It was widely debated whether the tax cuts would be maintained and passed on.

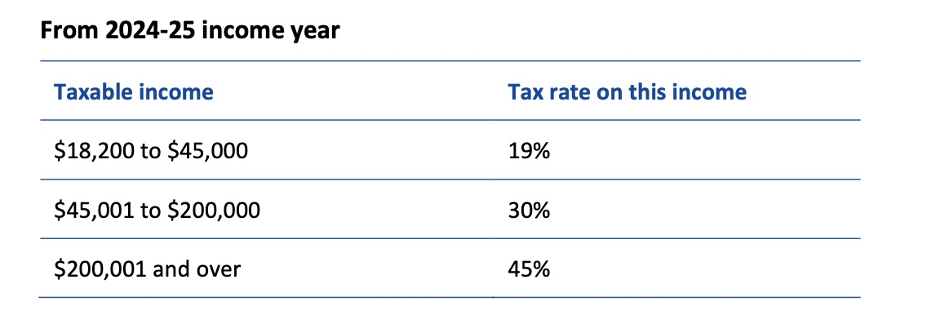

The tax cuts and reform announced by the previous Government have been maintained in this budget, and they are as follows:

The Government announced no change to these tax cuts in this Federal Budget. The effective date of the final stage of the personal income tax plan remains unchanged at this stage, although there are likely two further Budgets before their commencement.

Cryptocurrency is not a foreign currency.

Cryptocurrency is not a foreign currency.

As previously flagged, the Government will legislate to clarify that digital currencies such as Bitcoin will continue to be excluded from the Australian income tax treatment of foreign currency. The exclusion does not apply to digital currencies issued by, or under the authority of, a government agency, which continues to be taxed as foreign currency.

Additional funding for floods and natural disasters.

An additional $51.5m has been provided to support communities impacted by natural disasters through the Australian Government Disaster Recovery Payments (AGDRP), Disaster Recovery Allowance (DRA) and other payments made under the Disaster Recovery Funding Arrangements.

Community batteries for household solar (From 2022-23).

Community batteries for household solar (From 2022-23).

The Government will provide $224.3m over four years from 2022-23 to deploy 400 community batteries across Australia.

A related solar initiative will see an additional $102m committed to establishing a Community Solar Banks program to deploy community-scale solar and clean energy technologies. This initiative is aimed at regional communities, social housing, apartments, rental accommodation, and households traditionally unable to access rooftop solar.

ATO targets in sharp focus.

Personal income tax deductions and incorrect reporting

The ATO will receive an additional $80.3 to crack down on non-compliance, including:

The ATO will receive an additional $80.3 to crack down on non-compliance, including:

- Overclaiming deductions; and

- Incorrect reporting of income

The spend is expected to increase tax receipts by $674.4m and payment by $80.3m over four years.

Cash payments and tax evasion by business

The ‘shadow economy’, cash-in-hand payments, including underpayment of wages, visa fraud, and other nefarious activity that deprives the economy of the income from tax receipts, will come under scrutiny with the extension of the ATO’s Shadow Economy Program for a further three years from 1 July 2023. Over this period, the program is estimated to increase tax receipts by $2.1bn and payments by $685.2m over the four years from 2022-23.

Multinational business and the Tax Avoidance Taskforce

The ATO’s Tax Avoidance Taskforce will receive an additional $200m over four years from 1 July 2022 primarily to pursue multinational enterprises and large public and private businesses. This task force is expected to deliver a whopping $2.8bn in additional tax receipts and $1.1bn in payments over the four-year period.

Additional Resources:

-

- Treasury: Clarifying crypto not taxed as a foreign currency

- Media Release: Crypto not taxed as foreign currency