Yes…eventually!

Yes…eventually!

The wave of pent-up buying in the banking sector indicates a change in sentiment, with most of the Big Four up 25% from their dismal COVID lows.

Although they are still 20% off their pre-COVID levels, in our view, the move up is underway. Why?

- Banks have taken big provisions – governments have influenced this. Governments have proven to be very conservative in their economic assumptions around COVID which implies the banks have over-provisioned. They’re also holding a lot of capital at the behest of regulators – probably too much;

- While it’s hard to know what bad debt levels will do in the next 6 months, looking out to 2021/22, they will get back to a normal, so too will bank profits and dividends;

- If that happens, CBA will trade mid $80’s and ANZ, NAB and WBC share prices will recover back to mid-$20’s, which is a solid bounce across the board;

- Share prices have started to move higher sooner, rather than later;

- CBA is the most highly capitalised bank and is growing income at the highest rate – that’s why it trades at a premium to the other banks; and

- We’re not keen on the regional banks, given they need to spend up big on technology and improving their internal operations – it would make more sense for them to join forces.

But there is always the risk of a second wave of infections.

What’s our medium to long-term outlook on Australian banks?

We still see the current risk-reward equation as compelling.

Romano Sala Tenna from Katana Asset Management notes:

“Whilst it is difficult to know precisely where the banks will move in the short term, we are confident that over the medium term and beyond, they will be substantially higher due to the:

1. Investor need for yield;

2. Long term track record of profitability and dividends;

3. Core nature of banking; and the

4. Competitive advantages and oligopolistic industry structure.“

There is an old industry saying: ‘The short term is unknowable, but the long term is inevitable’. This means that in the short term, sentiment rules the roost, but over the long-term fundamentals drive share prices.

These 4 points are really important and warrant further explanation, as they directly impact on future stock prices and dividends, so we will cover off on these in Part II.

Where did we position ourselves?

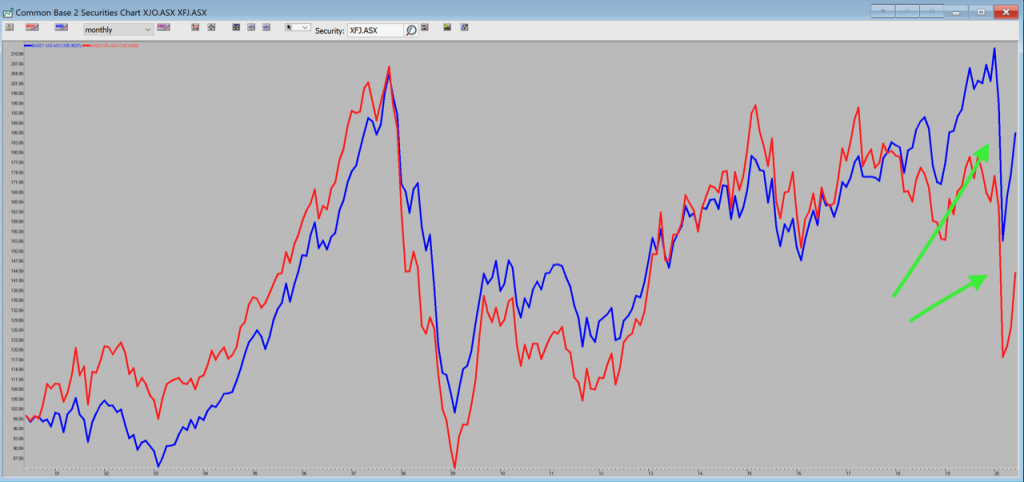

You can see from the chart below that the disconnect between the ASX200 and the banking sector since 2018, is at record levels.

Source: IRESS The ASX200 is the blue line, while the Banking Index is the red line.

The NAB, WBC and ANZ shares prices were at GFC lows. This is bizarre given that the GFC arose out of poor bank lending practices.

These share price declines seem excessive.

We have focussed on the ANZ, NAB & WBC banks as they have fallen relatively further than the CBA. Even though the CBA is a better business, it is not twice as good as the others.

What about record low rates and the economy?

Mr Sala Tenna goes on to explain:

“It is clearly harder to hide bank margin in record low rates. With the official rate at 0.25% and mortgage rates now testing the 2% barrier, the net interest margin (NIM) has never been tighter. This is clearly a significant headwind. And with deposit rates on many accounts already at 0% (or negative when account fees are included), there is no scope to reduce them any further to increase the spread.

Whilst not sufficient to completely offset the tight rates, the banks do have a few levers to pull.

To begin with they have been reducing the impact on margin by withholding a component of some of the recent rate cuts.

Of course, the shorter-term impact is of more immediate concern to investors. And once again we believe that the record low interest rate should play a significant role in mitigating the extent of bad debts and provisioning.

During the GFC, the RBA’s official rate was set at around 6%. This is a long way from the 0.25% we have today and provides a significant buffer.

This is likely to be the case especially for households/mortgages, where the lowest rates on record will mean that a much smaller percentage of loans will default. We anticipate that only a fraction of the estimated $200bn currently requesting loan deferrals will actually progress into default.”

What about APRA and the role of the regulators?

We need to remember that APRA has been regulating the banks’ lending standards more diligently than in prior cycles. Lender Mortgage Insurance is often compulsory for high Loan-to-Value-Ratio loans. And importantly, we have seen no crash in property prices yet, which in part was due to the cooling that occurred prior to COVID.

September will be the lie detector test (after the six month “holiday” period expires). So, we expect bad debts to peak in the second half of 2020.

Any other risks?

Household lending is seen as less of an issue than during the GFC, the sting in the tail is likely to be in the Small to Medium Enterprises side. Regardless of how low rates are, if revenue drops below expenses, you no longer have a business! This is the major risk factor we see.

The threat posed by Neo Banks in 2019 may well recede as the COVID inspired ‘flight to quality’ sees Neo Bank deposits switch back to the major banks, at a time when losses on the Neo Bank loan books are increasing.

What does this mean for my investments?

What to do with the Australian banks is one of the major questions facing both institutional and retail investors alike, as their share prices have fallen significantly in 2020 and they appear priced for the most pessimistic outcome – although they have rallied spectacularly in the past two weeks.

We don’t expect that the banks will have a smooth ride, but the big difference between the COVID crisis and previous crises has been the speed and size of the fiscal responses.

During the GFC, it took around 12 months for politicians to respond to the unfolding crisis, mainly due to the impression that those most affected were bankers and US sub-prime borrowers.

But, when we remember that our banks entered this crisis with the strongest balance sheets on record (thanks to years of APRA prodding), we have some confidence that they will see out this downturn in reasonable shape.

In conclusion

The current pricing suggests that their issues are more systemic or of longer duration. We believe that this is not the case; that COVID will have a transient effect on book quality.

While the outlook for the banks may look uncertain, Australia’s banks have historically performed well coming out of crises.

Please check in for Part II of this series, it’s important…..