Are you over 60 yet not ready to fully retire but want to ensure you maximise your superannuation funds and retirement savings?

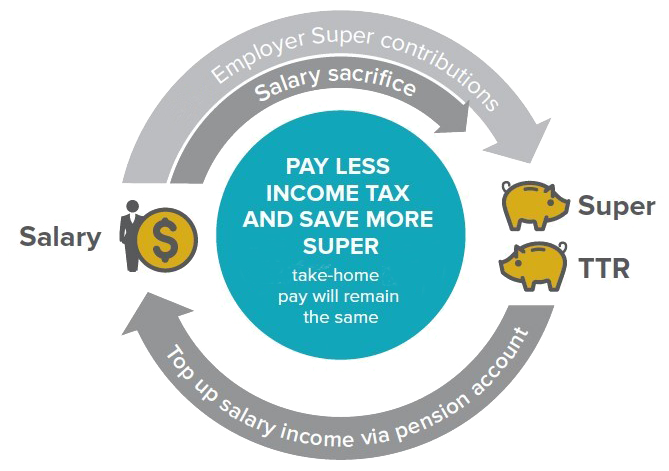

One strategy you can look at is a transition to retirement (TTR) pension strategy.

So what is a TTR pension:

A transition to retirement (TTR) pension allows you to supplement your income by allowing you to access some of your super once you’ve reached your preservation age.

Benefits of a TTR Pension:

- Cut back your working hours without reducing your income or increase your income to pay down debt, or increase your income to re-contribute funds back into super to maximise your super contributions and decrease your taxable income and tax payable.

- The taxable component of TTR pension payments attracts a 15% tax offset between the preservation age and 59, and all payments are tax-free at 60 or over.

- Investment earnings are generally taxed at a maximum rate of 15%.

What is my preservation age?

Your preservation age is based on your date of birth:

| Date of birth | Preservation age |

| Before 1 July 1960 | 55 |

| 1 July 1960 – 30 June 1961 | 56 |

| 1 July 1961 – 30 June 1962 | 57 |

| 1 July 1962 – 30 June 1963 | 58 |

| 1 July 1963 – 30 June 1964 | 59 |

| From 1 July 1964 | 60 |

Risks and things to consider

- For TTR pensions, the minimum pension payment is 4% up to a maximum of 10% of your account balance as of 1 July of each financial year or the value from the date your TTR pension started in that financial year. The minimum will need to be drawn each year the TTR Pension is in place;

- You’ll need to keep a super account open to accept employer contributions (or any other contributions), as these can’t be contributed directly to a pension account. This does create multiple accounts, which can become an administration hassle, but our experienced Wealth Management team are here to help you work through and understand it;

- TTR pensions don’t hold any insurance coverage. This means you may want to keep any personal insurance you have connected to your super account; and

- TTR pension will enter the retirement phase when certain events occur, and the pension balance will be included in your transfer balance cap:

- If you are not contributing funds back in as part of this strategy, you will deplete your superannuation savings accordingly, which may mean you have insufficient funds in retirement.

An example of how we have helped clients using this strategy

A Client recently turned 60, and his main goal is to repay his home loan before he retires. We reviewed his position and provided his personalised advice to commence a TTR pension from his superannuation funds.

A Client recently turned 60, and his main goal is to repay his home loan before he retires. We reviewed his position and provided his personalised advice to commence a TTR pension from his superannuation funds.

He commenced a salary sacrifice arrangement with his employer ensuring his contributions do not breach his concessional contribution cap. He then replaced the amount he was salary sacrificing by taking a regular payment from his TTR pension.

This strategy will decrease the tax he will pay under the salary sacrifice arrangement and will not deplete his overall superposition accordingly. He can then use the amount he is saving in tax to increase his repayments to his home loan paying his loan off quicker.