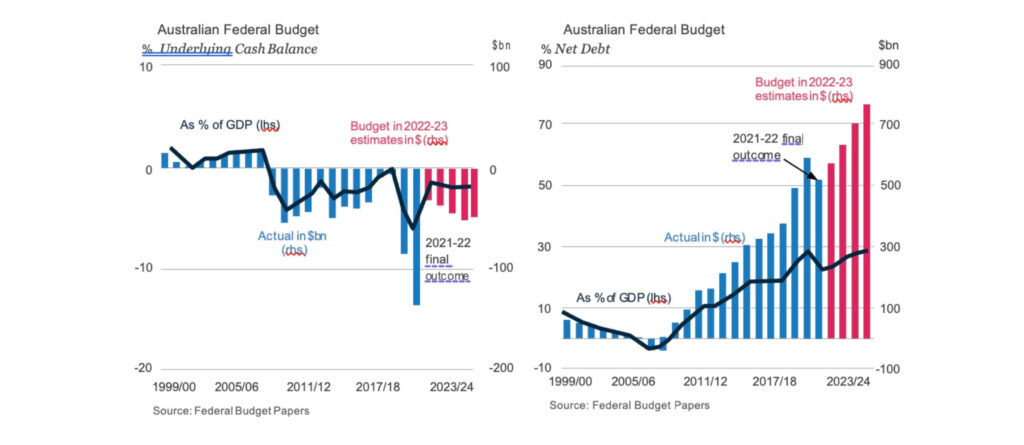

The Labor Government has enjoyed the benefits of some of the economic success of Australia, having collected more taxes, more GST and more revenue from the increased activity from the mining sector, plus the lower unemployment rate:

The Labor Government has enjoyed the benefits of some of the economic success of Australia, having collected more taxes, more GST and more revenue from the increased activity from the mining sector, plus the lower unemployment rate:

- more people that are employed means

- more people are earning income which in turn means

- more people are paying tax

The increase in wage rates that the Government announced in June and passed in July has had an inflationary effect, which has meant more income for many Australians, and again, moving people into the net tax bracket, meaning more tax again.

So, all in all, the Government has been the beneficiary of the increase in taxes, which has meant a lower deficit.

Balancing act.

The Government appears keenly aware of the economic balancing act taking place, keeping the budget predominantly to election promises and redirecting existing initiatives to avoid exacerbating inflationary pressures. As the Treasurer said, “Australians know this is a time of great challenge and change.”

The Government appears keenly aware of the economic balancing act taking place, keeping the budget predominantly to election promises and redirecting existing initiatives to avoid exacerbating inflationary pressures. As the Treasurer said, “Australians know this is a time of great challenge and change.”

In more detail, the global economic environment has sharply deteriorated. Inflation has risen rapidly across advanced economies. The Russian invasion of Ukraine has significantly driven up global energy costs and exacerbated the impact of poor weather on global food prices. All of this impacts Australia. Here are the highlights:

Inflation is expected to peak at 7.75% in the December quarter and will persist at higher rates for longer than anticipated before easing to 3.5% by June 2024.

Inflation is expected to peak at 7.75% in the December quarter and will persist at higher rates for longer than anticipated before easing to 3.5% by June 2024.

The Labor Government has enjoyed the benefits of some of the economic success of Australia, having collected more taxes, more GST and more revenue from the increased activity from the mining sector, plus the lower unemployment rate:

The Labor Government has enjoyed the benefits of some of the economic success of Australia, having collected more taxes, more GST and more revenue from the increased activity from the mining sector, plus the lower unemployment rate: The Government appears keenly aware of the economic balancing act taking place, keeping the budget predominantly to election promises and redirecting existing initiatives to avoid exacerbating inflationary pressures. As the Treasurer said, “Australians know this is a time of great challenge and change.”

The Government appears keenly aware of the economic balancing act taking place, keeping the budget predominantly to election promises and redirecting existing initiatives to avoid exacerbating inflationary pressures. As the Treasurer said, “Australians know this is a time of great challenge and change.”