Let’s start with a quote from the investing guru himself:

“You will continue to suffer if you have an emotional reaction to everything that is said to you. True power is sitting back and observing things with logic. True power is restraint. If words control you that means everyone else can control you. Breathe and allow things to pass.”

Warren Buffett

When markets truly are challenging, the mainstream media screams at us, social media screams at us, and family/friends can be full of advice. So why don’t they make a career out of it? Do they know what’s best for you?

All of these are distractions.

They are trying to get you to notice them; that’s their job; more clicks = more eyes = more advertising revenue or just plain old attention at a gathering.

So why do we listen to it? Because we’re human.

It’s perfectly natural to take notice. But what sets us apart as a species is that we can choose how we react.

So why act when the world is screaming at you to sell everything and go and live under a bridge because that’s the only safe place?

It might be safe because you know where the bottom is, but it’s neither ideal nor comfortable. So why consider it?

The first rational thing to do is take a breath.

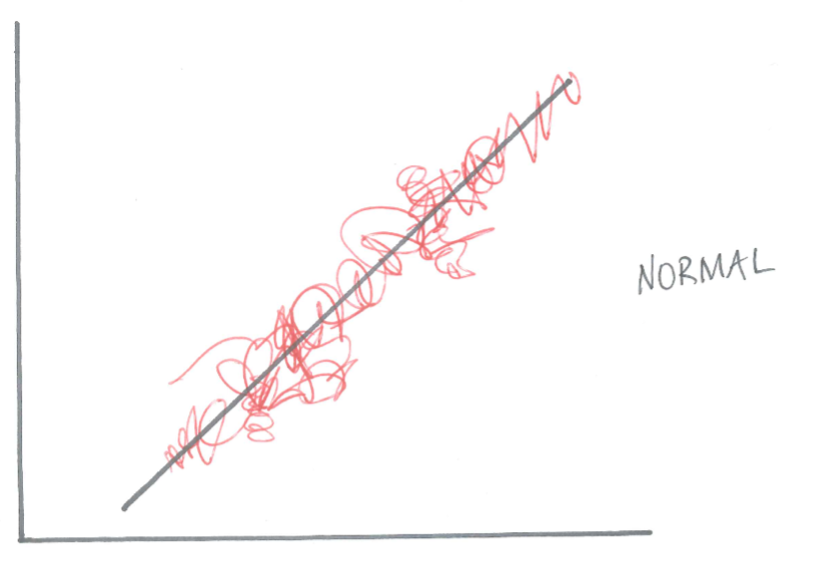

What a knee-jerk investment strategy looks like

Imagine if…

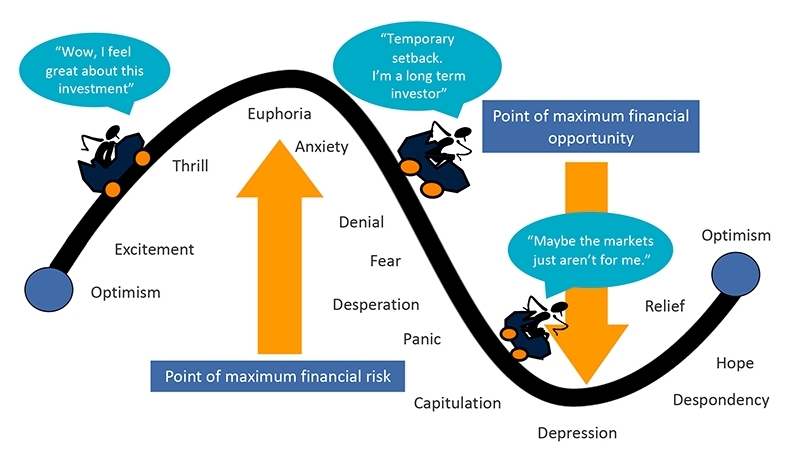

You bought when your emotions were running high (which coincides with market highs) and sold when you were frightened or scared (when the market is down).

