Financial markets are subject to periods of event-related volatility during which investor confidence can be shaken to its core.

Here we go again we can hear you say but remember when markets tumble:

- Volatility is a normal part of long-term investing;

- Over the long-term, equity risk is usually rewarded;

- Market corrections can create attractive opportunities;

- Avoid stopping and starting investments;

- The benefits of regular investing stack up;

- A focus on income increases total returns;

- Investing in quality stocks delivers in the long run; and

- Don’t be swayed by sweeping sentiment; turn down the noise.

What’s been driving the plunge in the market

How did we get here? The key drivers of the fall in shares:

- Shares had solid gains from their March 2020 lows, and speculative froth had become evident in tech stocks, meme stocks and crypto, and this left them vulnerable;

- High and still rising inflation flowing from pandemic distortions made worse by the war in Ukraine and Chinese lockdowns;

- US inflation rose further in May to 8.6%, it’s over 8% in Europe and looks to be on its way to 7% or so in Australia (not helped by our electricity crisis and floods);

- The ongoing upside surprises on inflation have seen central banks become more aggressively focused on pulling it back down and so stepping up the pace of rate hikes with the US, Canada, Australia, NZ and the UK continuing to raise interest rates. The ECB is moving towards rate hikes.

- The increasing aggressiveness of central banks in the face of higher inflation is, in turn, raising the risk of triggering a recession, which could depress company profits;

- Rising bond yields in response to rising inflation and central bank tightening is adding to the pressure on share markets by making them look relatively less attractive, which is driving the lower price to earnings multiples;

- The ongoing war in Ukraine, along with tensions with China, are adding to the risks; and

- As always, the most speculative “assets” are getting hit the hardest, including the pandemic winners of tech stocks (with Nasdaq having fallen 34%) and cryptocurrencies (with Bitcoin down 70% from its high last year). Cryptocurrencies surged with semi-religious fervour around the claimed marvels of blockchain, decentralised finance, NFTs, freedom from government, an inflation hedge, etc., only to become a speculative bandwagon fuelled by easy money and low-interest rates.

Trying to disentangle its fundamental value from the speculative mania became impossible. And now, the easy money and low rates are reversing, pulling the rug out from under the mania and driving mishaps along the way (e.g., Terra, Celsius Network and Babel Finance).

Fortunately, the exposure of major banks and mainstream investors to crypto is still relatively low, so this is unlikely to be another GFC moment.

Seven critical things for investors to keep in mind

Let’s unpack this concept even further…

Sharp market falls are stressful for investors. No one likes to see their investments (including their super) fall in value. But explore these tabs for a deeper dive into the things we need to keep in mind:

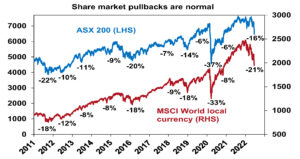

While they unfold differently, periodic share market corrections and occasional bear markets (usually defined as falls greater than 20%) are a normal part of investing in shares.

For example, the last decade regularly saw significant pullbacks.

Source: Bloomberg, AMP

Source: Bloomberg, AMP

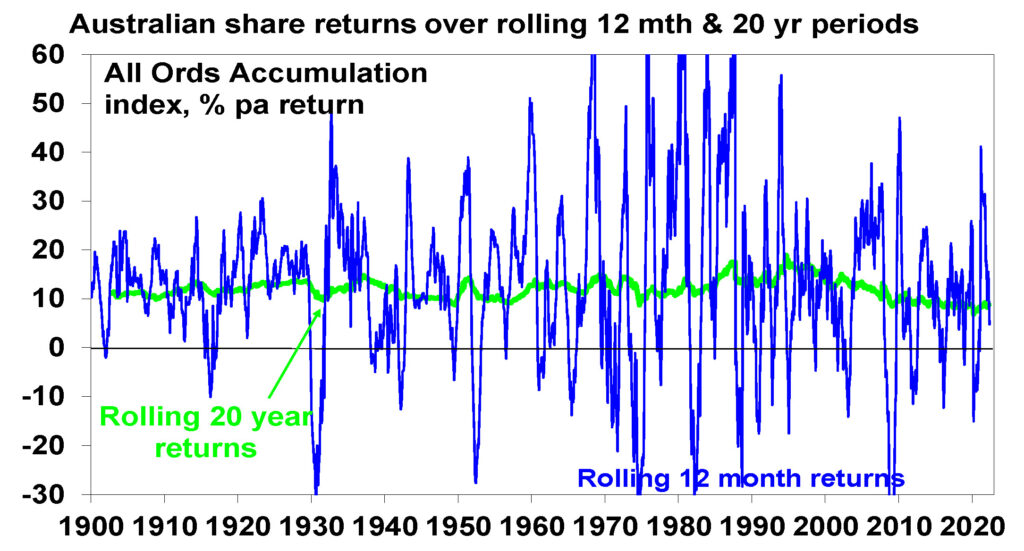

And as seen in the following chart rolling 12-month returns from shares have regularly gone through negative periods.

