Why do we like investing for income? — Dividends the gift that keeps on giving!

Many commentators love speculating on which direction markets are heading and when they will likely turn. They are never consistently correct….

But while the media love expert speculators, they’re not much use to long-term investors.

That’s because any experienced investor will tell you it’s incredibly difficult to time the market – so you’re usually better off not trying.

You’re better off looking at long-term fundamentals and trends and deciding where you’re likely to get the best return in the medium to long term.

Why invest for income?

Ultra-low interest rates and readily available, cheap money drove a very long bull market.

With high inflation and rising rates, the time for cheap money has passed.

And central banks in the US, Australia and elsewhere are adding further macro-economic headwinds by continuing to remove money from the economy via quantitative tightening.

Volatility is just a fact of life…

When we refer to volatility in the market, we mean sudden changes for the worse; unpredictability is the opposite of stability.

While this makes it a challenging market for investors, it also offers opportunities.

At the core, we still look to dividends from lower-risk industrial stocks to generate the bulk of the income.

Not convinced? Well, then… let’s look at the data.

Dividends will likely make up a more significant share of total return than capital growth over the next decade.

For us, dividends have always been an essential part of investment returns, and in times like these, their importance increases.

There are two main reasons why:

- Dividends provide more reliable returns than capital gains; and

- Dividend yields can act as a ‘safety net’ at times of volatility.

Let’s unpack this a little further.

1. Dividends provide more reliable returns than capital gains

Returns from a share portfolio come from two sources – the capital appreciation from the shares and the dividends received from each share.

If you look at the table below, showing returns from the ASX 300 over the last 20 years, you can clearly see how significant dividends are to overall returns.

ASX 300 returns capital and income 20 years

|

ASX 300 returns |

20 years p/a |

|

Returns from capital growth |

4.4% |

|

Returns from income |

4.5% |

|

Total returns |

8.9% |

|

% of returns from income |

51% |

Source: Morningstar data as of 30 November 2022

Over the last 20 years, dividends have returned 51% of overall returns.

While return on capital fluctuates significantly, dividend returns are remarkably reliable – making them particularly valuable when returns on capital are low or negative.

While the level of capital returns from a share portfolio depends on movements in individual share prices, this is not the case for dividends.

That’s because the company’s board decides the level of dividends received by an investor and generally reflects the company’s overall profitability – its financial performance.

So, in periods where the overall share market goes down, an investor’s dividends should stay much the same if they have a diversified portfolio of quality companies.

2. Dividends can act as a ‘safety net’ in times of volatility

The movement in the share market – particularly over shorter time periods of 6 to 12 months – is more often than not dictated by investor sentiment.

Sentiment can be erratic, impacted by anything from predictions of future economic activity levels to inflation and interest rates or perceptions of geopolitical stability.

