This is our first newsletter in a series over the next few weeks, detailing the key changes to personal income tax that have been announced in The 2020 Federal Budget of 6 October.

For a summary of all of the budget announcements, see here.

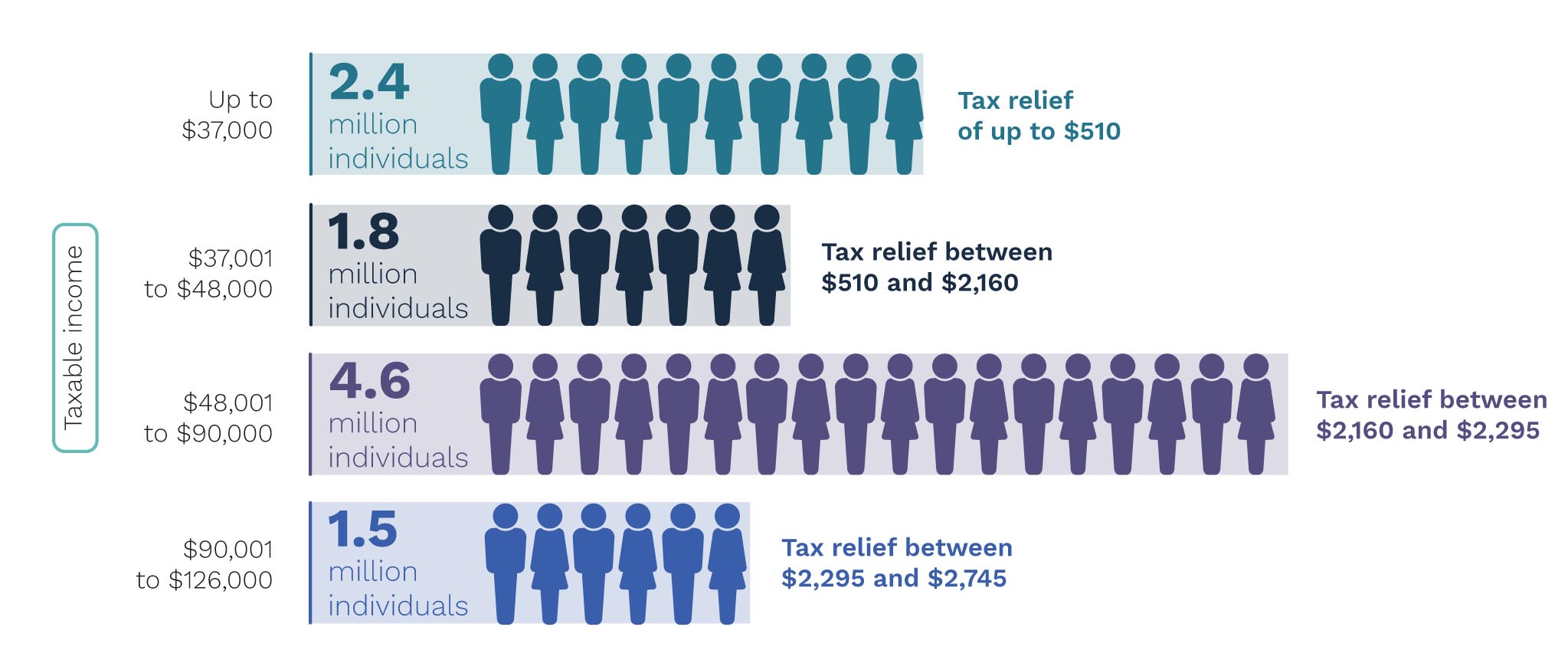

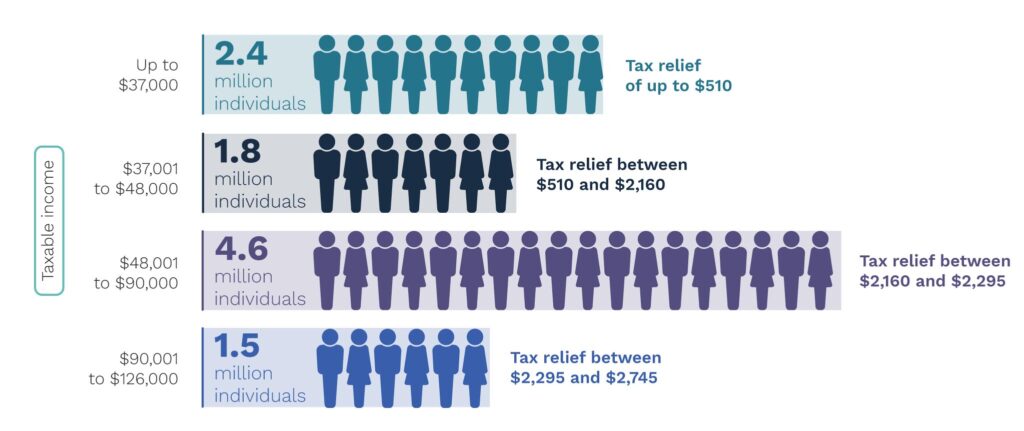

One of the highlights was that personal income tax cuts already legislated are going to be brought forward. This will deliver tax relief to low and middle-income earners for the 2020-21 income year with much of the benefit going to those on incomes below $90,000 per annum.