Source: ASX, Bloomberg, AMP

Source: ASX, Bloomberg, AMP

But while the falls can be painful, they are healthy as they help limit excessive risk-taking.

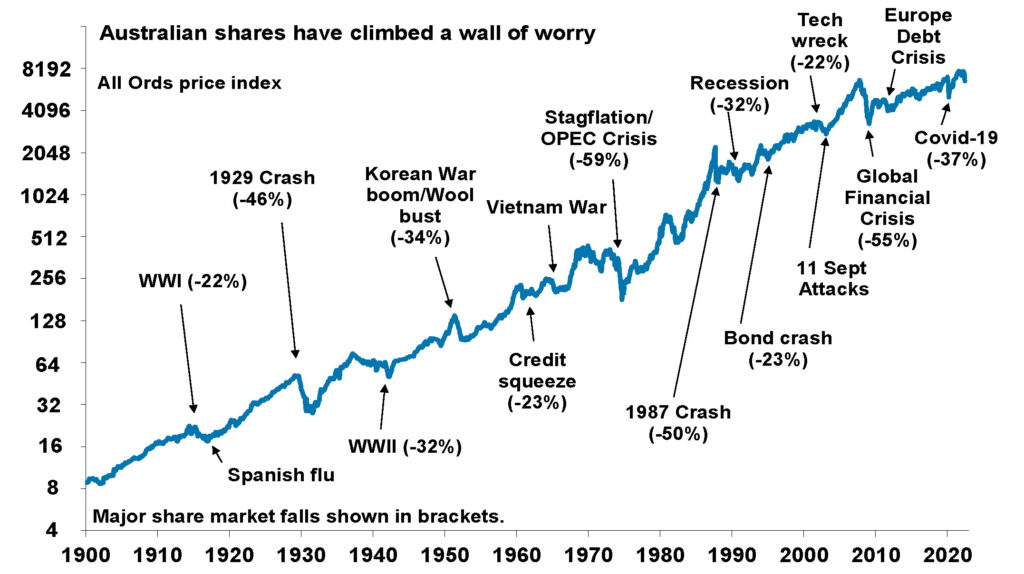

Shares climb a wall of worry over many years with numerous events dragging them down periodically (following chart), but with the long-term trend ultimately up and providing higher returns than other more stable assets.

Again, volatility is the price you pay for a seat at the table. We can’t emphasise enough that bouts of volatility are the price we pay for the higher longer-term returns from shares.

As can be seen in the previous chart, the rolling 20-year return from Australian shares has been relatively stable and solid. This is why super funds have relatively high exposure to shares and other growth assets.

Recent weakness has to be seen in perspective.

Source: ASX, AMP

Source: ASX, AMP

Historically, the main driver of whether we see a correction (a fall of say 5% to 15%) or even a mild bear market (with say a 20% or so decline that turns around relatively quickly as we saw in 2015-2016 in Australia – which may be called a “gummy bear market”) as opposed to a major (“grizzly”) bear market (like that seen in the mid-1970s or the global financial crisis when shares fell by around 55%) is whether we see a recession or not – notably in the US, as the US share market tends to lead most major global markets.

AMP Capital remain of the view that we can avoid a global recession if:

- Inflation starts to slow later this year or early next (as supply improves), taking pressure off central banks; and

- Growth at home initially cools faster than expected (as the consumer confidence plunges suggest it will). This will put a cap on how much the RBA needs to hike interest rates allowing it to avoid triggering a recession.

But with inflation still surprising on the upside and central banks hiking rates aggressively, the risks have increased to the point that it’s now a very close call. Either way, it’s still too early to say that shares have bottomed.

Of course, short-term forecasting is fraught with difficulty and should not be the basis for a long-term investment strategy, so it’s better to stick to long-term investment principles.

Selling shares or switching to a more conservative investment strategy whenever shares fall sharply turns a paper loss into an actual loss with no hope of recovering.