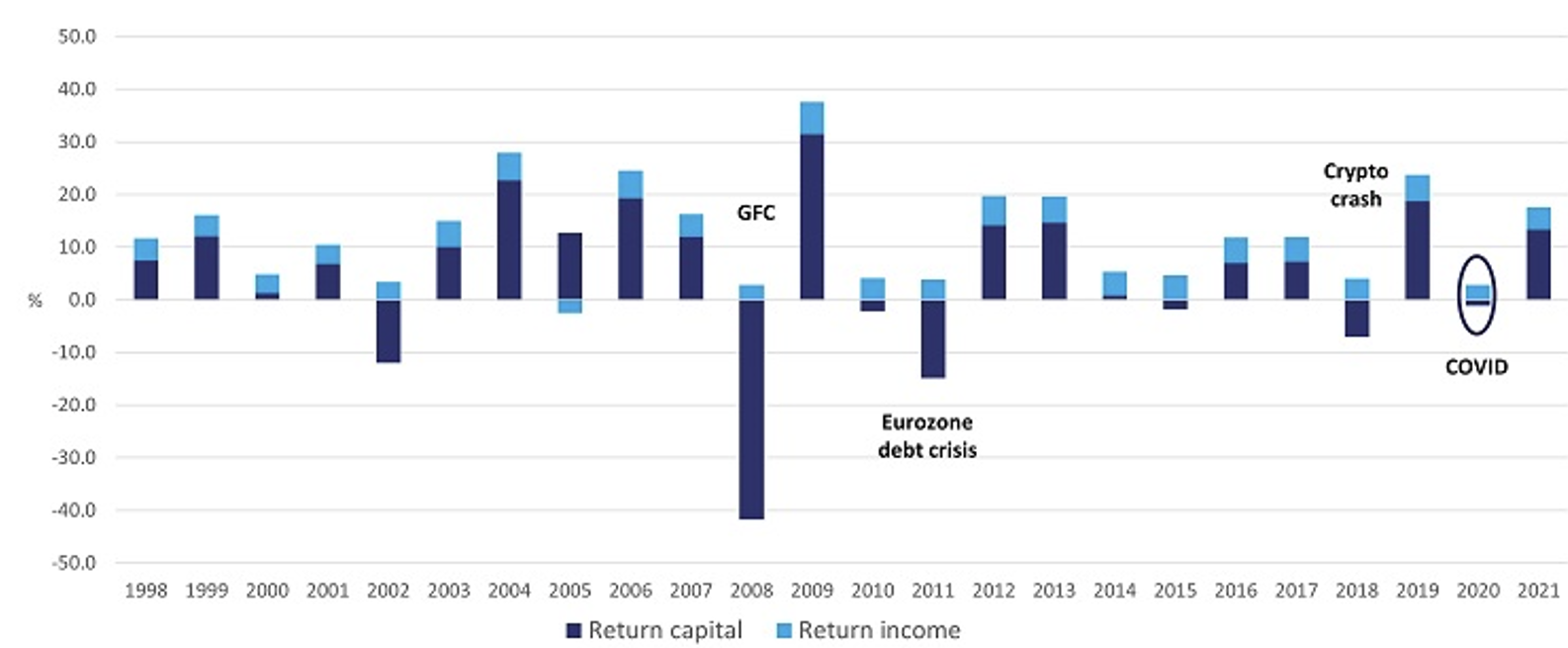

Take a look at this chart of ASX 300 returns over the last 20 years, with the light blue bars showing dividends and the dark blue bars showing capital growth.

ASX 300 returns capital vs income

Source: IML and Morningstar Direct, S&P ASX300 01/01/1998 – 31/12/2021

You can see how vital dividends were during those years when the ASX dropped significantly, or capital returns were lower:

- At the peak of the Tech Wreck in 2002, the ASX 300 provided a return on capital of -12%, but dividends returned 3%.

- In 2008, at the start of the GFC, capital dropped -42%, but dividends returned +3%.

- In the 2011 Eurozone debt crisis, capital returned -15%, but income returned +4%.

- And while the share market recovery from COVID was very swift, the ASX 300 still dropped -1% but income? It returned a steady 3%.

When the mood of the market is negative, stocks can fall heavily as investors and traders reduce their overall level of sharemarket exposure by rapidly selling shares – indiscriminately and independent of their quality.

Over many years of investing, we have observed that once sentiment starts to turn, companies with sustainable earnings that support a healthy, consistent dividend stream are often the shares that recover the most quickly.

The reason for this is simple – rational; long-term investors are always attracted to companies that pay a healthy dividend from a sustainable earnings stream.

They understand that the return level from dividends is not dependent on future share price performance.

In other words, once shares in quality companies fall to a level where the dividend yield is attractive and sustainable, long-term investors buy them so they can ‘lock in’ high-income levels, whatever happens to the share market in future.

Which stocks and sectors are likely to pay the best dividends in future?

With the economic outlook uncertain and lower growth and high inflation likely to stick around for a while, it’s a good time for investors to think seriously about where they will likely get the best income for the medium to long term.

Investors should be cautious of overconcentrating in riskier sectors such as commercial property, resources, and other cyclical sectors.

We like the major banks and low-cost index funds that keep pace with the market and provide sound dividend income with some capital growth.