Bringing forward the Personal Income Tax Plan |

|---|

Immediate personal income tax relief for individuals providing an indicative tax savings of $1,935 if you earn $45k or a savings of $2,295 if you earn $90k (compared to 2017/18 tax year). This is effective from 1 July 2020 having been brought forward from 1 July 2022. |

Retaining the Low and Middle Income Tax Offset (LAMITO) for 2020-21 and

|

|---|

The Low and Middle Income Tax Offset — capped at $1,080 — will be retained for the 2020–21 income year and the LMITO will be received on assessment after individuals lodge their personal income tax returns for the 2020–21 income year. The Low and Middle Income Tax Offset — capped at $1,080 — will be retained for the 2020–21 income year and the LMITO will be received on assessment after individuals lodge their personal income tax returns for the 2020–21 income year. |

Taxable income |

LAMITO Offset |

|---|---|

| $37,000 or less | $255 |

| Between $37,001 and $48,000 | $255 plus 7.5 cents for every dollar above $37,000, up to a maximum of $1,080 |

| Then between $48,001 and $90,000 | $1080 |

| Finally between $90,001 and $126,000 | $1,080 minus 3 cents for every dollar of the amount above $90,000 |

| From 1 July 2020, the maximum amount of the Low Income Tax Offset will increase from $445 to $700 and is summarised below. |

Taxable income |

LAMITO Offset |

|---|---|

| $37,000 or less | $700 |

| Between $37,001 and $45,000 | $700 minus 5 cents for every dollar of the amount above $37,000 |

| And between $90,001 and $126,000 | $325 minus 1.5 cents for every dollar of the amount above $45,000 |

Personal Income Tax Thresholds |

|---|

|

Rate – (%) |

2017-2018 tax thresholds – Income range ($) |

Current tax thresholds From 1 July 2018 Income range ($) |

New tax thresholds From 1 July 2020 Income range ($) |

|

Rate – (%) |

New tax thresholds from 1 July 2024 – Income range ($) |

|

|

Tax free |

0 – 18,200 |

0 – 18,200 |

0 – 18,200 |

|

Tax free |

0 – 18,200 |

|

|

19 |

18,201 – 37,000 |

18,201 – 37,000 |

18,201 – 45,000 |

|

19 |

18,201 – 45,000 |

|

|

32.5 |

37,001 – 87,000 |

37,001 – 90,000 |

45,001 – 120,000 |

|

30 |

45,001 – 200,000 |

|

|

37 |

87,001 – 180,000 |

90,001 – 180,000 |

120,001 – 180,000 |

|

45 |

>200,000 |

|

|

45 |

>180,000 |

>180,000 |

>180,000 |

|

|

|

|

|

LITO |

Up to 445 |

Up to 445 |

Up to 700 |

|

LITO |

Up to 700 |

|

|

LMITO |

– |

Up to 1,080 |

Up to 1,080* |

|

LMITO |

– |

|

* The LMITO will only be available until the end of the 2020-21 income year. Even with quick passage of legislation, the tax measures will be backdated by around four months. As a result, reduction in PAYG tax for the remainder of the financial year will be around 1.5 times the ongoing rate giving you instant tax savings without having to wait until lodgement of your 2021 personal income tax return. |

Increasing the Medicare Levy low-income thresholds |

|---|

Our Government has increased the Medicare Levy low-income thresholds for singles, families, and seniors and pensioners from 2019-20. The increases take account of recent movements in the consumer price index. Our Government has increased the Medicare Levy low-income thresholds for singles, families, and seniors and pensioners from 2019-20. The increases take account of recent movements in the consumer price index.This way low-income taxpayers generally continue to be exempted from paying the Medicare levy on their personal income tax return. The Medicare Levy low-income thresholds have increased as follows:

|

Full details are available here https://budget.gov.au/

Still have questions? We are here to help.

For assistance with your personal income tax return, and questions relating to whether you or your family qualify for any of the above measures, please contact us at consulting@austasiagroup.com.