Most people make the same mistake with money over and over:

They buy high out of FOMO and greed, then sell low out of fear, despite knowing on an intellectual level that it is a very bad idea.

The easiest way to see this behaviour is to watch the money flow in and out of markets.

Here we paraphrased some of Carl Richard’s very intuitive views…. so let’s push forward…

Let’s go back to early 2000

The dot-com market had gone ballistic.

The dot-com market had gone ballistic.

People were using their home equity to buy tech stocks right after the NASDAQ had a single-year return of better than 80%!

In January 2000, US investors put close to $44 billion into stock funds, according to the Investment Company Institute, shattering the previous one-month record of $28.5 billion.

We all know the story from there.

Money continued to pour into stock funds, breaking records for February and March and pushing the NASDAQ to 5,000, only to lose half of its value by October 2002.

This gets worse!

That same October (at the low for the cycle), as investors were selling stocks as fast as they could, where was all the money going? Into bonds at a time when bond prices were near record highs.

Think about this pattern for a minute…

At the top of the market, they can’t buy fast enough. About three years later, at the bottom, they can’t sell fast enough.

And they repeat that over and over until they’re broke.

No wonder most people are unsatisfied with their investing experience.

We realise this is a story from ancient history; 2000 feels like a long time ago. But people do this time and time again.

Right now, there’s a story like this every month.

Here’s where the Audi dealership comes in…

Can you imagine doing this when making any financial decisions or in any other setting?

Picture someone walking into an Audi dealership and saying, “I need a new A6.”

The salesperson says, “Oh my gosh, you’re in luck, we just marked them up 30%!”

And the buyer says, “Awesome, I’ll take three!”

Think of this in reverse…

Imagine walking into the same Audi dealership and saying, “I need a new A6.”

Only to have the salesperson says, “Oh my gosh, I’m so sorry; we just marked them down 30%.”

Would the buyer be disappointed and, with head hanging, shuffle out the door and say, “Damn it, I’m so unlucky! I should have been here six months ago when they cost more…”

How does this relate to investing?

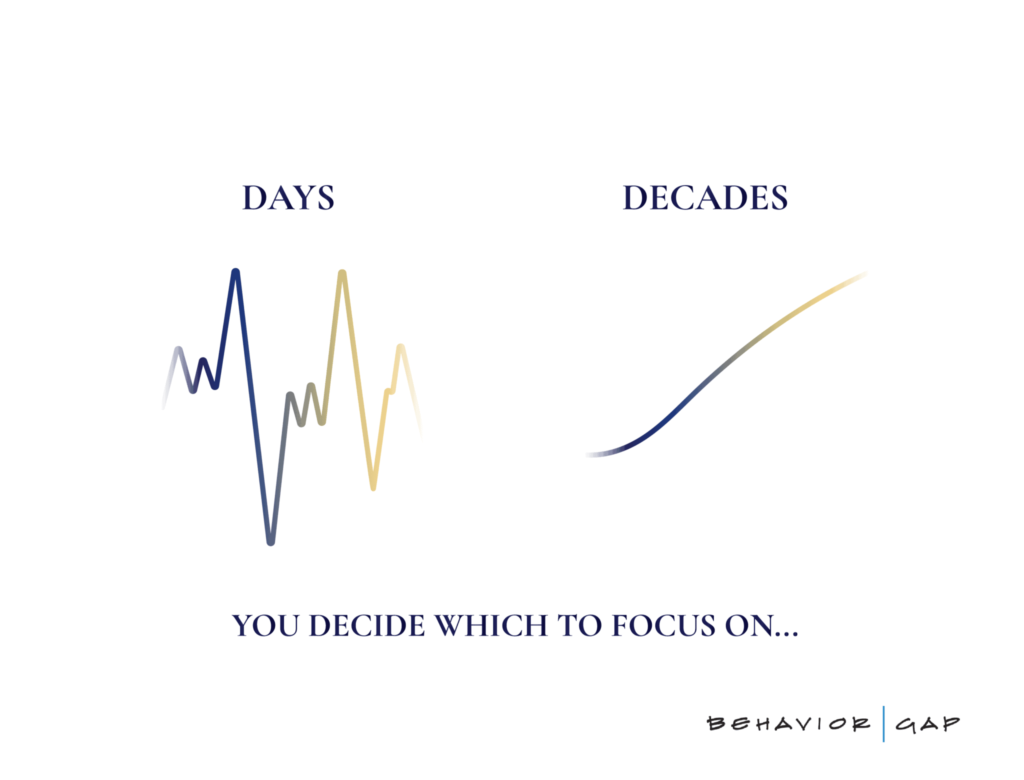

We’re hardwired to get more of what gives us security and pleasure and run away, as fast as we can, from things that cause us pain.

That behaviour has kept us alive as a species. If you mix that with our desire to be part of the herd and the feeling that there’s safety in numbers, you get a pretty potent cocktail.

When everyone else is buying, it feels like if we don’t join them, we’re going to get eaten by the financial version of a tiger.

But this behaviour is terrible for us when it comes to investing.

Of course, it’s important to know that it’s totally normal to feel fear, greed and FOMO or to be scared when the markets are scary. The fact that you feel those things just means you’re human.

It’s okay to feel it. But understand that acting on it will cause financial harm.

What will set you apart is understanding what’s going through the minds of the masses and being able to move ahead of that.

It’s also how you’re able to understand and control your own emotional responses that’ll determine your success as an investor.

Resilience and patience.

But this is what it feels like.

Just remember, security makes you feel good at that time, however, it might not help with your longer-term investment goals.