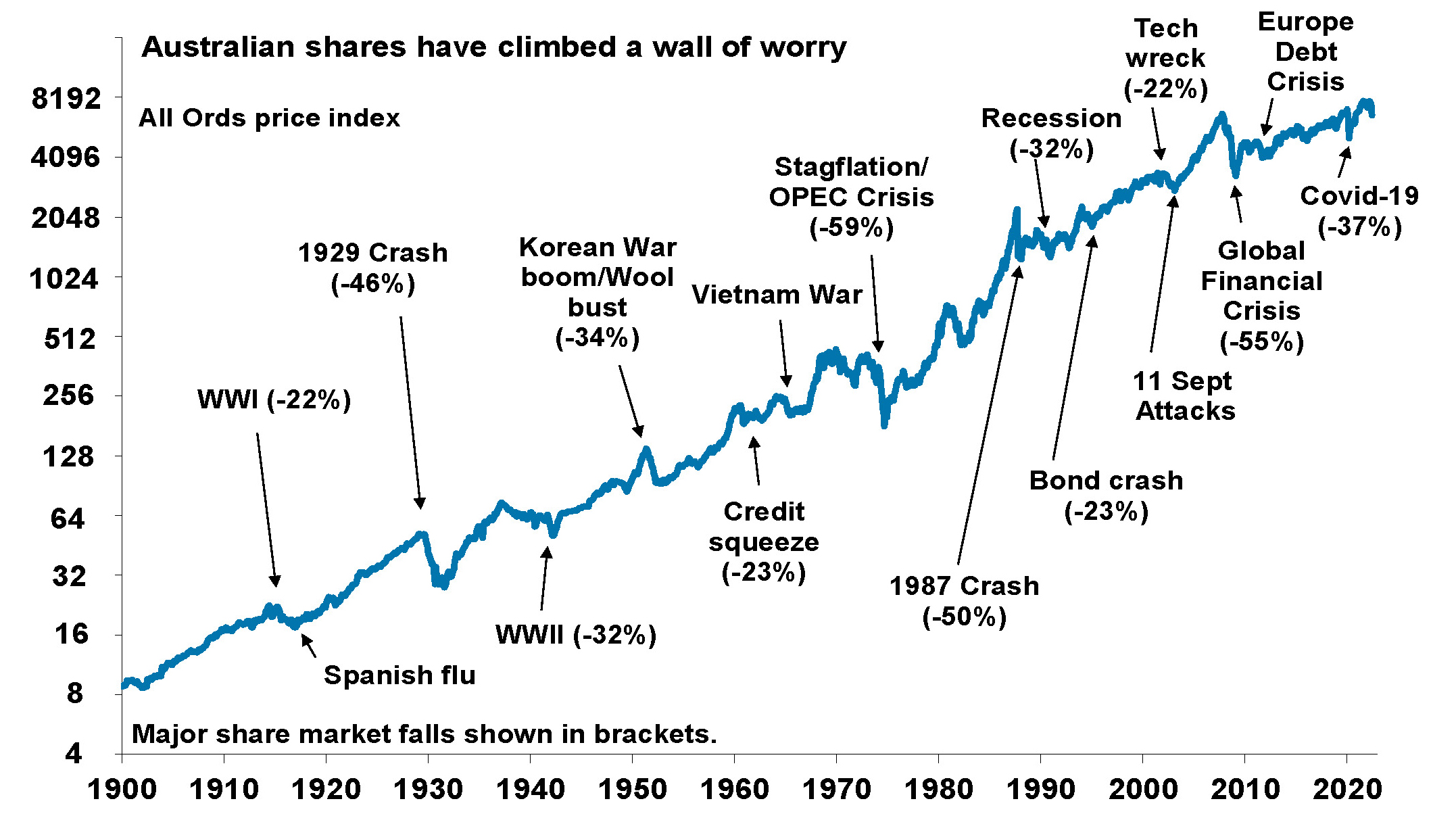

Crashes don’t happen often, but corrections do.

You don’t have to like them, they will test you to your very core, but they are an investing fact of life.

