With the end of the financial year just two months away, we’ve prepared a few tips for our personal clients to make sure they maximise their deductions for their tax returns before 30 June 2022.

For this insight, we are focusing on three areas:

- Superannuation considerations – these are extremely important to be done no later than 24 June 2022 to make sure that any contributions make it to your fund by 30 June 2022

- Tax Deductions for your personal tax return

- Financial considerations for your personal tax return

Tax Planning Part 1: Using super to its advantage – Boost before 30 June 2020

Many people make the constant mistake of comparing superannuation funds by examining their investment returns and fees.

Superannuation is a tax-effective investment vehicle that you can use to provide for your retirement. The performance of your superannuation will depend on the investment options that you select, the level of life insurance cover that you choose, and then the choice of administration platforms.

With the end of the financial year close to being upon us, here are our Top 5 superannuation strategies that could help you save tax and boost your overall financial position in the lead up to the end of the financial year and moving into next year.

- Review your superannuation contributions

- Top up your super from after-tax amounts

- Make a downsizer contribution

- Get a super top-up from the government for you or your spouse

- Additional tax on super contributions by high Income earners

As an employee, you may want to sacrifice your pre-tax salary or bonus into super rather than receive it as cash, so you will:

• Reduce tax on your salary or bonus by up to 30%, and

• Take advantage of the contribution cap that applies in this financial year.

With the new changes in superannuation deductibility, you can now make a personal contribution to super directly and make “catch-up” superannuation contributions using your unused concessional contributions caps (for up to five years) from 1 July 2018.

The concessional contributions cap for the 2022 financial year is $27,500. If you are making personal contributions and would like to claim a tax deduction, remember to give your superannuation fund a notice of intent to claim a tax deduction and that you receive an acknowledgment letter from your superfund. This ensures that you are allowed the deduction when the ATO matches its records to your superannuation fund.

AAG Wealth Management and Client Care Teams can help.

You are allowed to put into superannuation an amount of after-tax funds (known as non-concessional contributions) of up to $100,000 per annum (and more if you use the ‘bring forward’ rule). To assist in boosting your retirement savings, you can consider several strategies:

If you have an investment in your name, you may want to cash out the investment and use the money to make a personal after-tax super contribution, so you can:

• Reduce tax on investment earnings by up to 30%, and

• Increase your retirement savings.

If you have received an inheritance or a windfall, you can consider putting those funds into superannuation, and the earnings on those funds will be taxed at 15% rather than at your standard marginal tax rate.

AAG Client Care Team can help.

Individuals aged 65 years or older can make downsizer contributions of up to $300,000 into their superannuation using the proceeds from the sale of their primary residence where sale contracts are exchanged on or after One July 2018 (and superannuation providers can accept such contributions).

AAG Client Care Team can help.

If you earn $41,112 or less for the tax year ending 30 June 2022, you may want to make a personal after-tax super contribution of $1,000, and you may qualify for a government co-contribution of up to $500.

You could also make this contribution for your spouse to top up their super if they earn $41,112 or less, and you can also claim the co-contribution for your spouse.

Alternatively, if you have a spouse who earns $37,000 or less for the year to 30 June 2022 (subject to other conditions), you may want to make an after-tax super contribution on their behalf, and you can receive a tax offset of up to $540.

AAG Client Care Team can help.

The income threshold at which the additional 15% (‘division 293’) tax is payable on super $250,000 p.A. Where you are required to pay this extra tax, making super contributions within the cap is still a tax-effective strategy.

With super contributions taxed at a maximum of 30% and investment earnings in super taxed at a maximum of 15%, both these tax points are more favourable when compared to the highest marginal tax rate of 47% (including the Medicare levy).

AAG Consulting Team can help.

Tax Planning Part 2: Review your Tax Deductible Expenses for 30 June 2022

Here are some of the common tax deductions you can claim, and what to look out for. The major issue for clients is that to receive a tax deduction, you must have spent the money before 30 June 2022, and show that you have made the payment for the expense.

- Motor Vehicle Expenses

- Travel Expenses

- Deductable Donations

- Mobile Phone and Internet Plans

- Laundry Expenses

- Sun Protection Expenses & work related Expenses

- COVID-19 Work Related Deduction for Home Office

- Prepay Expenses, Interest and Income Protection Insurance Premiums

- COVID-19 Test Expenses

Ensure that you have kept an accurate and complete Motor Vehicle Logbook for at least 12 weeks. The start date for the 12-week period must be on or before 30 June 2022. You should record your odometer reading as of 30 June 2022 and keep all receipts/invoices for your motor vehicle expenses (e.g. fuel, interest, servicing and insurance). Once prepared, You can generally use a logbook for a 5-year period.

An alternative (with no logbook needed) is to simply claim up to 5,000 business kilometres (based on a reasonable estimate) using the cents per km method.

AAG Client Care Team can help.

If you have travelled for work purposes and would like to claim the costs associated with the travel, ensure you have maintained a travel diary if you have travelled away from home for six or more nights in a row. If you intend to claim for travel to a rental property, please refer to the ATO website to check your eligibility.

