We’ve had quite a few queries about what Telstra has been up to, so we thought we’d put “pen to paper”.

You’re going to wish you hadn’t asked because it’s quite technical, but let’s dive in!

Bottom line… it’s positive for Telstra Group’s shareholders.

The short-version

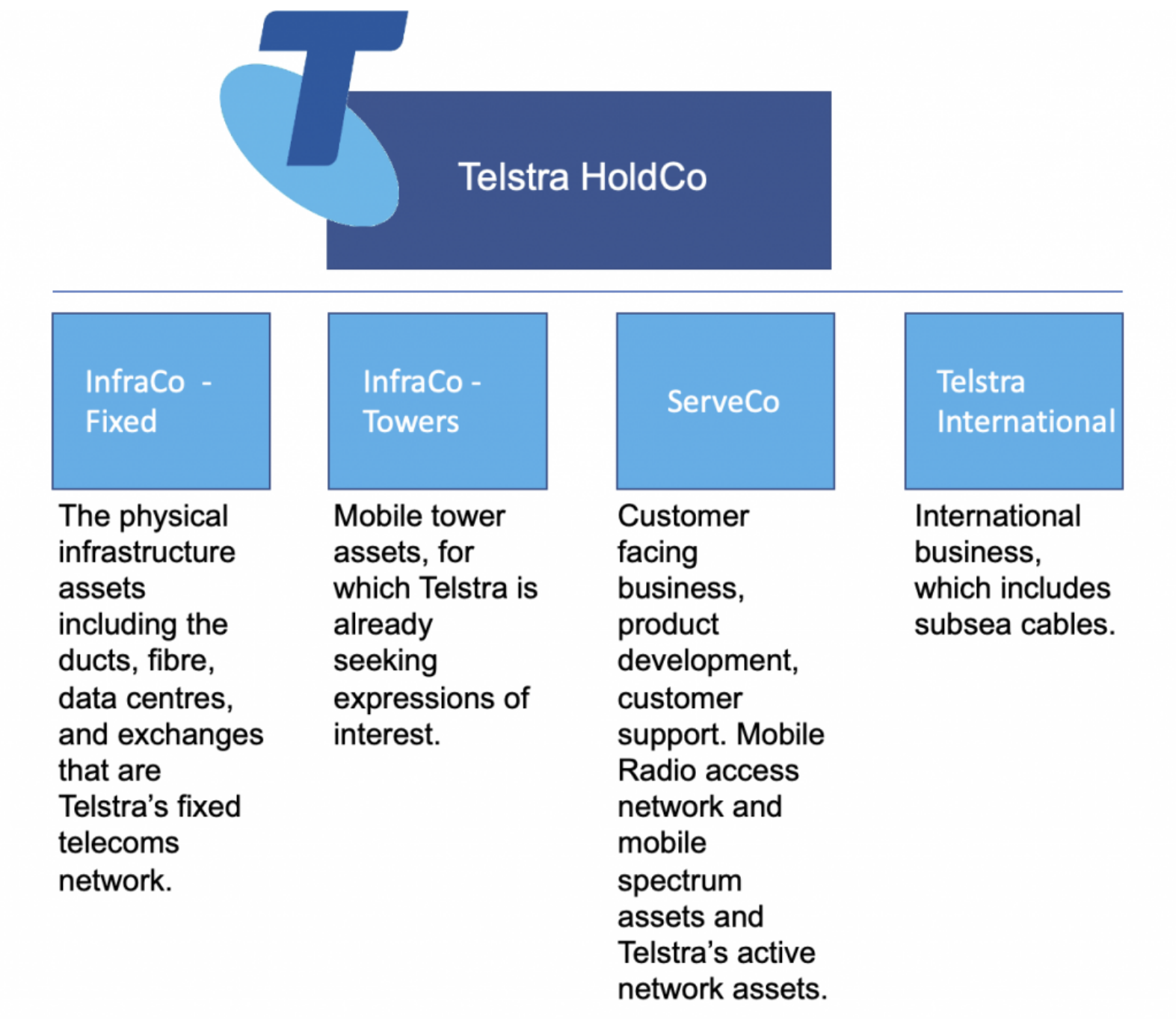

Telstra’s legal structure now comprises four standalone business units:

1. InfraCo Fixed |

Owns and operates Telstra’s physical infrastructure assets. These assets include ducts, fibre, data centres and exchanges. |

2. InfraCo Towers |

Owns and operates Telstra’s mobile tower assets. It is these assets that have the market keenly interested, given the strong demand and compelling valuations for this type of high-quality infrastructure. |

3. ServeCo |

Maintains Telstra’s focus on products and services, including the radio access network and spectrum assets critical to the Group’s mobile coverage and network superiority. |

4. Telstra International |

Established as a separate subsidiary within the Group, with a focus on subsea cables |

Intercompany Agreements between the infrastructure owners (InfraCo Fixed and InfraCo Towers) and ServeCo support sustainable earnings for each of these entities and preserve shareholder value at the Group level.

The longer-more technical-version

- The new legal restructure formalises separate ownership of infrastructure assets in new entities.

- The restructure creates the option to monetise value in privileged infrastructure assets.

- Strong global demand exists for mobile tower assets at compelling valuations.

- Telstra International has been established with a focus on subsea cables.

- Global demand for high-quality telecommunication infrastructure assets supports long-term shareholder value accretion.

The finalisation of Telstra’s legal restructure has ushered in a new parent entity to be known as Telstra Group Limited.

TLS shareholders have received one new Telstra Group share for each of their existing Telstra Corporation shares. Assets and liabilities have been transferred to various entities within the Group.

The restructure is much more than a variation to Telstra’s name; it is a fundamental change that responds to a rapidly evolving telecommunications industry driven by digitisation, analytics, Artificial Intelligence, and related technology network ‘smarts’, as well as unlocking the value embedded in Telstra’s assets.

These key essential assets include the towers, ducts, fibre, data centres, subsea cables and exchanges supporting Australia’s leading telecommunications network.

The restructuring was a complex process and the most significant corporate change since privatisation.

A key outcome for shareholders is that the restructure should enable a higher overall market value to be attributed to the Group by improving visibility and returns on essential fixed assets with monopolistic style characteristics and value.

This is because Telstra’s infrastructure assets have identifiable, contracted, long-term, recurrent and low-risk cash flows.

On a standalone basis, these assets autonomously managed by a separate leadership group should release value to shareholders over time. While not explicitly stated by Telstra’s management, the legal and structural separation of key monopolistic style assets provides optionality for the sale or separate ASX listing of these assets.

Given their reliable cash flow and low-risk profiles, compared to other service-oriented parts of the business, a standalone entity comprising these assets is likely to command a premium valuation by global investors.

In conclusion

Telstra wants investor focus to be less on the state of the business today and more about how well-positioned Telstra is for the future.

The digital economy is the future, and its dependence on a reliable, technologically superior telecommunications platform is fundamental to the vibrancy and productivity of the Australian economy.

The digital economy is the future, and its dependence on a reliable, technologically superior telecommunications platform is fundamental to the vibrancy and productivity of the Australian economy.

Telstra’s legal and physical restructure should uncover the increasing value of infrastructure assets globally, and the new TLS is well-placed to deliver shareholder value accretion over the long term.

They have been vigorous in cyber-security spending – let’s hope it stays that way!

Here’s the Scheme Notification Letter for more.