The old saying, which is now backed up by evidence, goes that:

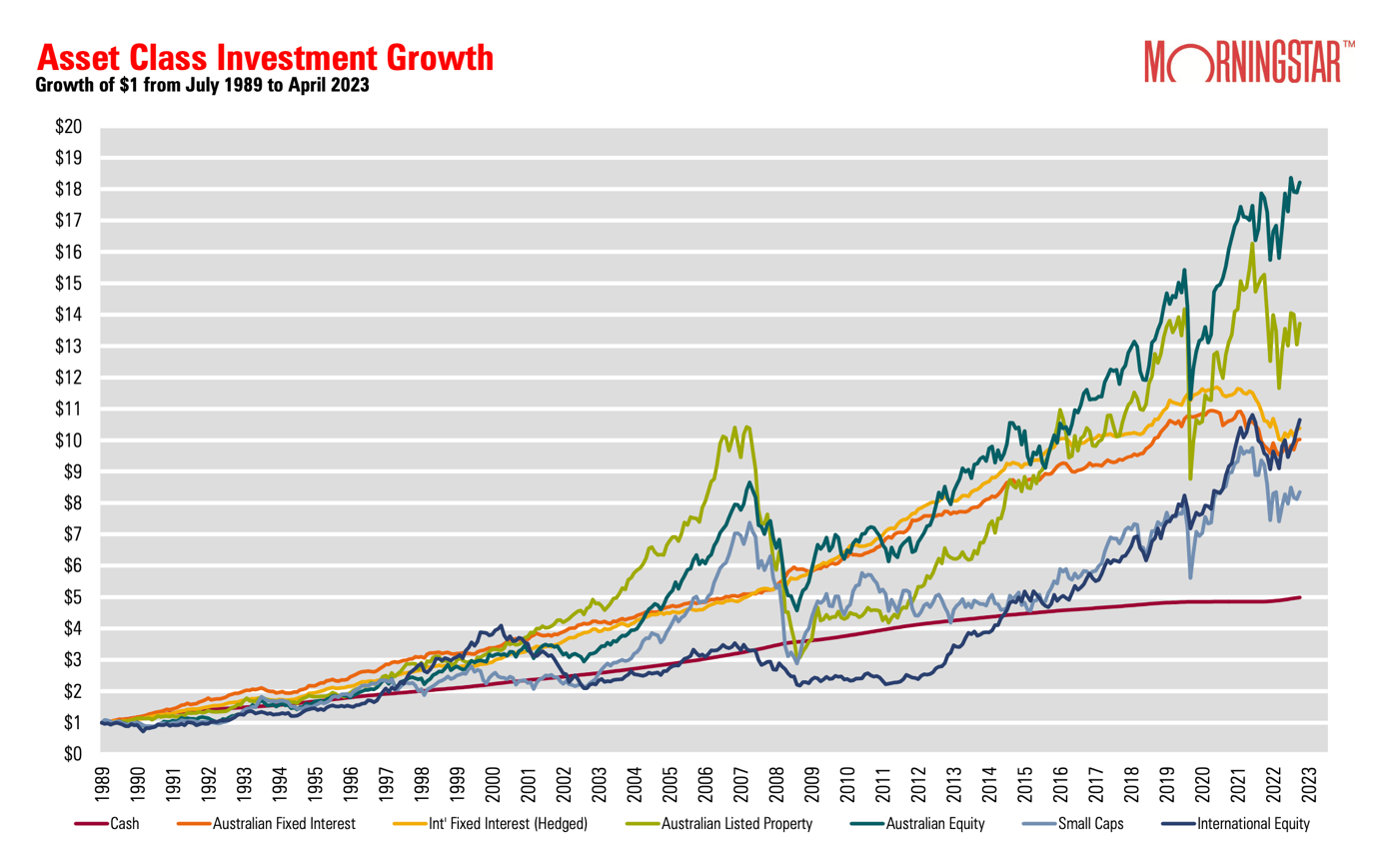

Time in the market is better than trying to time the market.

Yet, investors tend to have a bad habit of buying high, then selling low, based on emotions and FOMO.

Staying the course does not necessarily mean sitting still.

It means avoiding bad behaviour, remembering your goal(s) and approaching investing with discipline.

We’re going to reverse the usual order here and start with the conclusion which includes, implications for investors and our investment mantra.