AAG Client Care Team can help.

Make your donations to charities that have Deductible Gift Recipients (DGR). Ensure, wherever possible, that you get your receipt in the higher-earning spouse’s name.

AAG Client Care Team can help.

Calculate how much you use your mobile phone and the internet for work.

AAG Client Care Team can help.

Consider your laundry expenses, and check if you are eligible to make a claim.

AAG Client Care Team can help.

From 1 July 2021, if you’re an employee, sole trader or contractor and you pay for a COVID-19 test for a work-related purpose, you can claim a tax deduction. Remember to keep all your receipts!

AAG Consulting Team can help.

Tax Planning Part 3: Capital Gains and Investments Review

- Review and Prepay Interest on Investment Loans

- Check the Ownership of Investments

- Mortgage Offset Accounts

- Review your Investments Capital Gains and Losses

- Defer Asset Sales to Save Tax

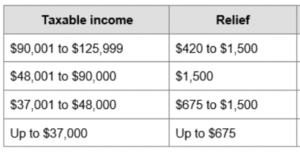

- Cost of Living Relief

- Medicare Levy Surcharge (MLS) / Health Insurance

You may be entitled to an immediate deduction for certain prepaid expenses where the goods or services will be provided within 12 months from the date of expenditure.

For example, if you have an Investment loan used to fund an investment property or shares, you can pay the interest in advance for the next 12 months and claim the tax deduction in the current financial year.

This can be effective in many instances, including:

• If you have more income this year and are retiring or expecting your income to reduce next year;

• If you want to bring a tax deduction forward into this year as you received a one-off bonus or other income; and

• If you made a capital gain on an investment.

This can also be an excellent time to review the structure of your home loans so that they are the most tax-effective that they can be.

Due to the time it takes to deal with bank regulations and rules, we recommend reviewing this strategy as a priority. As we are tax accountants and finance brokers, we can assist you with reviewing the strategy and implementation.

AAG Finance Team can help.

Clients who are the legal owners of assets such as shares or Term Deposits can expect to be taxed on the income. Hence, we recommend you review how your investments are held and consider if it’s worthwhile holding the investments in the lower-income earning spouse’s name to save tax.

However, any change of ownership needs to be planned carefully due to capital gains tax and stamp duty implications. Please get in touch with us to discuss this further.

AAG Wealth Management and Client Care Teams can help.

You should also review the benefit of mortgage Offset Accounts and their use. Generally, Offset Accounts reduce the amount of interest you pay, whereas income from funds held in a bank account that pays interest is taxable income.

The Offset Account reduces the amount of interest payable on your home loan, so you are saving interest on a non-tax-deductible expense. Having the monies held in a separate standard bank account and not offset can mean that you’re paying tax on a small amount of interest and not utilising the offset to its full advantage.

AAG Wealth Management Team can help.

If you have claimed realised Capital Gains this year from your investments, you may want to trigger a capital loss by selling a poorly performing investment that no longer suits your circumstances, so you can:

• Use the capital loss to offset your taxable Capital Gain and save tax; and

• Free up money for more suitable investment opportunities.

AAG Wealth Management Team can help.

If you are thinking of selling a profitable asset this financial year, you may want to defer the sale until AFTER 30 June 2022 to:

• Defer paying Capital Gains Tax (CGT); and

• Reduce your CGT liability.

The Contract Date (not the Settlement Date) is generally the key date for working out when a sale or purchase occurred.

AAG Wealth Management and Client Care Teams can help.

If you are single and your income is above $90,000 or if you have a spouse and your combined income is more than $180,000, you should consider private health insurance if not already held. MLS may be payable if you do not have appropriate private health cover (which may cost less than the MLS payable).

AAG Client Care Team can help.

No one knows your affairs better than yourself, so you will recognise if any of the above tax tips applies to your circumstances. But no one is better informed as to what is appropriate, or indeed allowable, than your tax agent (and don’t forget, any fee is an allowable deduction in the year it is paid).

No one knows your affairs better than yourself, so you will recognise if any of the above tax tips applies to your circumstances. But no one is better informed as to what is appropriate, or indeed allowable, than your tax agent (and don’t forget, any fee is an allowable deduction in the year it is paid).

Every individual taxpayer is required to lodge their return before October 31. However, tax professionals are generally given more time to lodge, which can be a handy extension to a payment deadline if any arises.

Of course, suppose you’re sure you will get a refund. In that case, there is no use delaying, so in these cases, it is worth getting all of your information in and your return lodged as soon as you can after July 1 – especially if the value of a refund is important for your circumstances.

We are here to help

This is general advice only and does not consider your financial circumstances, needs and objectives.

Before making any decision based on this document, you should assess your circumstances, seek advice from your financial adviser, and seek tax advice from your accountants at AustAsia Group.

Information is current at the date of issue and may change.

Contact our Client Care Team today, before the 30 June 2022 deadline, at (08) 9227 6300 or via our Contact Us Page for assistance in reducing your tax!