This is what your trading would look like in a simple graph….

Chart 1 – Fast track to the bridge

Or, in slow motion…

Chart 2 – The roller coaster of investor emotion

This is exact opposite of what you should do.

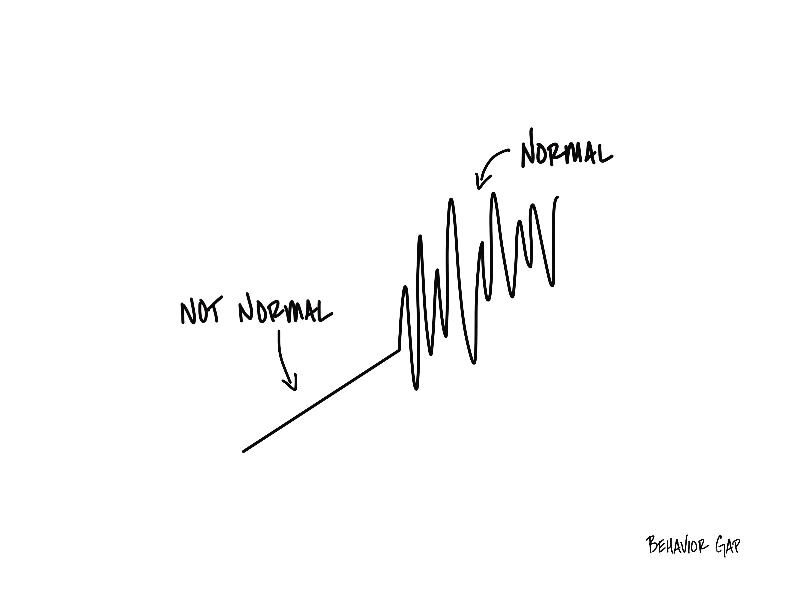

What a sound investment strategy looks like over time

We’ve all seen and heard the data many, many times. Why is that?

Because it’s living breathing evidence.

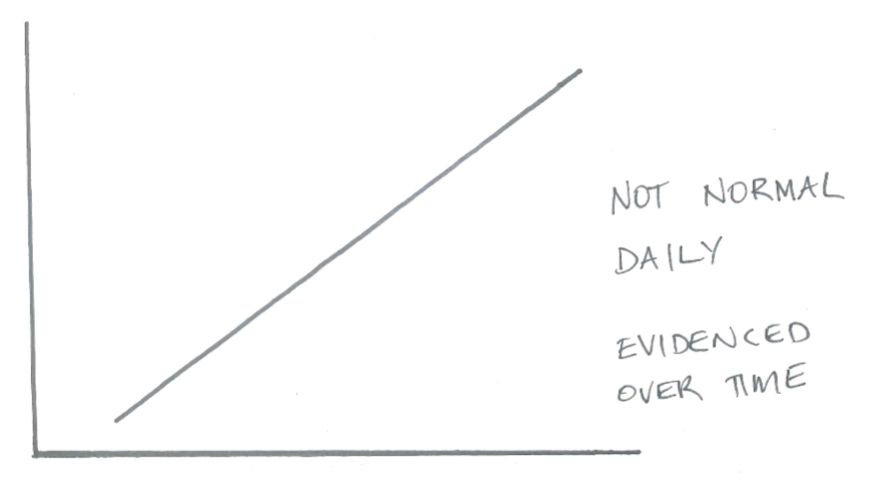

We look back with perfect 20/20 hindsight and this is the long-term Back of the Envelope drawing of what actually happens over time:

This is not what we see on a daily or yearly basis; it is not normal.