Then we’ll go into the details for those that want to feast on some data.

So… let’s start with the end….

Conclusion

Implications for investors

Most reputable market commenters remain of the view that shares will do OK in the next 12 months, as central banks ease as inflation cools.

But given the list of negatives, global and Australian shares are vulnerable over the next few months to a correction.

There are several implications for investors:

- For short-term investors, it’s a time to be cautious.

Short-term investors usually either turn into longer-term investors or lose all their money (depending on which comes first). - For longer-term investors (superannuation members and most investors), while times can be stressful, the best approach is to stick to basic investment principles.

And remember, the overall trend is always up!

Our mantra

We are repeating ourselves (as this is our mantra), but these things are always worth keeping in mind:

| 1. | Share market pullbacks are healthy and normal – their volatility is the price we pay for the higher returns they provide over the long term. |

| 2. | It’s tough to time market moves, so the key is to stick to an appropriate long-term investment strategy. Know what you own and why! |

| 3. | Selling shares after a fall only locks in a loss. |

| 4. | Share pullbacks provide opportunities for investors to invest cheaply. Consider buying! |

| 5. | Shares invariably bottom with maximum bearishness. |

| 6. | Australian shares still offer attractive income versus bank deposits. |

| 7. | To avoid getting thrown off an excellent long-term strategy, it’s best to turn down the noise of the negative news flow. |

| 8. | Repeat after us: This too shall pass! |

Let’s get into the how and why….

Key points

- Shares are vulnerable to a pullback in the months ahead, reflecting the rising risk of recession on the back of central bank tightening.

- Falling inflation should enable central banks, including the RBA, to start easing later this year or early next, providing some support for share markets.

Although with our last set of CPI numbers, interest rates will remain “higher for longer”. - Share market falls are painful for investors but stick to a long-term strategy.

Introduction

Global and US shares are up 17% from their lows last year. Australian shares are up 13% as investors have been buoyed by evidence of peaking inflation, anticipation that central banks are near the top, resilient growth and profits, and enthusiasm for Artificial Intelligence (AI) following the launch of ChatGPT late last year.

This has resulted in solid year-to-date returns. But is it sustainable?

The worry list for shares

Right now, there is a worry list for shares. This is no different to every other day; there are always triggers with noisy media hurling flash-bangs:

- So far, AI-related stocks have accounted for all of the rise in the US S&P 500, with the Dow Jones index actually flat year to date.

–

–

–

–

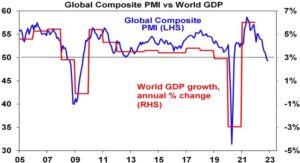

– - Leading economic indicators continue to point to a high risk of recession in the US and elsewhere.

– - A recession would mean a sharp decline in company profits which is not currently expected by the consensus.

–

–

–

–

–

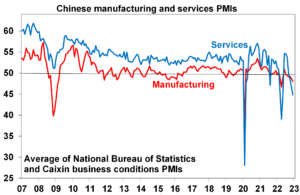

– - The Chinese economic recovery has started to disappoint. In particular, it’s concentrated on services as opposed to manufacturing. This may mean less global growth.

–

–

– - Weakness in copper, oil (despite OPEC production cuts) and other industrial commodities suggests weakening demand. This is also reflected in the growth-sensitive Australian dollar, which recently broke below support of $US0.66.

This is partly related to the relative weakness in manufacturing in China and partly explains the underperformance of the Australian share market so far this year – it’s up 2.5% compared to a 9% rise in global shares. - US banking stress is continuing, resulting in an additional tightening in lending standards as other banks seek to avoid a Fed takeover.

- While the US debt ceiling is close to resolution, there will be less spending than would otherwise have been.

- While central banks are probably at or close to the top, they remain trigger-happy and risk doing more – potentially overtightening.

The US Fed (at 5.13%) and the RBA (at 4.10%) are concerned about sticky inflation.

At this stage, the Fed is likely to pause at its June meeting but may still do more at its July meeting.

In Australia, we have continuing hawkish commentary from the RBA with risks around wages, poor productivity growth and rising home prices (which are reversing the negative wealth effect).

