No change to legislated ‘stage 3’ tax cuts

The previous government implemented a three-stage plan for personal income tax cuts, starting from the 2018-19 financial year. The third stage of these tax cuts is scheduled to come into effect on July 1, 2024. Although the current government had previously stated that there would be no changes in this area, there has been ongoing speculation regarding potential delays, modifications, or even cancellation of these tax cuts due to their significant impact on the budget and the perceived benefit to higher-income earners.

In the recent Budget announcement, no new information was provided regarding the stage 3 tax cuts. As of now, they remain legislated and are set to be implemented on July 1, 2024. However, it’s important to note that there is still more than a year and an additional Federal Budget before the scheduled commencement date. This leaves room for potential future developments or alterations to the plan.

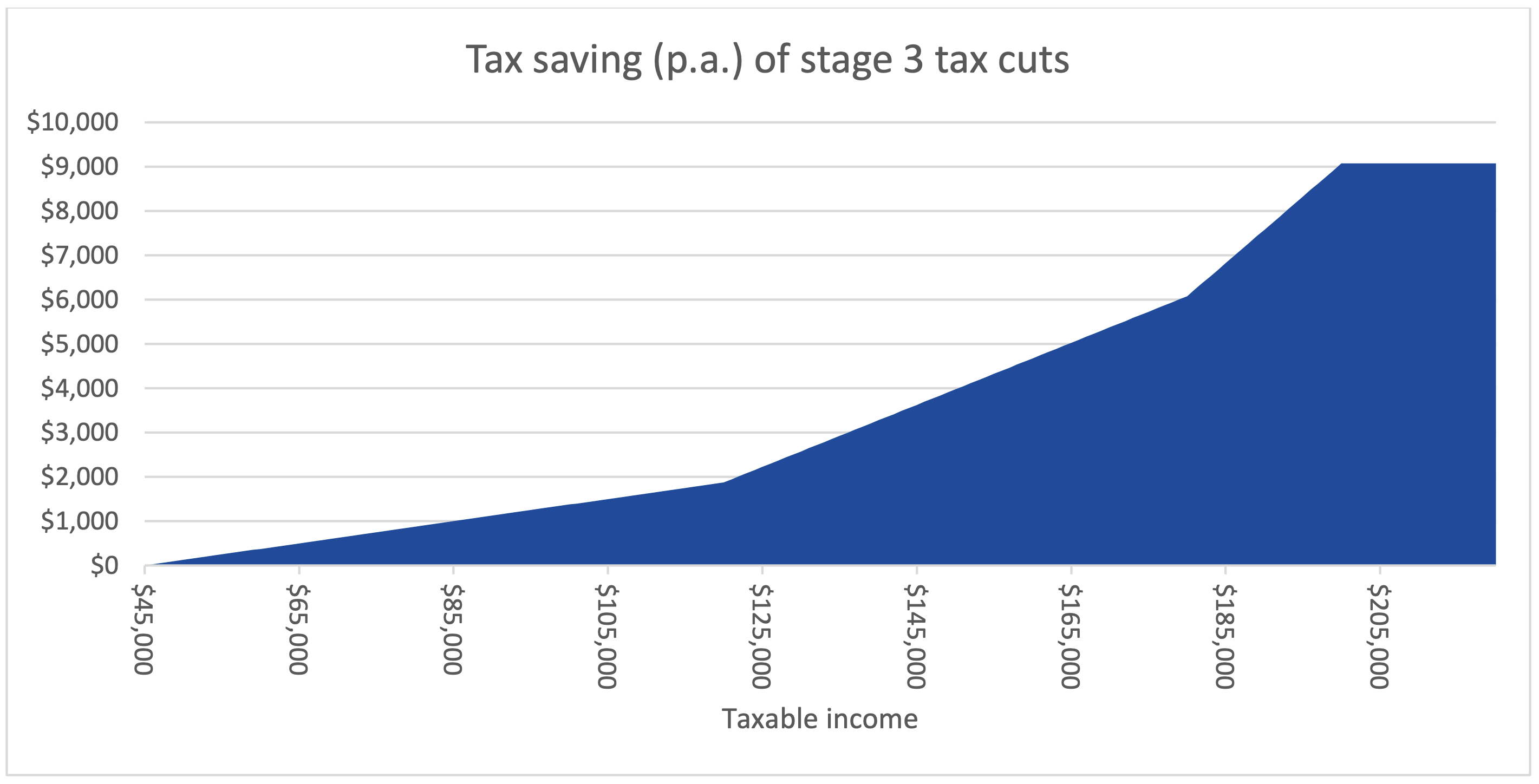

The graph presented below illustrates the annual tax savings resulting from the stage 3 tax cuts. The savings are depicted based on the individual’s taxable income.