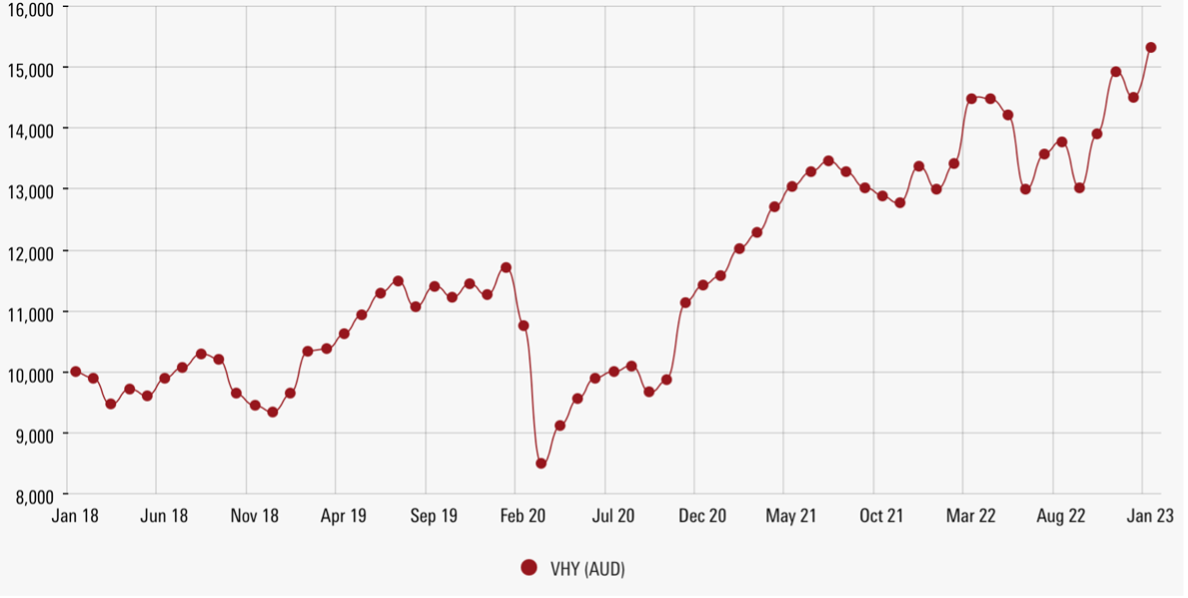

Let’s take an example where we can take some of the guesswork out by investing in an index fund, such as Vanguard Australian Shares High Yield ETF (VHY), where we can combine high dividend income with some capital growth:

VHY provides low-cost exposure to companies listed on the ASX with higher forecast dividends than other ASX-listed companies (excluding Real Estate and infrastructure).

Investors can gain targeted exposure to around 60 of Australia’s top dividend-paying companies for an annual fee of 0.25% p.a. Dividends are paid quarterly.

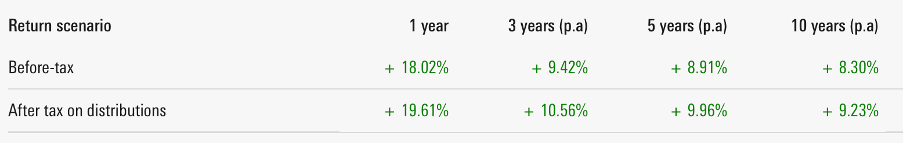

Here’s the total return table for a superfund:

Source: Vanguard

*Remembering that past returns are no guarantee of future returns*

If we want to break this down further, we see that for the 5-year returns, growth was 2.78 %pa, and dividends were 7.18 %pa (including franking credits).

If we had reinvested the dividends back into VHY over this period, our return would have been 55.1% as long as we simply held the investment and did not buy and sell on emotions or tried to time the market.

Investing for dividends via something like VHY means you can enjoy regular income (with quarterly distributions), including access to franking credits, with some growth on your capital.

Here’s a picture of it:

Growth of $10,000 for five years from Jan 2018 to Jan 2023

Source: Vanguard

Dividends are always important; right now, they’re critical

In Australia, dividends always make up a significant part of share market investors’ total return.

During volatile times, down markets or protracted periods of lower capital growth then, the dividend share of total returns is even higher.

Nobody can reliably pick the bottom of the market or know how the share market will perform in the coming months and years.

So, in times like these (thanks, Dave Grohl), with volatility high and lower growth likely for the medium to long term, it’s best to minimise your risks and invest your money where you have the best chance of healthy returns.

For us, that means buying and holding shares in quality companies at attractive valuations that pay strong dividend yields. This has you well positioned for whatever mood the share market happens to be in.

And if you’re in a position where you don’t need the money yet, so you can reinvest your dividend income to make more dividend income, you get the benefit of compounding, rinse and repeat!

In conclusion

There’s a well-known maxim that budding journalists are taught on their first day in a newsroom – bad news sells.

Sure, it’s nice to read about markets going up and the magic of compounding, but really, planes crashing, corrupt companies, cyber hacks, celebrity felonies, viral social media posts, and government blunders are much more likely to get the eyeballs.

So, turn down the noise and just grin and bank it!

Dividends…. the gift that just keeps giving…