On wages, watch the June minimum wage decision as a 7% minimum wage rise will add around 0.45% to wage growth directly, plus more indirectly due to its influencing effect.

Add to this the 15% rise in wages for aged care workers, with the potential to flow on to others in the hospitality industry, and accelerated public sector wage growth, and all may likely take wage growth beyond the level consistent with the inflation target.

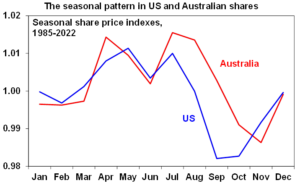

All this means the risk of further RBA rate hikes is very high. Further rate hikes will exacerbate the economic downswing and add to the already heightened risk of recession. - Finally, the period from May to September is often rough for shares, albeit with a bounce in July (particularly in Australia).

But it’s not all negative.

While worries exist, as always, there are some positives for shares:

So far, global economic conditions have held up far better than feared.

So far, global economic conditions have held up far better than feared.

According to purchasing manager surveys (PMIs), business conditions have improved since late last year, suggesting growth will surprise on the upside.

Related to this, so far, company profits globally have held up better than expected.

The complication is that the strength may be exaggerating things as services are driving it, but manufacturing is weak. It’s usually a better guide to cyclical conditions and warns of weaker conditions ahead.- Inflationary pressures looked to have peaked and are receding, even though our latest CPI numbers were sobering.

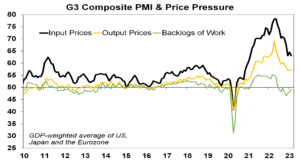

Business conditions PMI surveys show a continuing downtrend in input and output prices (for manufacturing and services), order backlogs are well down from their 2021-22 highs and delivery times are much improved.

At the same time, labour markets are gradually becoming less tight with slowing job openings.

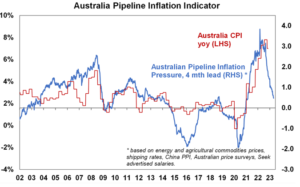

Further, AMP’s Pipeline Inflation Indicators for the US and Australia have continued to fall, pointing to a further decline in inflation ahead.

If correct, this will allow central banks to ease monetary policy early next year.

–

–

–

–

–

–

–

–

–

–

–

–

–

– - Enthusiasm for AI has the potential to push share markets higher directly in terms of IT stocks that will benefit from related demand associated with an upgrade to AI, but also via a productivity boost to high labour industries, which will boost growth and profits and lower unit labour costs.

Banks and insurance companies will benefit significantly from this trend.

Of course, as we saw with the late 1990s tech boom, the benefits could take time to materialise, and investor interest could get frothy, setting up a short-term pullback.

The psychology (fun facts)

Staying the Course Versus Timing the Market

“Staying the course” is a nautical phrase.

It is not always about sitting still (even though this is often the easiest path to investing success), but rather, focusing on the goal that you set in the first place and ensuring your behaviour aligns with it.

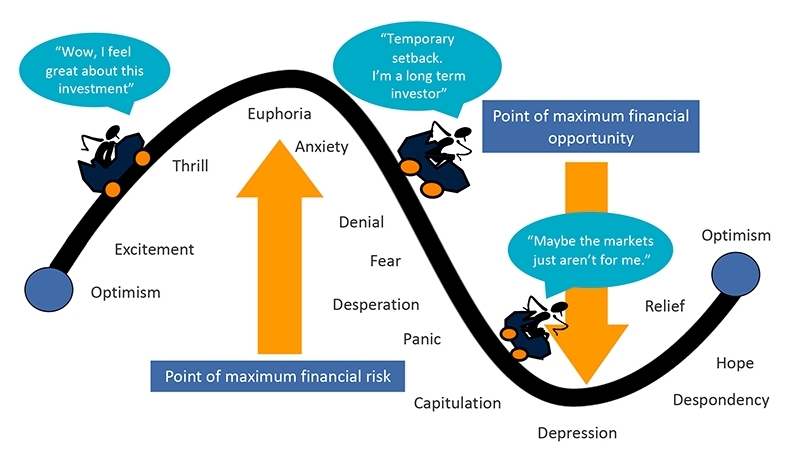

Let’s face it; investors too often redirect their focus from the destination to the journey.

