On the 11th of May 2021, the 2021 Federal Budget was handed down.

The announcement included maintaining personal income tax cuts brought forward last year. These announcements will deliver tax relief to low- and middle-income earners for the 2021-22 income year.

The Treasurer also announced a range of taxation benefits for small and medium businesses, intended to stimulate the business sector leading to jobs growth.

This summary provides coverage of the key issues:

Personal Income Tax |

|---|

Retaining the Low and Middle-Income Tax Offset (LAMITO) for 2021-2022, worth up to $1,080 for individuals or up to $2,160 for couples. Retaining the Low and Middle-Income Tax Offset (LAMITO) for 2021-2022, worth up to $1,080 for individuals or up to $2,160 for couples. |

Business Owners |

|---|

|

|

|

|

Employment Incentives |

|---|

|

|

|

|

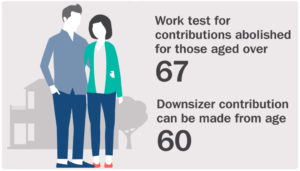

More flexibility around Superannuation |

|---|

A new option is to receive up to two lump sums of up to 50% of the Age Pension in a 12-month period. The maximum lump sum amount will depend on whether the individual is single or a member of a couple.

Products covered include market-linked and life-expectancy retirement products commenced prior to 20 September 2007 from any provider, including self-managed superannuation funds (SMSFs), and lifetime products from SMSFs. A two-year period will be provided for these retirement products and expected to commence from 1 July 2022. Individuals would need to consider social security consequences and any income tax cost. |

Homeownership proposals |

|---|

From 1 July 2021, 10,000 guarantees will be made available over four years to eligible single parents with a deposit of as little as 2%, subject to an individual’s ability to service a loan.

|

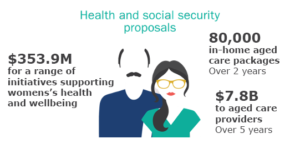

Aged Care and Women’s Health |

|---|

|

|

We will provide further details in relation to the items mentioned above over the next few weeks.

Full details are available here https://budget.gov.au/

Best Regards,

Simon Chesson

Director

Continuation of the provision allowing small business (aggregated annual turnover of less than $5 billion) to instantly write-off asset purchases enabling them to deduct the full cost of eligible capital assets acquired and first used or installed by 30 June 2023. This incentive can also be applied to the cost of improvements to existing assets.

Continuation of the provision allowing small business (aggregated annual turnover of less than $5 billion) to instantly write-off asset purchases enabling them to deduct the full cost of eligible capital assets acquired and first used or installed by 30 June 2023. This incentive can also be applied to the cost of improvements to existing assets. Temporary losses can now be carried back for an extra year, to support cash flow by allowing eligible companies to carry-back tax losses from the 2019/20, 2020/21, 2021/22, and now the 2022/23 income years to offset previously taxed profits in 2018-19 or later income years. This will generate a refundable tax offset in the year in which the loss is made. This now also applies to businesses with an aggregated annual turnover of less than $5 billion.

Temporary losses can now be carried back for an extra year, to support cash flow by allowing eligible companies to carry-back tax losses from the 2019/20, 2020/21, 2021/22, and now the 2022/23 income years to offset previously taxed profits in 2018-19 or later income years. This will generate a refundable tax offset in the year in which the loss is made. This now also applies to businesses with an aggregated annual turnover of less than $5 billion. Funding has been allocated to reduce the cost of child care for families with 2 or more children under 5 years, in child care and to boost workforce participation. The subsidy cap for high-income earners has also been removed.

Funding has been allocated to reduce the cost of child care for families with 2 or more children under 5 years, in child care and to boost workforce participation. The subsidy cap for high-income earners has also been removed. Focusing on improving Australia’s Digital skills base, funding has been promised to provide cadetships and scholarships in emerging fields, such as artificial intelligence, quantum computing, robotics and cybersecurity. The JobTrainer program has been extended for an additional 12 months until 31 December 2022.

Focusing on improving Australia’s Digital skills base, funding has been promised to provide cadetships and scholarships in emerging fields, such as artificial intelligence, quantum computing, robotics and cybersecurity. The JobTrainer program has been extended for an additional 12 months until 31 December 2022. First Home Super Saver Scheme (FHSSS): The FHSSS, which was introduced in the 2017/18 Budget, allows people to save money for their first home inside their super. The Government will increase the maximum amount of voluntary contributions that can be released under the FHSSS from $30,000 to $50,000.

First Home Super Saver Scheme (FHSSS): The FHSSS, which was introduced in the 2017/18 Budget, allows people to save money for their first home inside their super. The Government will increase the maximum amount of voluntary contributions that can be released under the FHSSS from $30,000 to $50,000.