Ever been stuck on the freeway and don’t know why. Then you drive past a minor car accident (or even just a breakdown) and curse all the other drivers for slowing down to have a good look and causing the traffic jam that is totally unnecessary. That is, of course, after having slowed down myself to have a look. The answer to that question is undoubtedly “yes”.

As you are no doubt aware, we do things a little differently around here. So, let us explain.

Human beings are wired to want more of what gives us security and pleasure, and to run away from things that cause us pain and discomfort. This behaviour has likely kept us alive as a species, but it wreaks havoc in our financial lives.

Carl Richards gives the example, when the markets go down and the over-zealous financial networks start yelling that you should save yourself before you end up living under a bridge, it feels like a wild animal is chasing you. The only thing to do is run!

Feeling scared is normal at that moment. The last thing you need in such times is a lecture on the history of long-term stock market returns.

You don’t need facts and figures; you need someone to listen to you, empathise and give you reassurance.

Where are we heading with this? Do we actually have a point? Well, again, yes! Let’s apply this to investing…

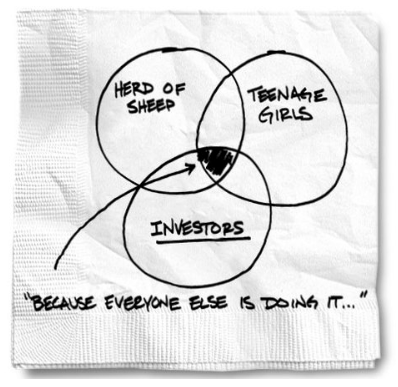

Just because journalists are telling you to bail out of your investments and run for your life, do you do it? It’s the same principle as a herd of sheep or teenagers.

Here’s Carl’s serviette chart that we find pretty amusing:

You can’t get unbiased financial advice from most media outlets. They want you to look at their news story – that’s how they make money. When we are frightened, we tune in. When we are happy, we tune out.

Peter Switzer explains that how the media portrays stocks is part of the reason why so many people don’t want to have a go at being an investor in the share market. At times like these, headlines get it wrong, telling us that “investors have dumped stocks” when it’s really professional traders and speculators.

Investors tend to be longer-term players of stocks and many know that when the market panics, it becomes a buying-opportunity, except for that one year in 10 when a crash often comes along.

Mr Switzer goes on to say that a lot of this negative sentiment that’s hurting economic numbers is trade war-related. He often quotes Warren Buffett, who counsels us that we should “be greedy when others are fearful” and vice versa.

He goes on to say “that’s great advice when the selloff is a correction that then rolls into another leg up for a bull market for stocks. But what if this sell-off is telling you that a crash is coming? Well, we don’t know that, but speculation would say no”.

Let’s return to the motorway – when you go past an accident or breakdown you don’t stop, get out of your car, leave it there, throw your keys away and say “I’ll never drive again”. Even if it is more than just a bingle, we all still get in our cars and drive. We may feel empathy for the drivers, but we don’t reconsider our financial goals.

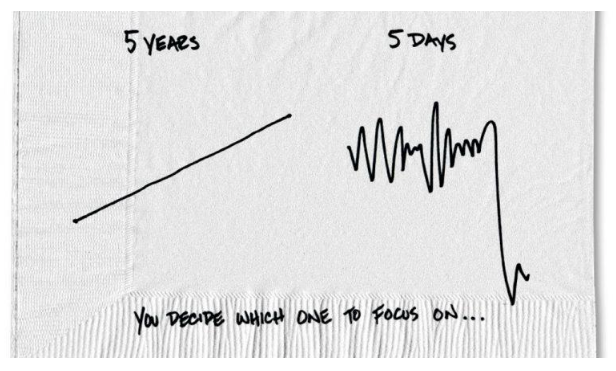

But, the longer you spend rubbernecking, the easier it will be to run off course and cause yourself more trouble in the long run. The longer you spend looking in your rear-view mirror, the more likely you yourself will come unstuck. There will always be a reason thrown at us to question our investing behaviour, but we need to focus on the left-hand side of this napkin:

Source: The BehaviourGap.com

It’s OK to slow down, recalibrate and have a look, we are humans after all.

But it’s important to understand what’s happening and accept that being frightened is perfectly normal. We also need to understand what’s happening to us as a human being and to re-adjust our behaviour – not to make any knee-jerk reactions, on our long-term investment strategy. We must keep our financial and emotional brains apart, otherwise your investing can look like this:

We need to block out this noise, continue towards our well-thought-out destination and understand that any distractions will just take us longer to get there.

There will always be a reason NOT to invest. Investing is NOT an exact science, but in the longer term, investing IS the only way to get ahead.

Then staying invested is the next challenge.

Important information and disclaimer

This publication has been prepared by AustAsia Group, including AustAsia Financial Planning Pty Ltd (AFSL License No 229454).

In writing this report, we have sourced information from:

AMP Capital Markets (including Dr Shane Oliver, Chief Economist and Head of Investment Strategy), ANZ Capital Markets, Australian Bureau of Statistics, BetaShares, Bloomberg, Business Insider, Carl Richards, Colonial First State, Commonwealth Bank, Investopedia IRESS, Livewire, Macquarie, Morningstar, Peter Switzer, Reserve Bank of Australia, Russell Investments and VanEck.

Any advice in this publication is general only and has not been tailored to your circumstances. Accordingly, reliance should not be placed on the information contained in this document as the basis for making any financial investment, insurance, or other decision. Please seek personal advice before acting on this information.

Information in this publication is accurate as at the date of writing, 10 October 2019. Some of the information may have been provided to us by third parties. While it is believed the information is accurate and reliable, the accuracy of that information is not guaranteed in any way.

Opinions constitute our judgement at the time of issue and are subject to change. Neither the Licensee nor any member of AustAsia Group, nor their employees or directors give any warranty of accuracy, nor accept any responsibility, for any errors or omissions in this document.

Any general tax information provided in this publication is intended as a guide only and is based on our general understanding of taxation laws. It is not intended to be a substitute for specialised taxation advice or an assessment of your liabilities, obligations or claim entitlements that arise, or could arise, under taxation law, and we recommend you consult with a registered tax agent.