Even if you get out and miss a further fall, the risk is that you won’t feel confident about getting back in until long after the market has fully recovered.

The best way to guard against deciding to sell based on emotion after falls in markets is to adopt a well-thought-out, long-term strategy and stick to it.

So, avoid stopping and starting investments.

When shares fall, they’re cheaper and offer higher long-term return prospects.

So, the key is to look for opportunities’ pullbacks provide. It’s impossible to time the bottom, but one way to do it is to keep investing over time.

Fortunately, the Australian superannuation system does just that by regularly putting money into shares for workers (via their super), effectively taking advantage of the fact they are cheaper.

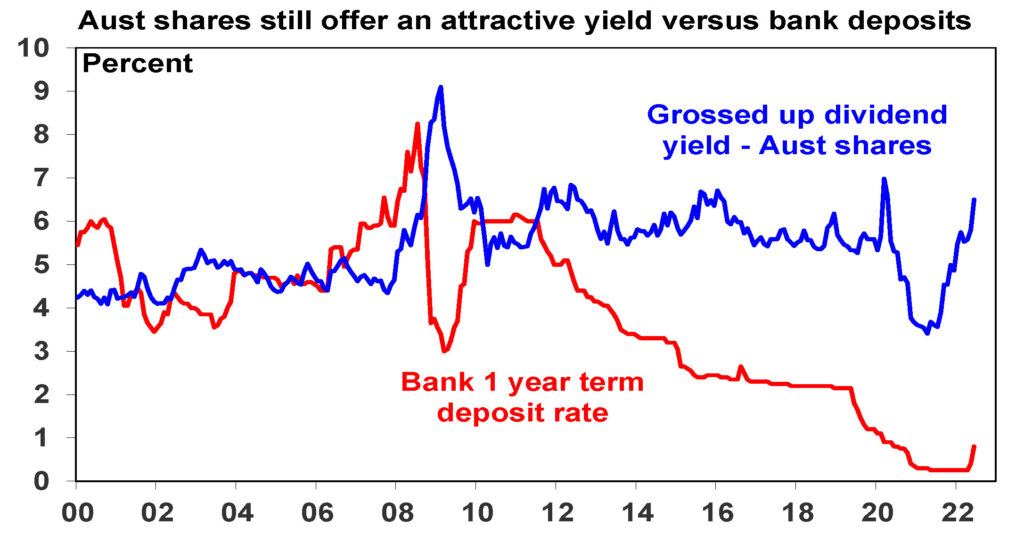

Share prices have fallen, but dividends have not, so the dividend yield has increased.

Australian shares offer a handsome dividend yield compared to bank deposits despite rising deposit rates.

Companies don’t like to cut their dividends, so the income flow you receive from a portfolio of shares will likely remain attractive.

Sustainable dividends paid by high-quality, cash-generative companies are attractive during market downturns. They can offer a regular source of income when interest rates are low.

High-quality, income-paying stocks tend to be leading brands that can perform thorough business cycles due to their established market share, pricing power and resilient earnings.

This through-cycle ability to offer attractive total returns makes them a good cornerstone for any portfolio.

Source: RBA, Bloomberg, AMP

Source: RBA, Bloomberg, AMP

Shares and other related assets often bottom at the point of maximum bearishness (i.e., when you and everyone else feel most negative towards them). So, the trick is to buck the crowd. “Be fearful when others are greedy. Be greedy when others are fearful,” as Warren Buffett has said.

So, reinvest income to increase total returns.

Reinvesting dividends can considerably boost total returns over time, thanks to the power of compound interest.

To achieve an attractive total return, investors need to be disciplined and patient, with time-in-the-market perhaps the most critical, yet underestimated, ingredient in the winning formula.

Regular dividend payments also tend to support share price stability, and dividend-paying stocks can help protect against the erosive effects of inflation.

Turn down the noise.

At times of uncertainty like now, negative news flow reaches a fever pitch.

Talk of billions wiped off share markets and of “crashes” help sell copy and generate clicks.

But less newsy are the billions recovered (or gained) when the market rebounds and the long-term upwards trend in share prices.

Moreover, they provide no perspective and only add to the sense of panic.

All of this makes it harder to stick to an appropriate long-term strategy.

So rather than tune in to the gabfest, watch the new Elvis biopic or work on your golf handicap.

Next steps

Please do not hesitate to contact us if you have any questions/thoughts concerning this article or would like more information. We are always here the help.