Much like in other walks of life, we can lose focus, making us susceptible to capitulation or giving up at the exact moments when we require fortitude and resolve.

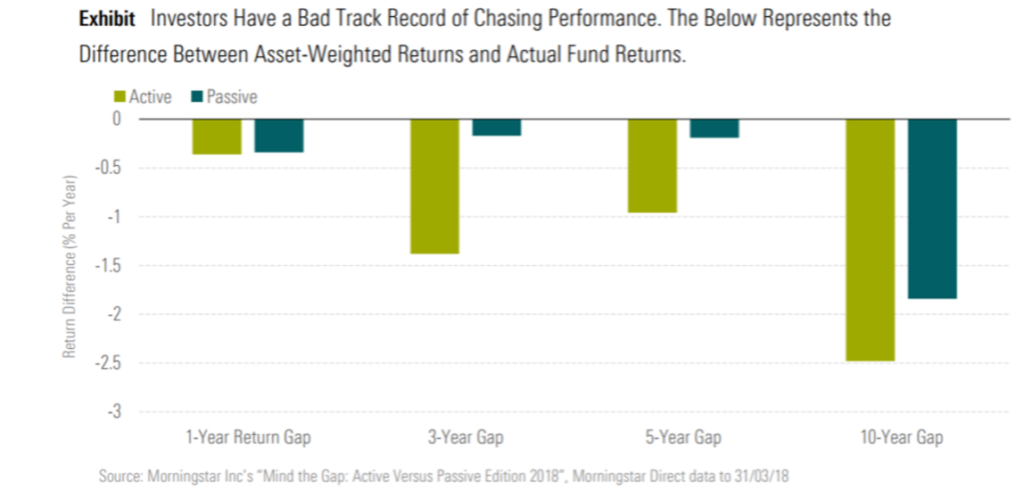

Investors are hard-wired to be procyclical, chasing the winners and selling out of the losers because of a yearning to make money work harder for us.

This is not just conceptual; we can see it directly in the fund flow numbers.

Therefore, it is vital that, as investors, we remain vigilantly aware of how animal spirits can drive irrational decision-making and that we adopt a reasoned framework for investing. Behavioural errors can wreak havoc on long-term portfolio returns due to excessive and unjustified turnover.

Therefore, it is vital that, as investors, we remain vigilantly aware of how animal spirits can drive irrational decision-making and that we adopt a reasoned framework for investing. Behavioural errors can wreak havoc on long-term portfolio returns due to excessive and unjustified turnover.

A Step-by-Step Guide to Staying the Course

The best thing an investor can do when contemplating change is to reflect on their goals.

The critical question to ask is whether anything has fundamentally changed since setting the original

strategy or whether it’s just that you’re disappointed, frightened or angry:

- If something has changed fundamentally, the next question to ask is whether you can clearly identify what has changed.

Write it down, then balance this by writing what it might mean if you’re wrong. This should include any misjudgement risk and the added costs if you decide to change investments.

You will often find that the change you desire is not necessarily going to increase the probability of reaching your goal(s). - If you are “just” disappointed, frightened, or angry (keeping in mind these are just emotions), nothing has fundamentally changed; the likely best option is to stay the course.

Remember that investment markets never move in straight lines, so try to avoid the perils of trying to time the market. - Furthermore, you may benefit by doing the opposite of your intuition, given the evidence

against it.

How do we think about “staying the course.”

Focus on the investment objective to remove any emotion from decision-making.

In this sense, staying the course is not idle or passive but rather about staying aware. And understand why you might not be doing anything. Even doing nothing is doing something…

Some investors may look at a recent period of lean returns and will fear the future.

Many will further justify to themselves that the risk-reward is simply insufficient and will consider a change in strategy.

This thinking is usually well-intentioned, but it is dangerous.

Conclusion II

Like many things, investing often involves taking the thorns with the roses.

Over dozens of years and through all investment literature, there is one golden thread which is:

The evidence favours time in the market over timing the market.

So, know what you own and understand why you own it.

The roller-coaster of investor emotion

The reality

Denise Locantro

Associate Director

Wealth Management and Protection