On the 6th of October 2020, the 2020 Federal Budget was handed down.

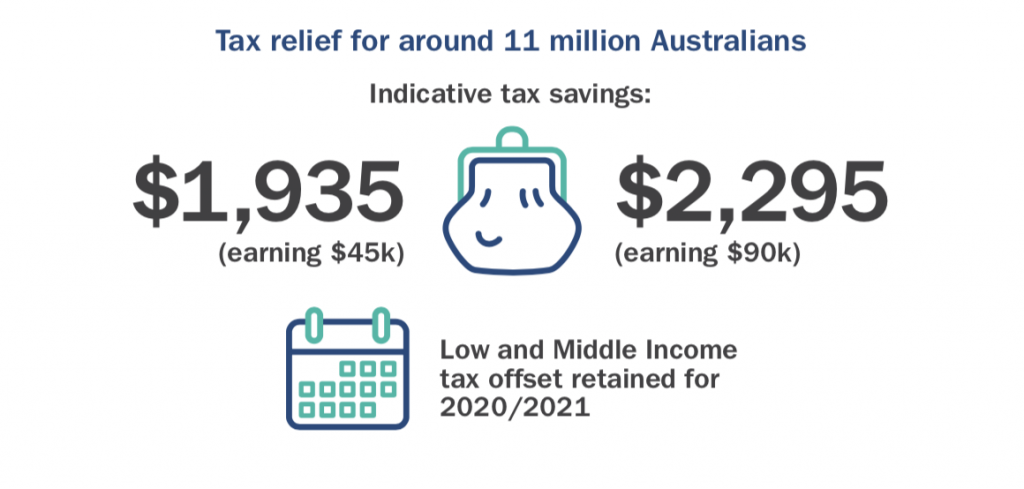

The announcement included bringing forward personal income tax cuts already legislated. Together, these changes will deliver tax relief to low- and middle-income earners for the 2020-21 income year.

The Treasurer also announced a range of taxation benefits for small and medium businesses, intended to stimulate the business sector leading to jobs growth.

This summary provides coverage of the key issues:

Personal Income Tax |

|---|

Immediate personal tax relief for individuals providing an indicative tax savings of $1,935 if you earn $45k or a savings of $2,295 if you earn $90k; Retaining the Low and Middle-Income Tax Offset (LAMITO) for 2020-2021; We expand on the details in this article Immediate personal tax relief for individuals providing an indicative tax savings of $1,935 if you earn $45k or a savings of $2,295 if you earn $90k; Retaining the Low and Middle-Income Tax Offset (LAMITO) for 2020-2021; We expand on the details in this article |

| Exempting granny flat arrangements from capital gains tax where there is a formal written agreement. The exemption will apply to arrangements with older Australians or those with a disability. When faced with a potentially significant CGT liability, families often opt for informal arrangements. This measure will remove the CGT impediments, reducing the risk of abuse to vulnerable Australians. |

Business Owners |

|---|

Extension of the provision allowing small business (aggregated annual turnover of less than $5 billion) to instantly write-off asset purchases enabling them to deduct the full cost of eligible capital assets acquired from 7:30 pm AEDT on 6 October 2020 (Budget night) and first used or installed by 30 June 2022. Read this article for more information Extension of the provision allowing small business (aggregated annual turnover of less than $5 billion) to instantly write-off asset purchases enabling them to deduct the full cost of eligible capital assets acquired from 7:30 pm AEDT on 6 October 2020 (Budget night) and first used or installed by 30 June 2022. Read this article for more information |

Temporary losses can be carried-back to support cash flow allowing eligible companies to carry-back tax losses from the 2019-20, 2020-21- or 2021-22 income years to offset previously taxed profits in 2018-19 or later income years. This will generate a refundable tax offset in the year in which the loss is made. In this article, we expand on how to combine this Carry-Back with the Instant Asset Write-off. Temporary losses can be carried-back to support cash flow allowing eligible companies to carry-back tax losses from the 2019-20, 2020-21- or 2021-22 income years to offset previously taxed profits in 2018-19 or later income years. This will generate a refundable tax offset in the year in which the loss is made. In this article, we expand on how to combine this Carry-Back with the Instant Asset Write-off. |

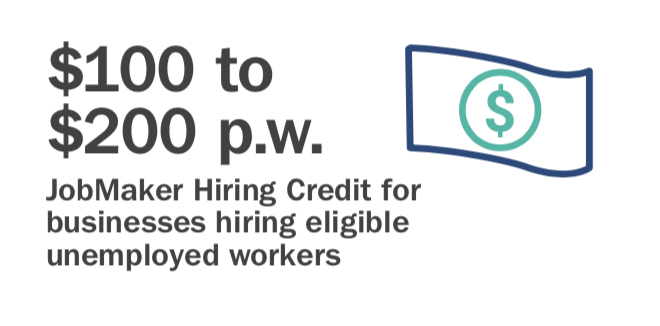

The creation of the JobMaker Hiring Credit which will provide: The creation of the JobMaker Hiring Credit which will provide:

A news post is available here. A Questions and Answers page is here. |

The Boosting Apprenticeships Wage Subsidy supporting 100,000 new apprentices and trainees by paying a 50 per cent wage subsidy, up to a cap of $7,000 per quarter, for commencing apprentices and trainees at businesses of all sizes, in all industries, and in all locations. The Boosting Apprenticeships Wage Subsidy supporting 100,000 new apprentices and trainees by paying a 50 per cent wage subsidy, up to a cap of $7,000 per quarter, for commencing apprentices and trainees at businesses of all sizes, in all industries, and in all locations. |

Superannuation |

|---|

| Superannuation reform in hopes to improve outcomes for superannuation fund members. The reforms will reduce the number of duplicate accounts held by employees as a result of changes in employment and prevent new members joining underperforming funds. |

Social Security |

|---|

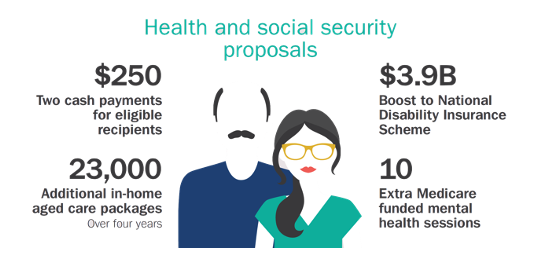

Further Covid-19 response packages whereby the Government will provide $2.6 billion over three years from 2020-21 to provide two separate $250 economic support payments, to be made from November 2020 and early 2021 to eligible recipients and health care card holders. These payments are exempt from taxation and will not count as income support for the purposes of any income support payment. Further Covid-19 response packages whereby the Government will provide $2.6 billion over three years from 2020-21 to provide two separate $250 economic support payments, to be made from November 2020 and early 2021 to eligible recipients and health care card holders. These payments are exempt from taxation and will not count as income support for the purposes of any income support payment. |

We will provide further details in relation to items mentioned above over the next few weeks.

Full details are available here https://budget.gov.au/

Best Regards,

Simon Chesson

Director