Chart 3 – Back of the Envelope (literally) – Straight Line Indicator of Market Returns

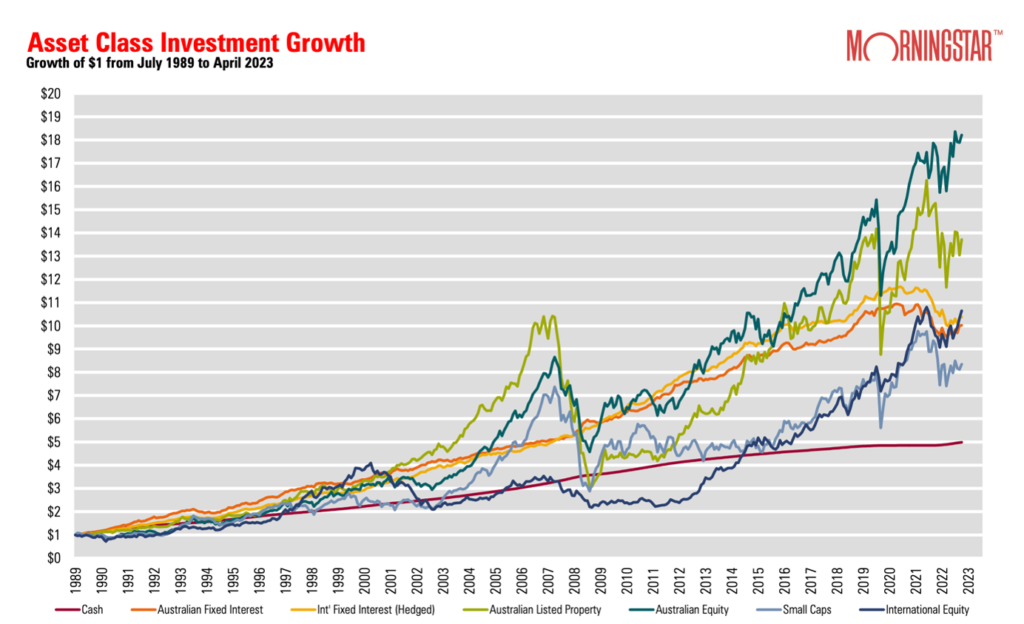

We extrapolated that from applying market data such as Morningstar.

Chart 4

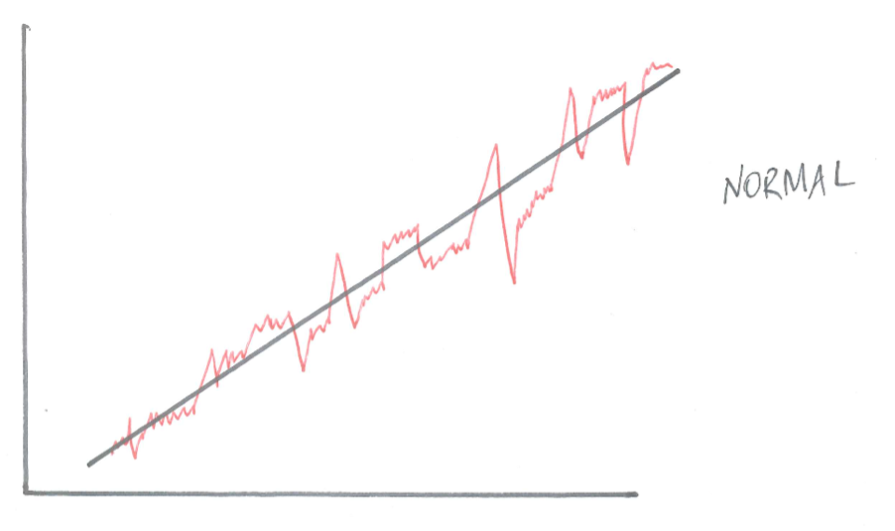

This is normal.

Chart 5 – Back of the Envelope (literally)

And this is what normal can feel like.

Chart 6 – Back of the Envelope (literally)

Not our idea of fun!

It looks and feels hyper-agonising, and it will give you multiple ulcers if you let it, or at the least, a very bad drinking habit.

Let’s now transpose all of these charts over each other.

No, let’s not because that’s way above my technical capabilities, but you get the idea.

So why do this to ourselves when the reality is Charts 3 and 4?

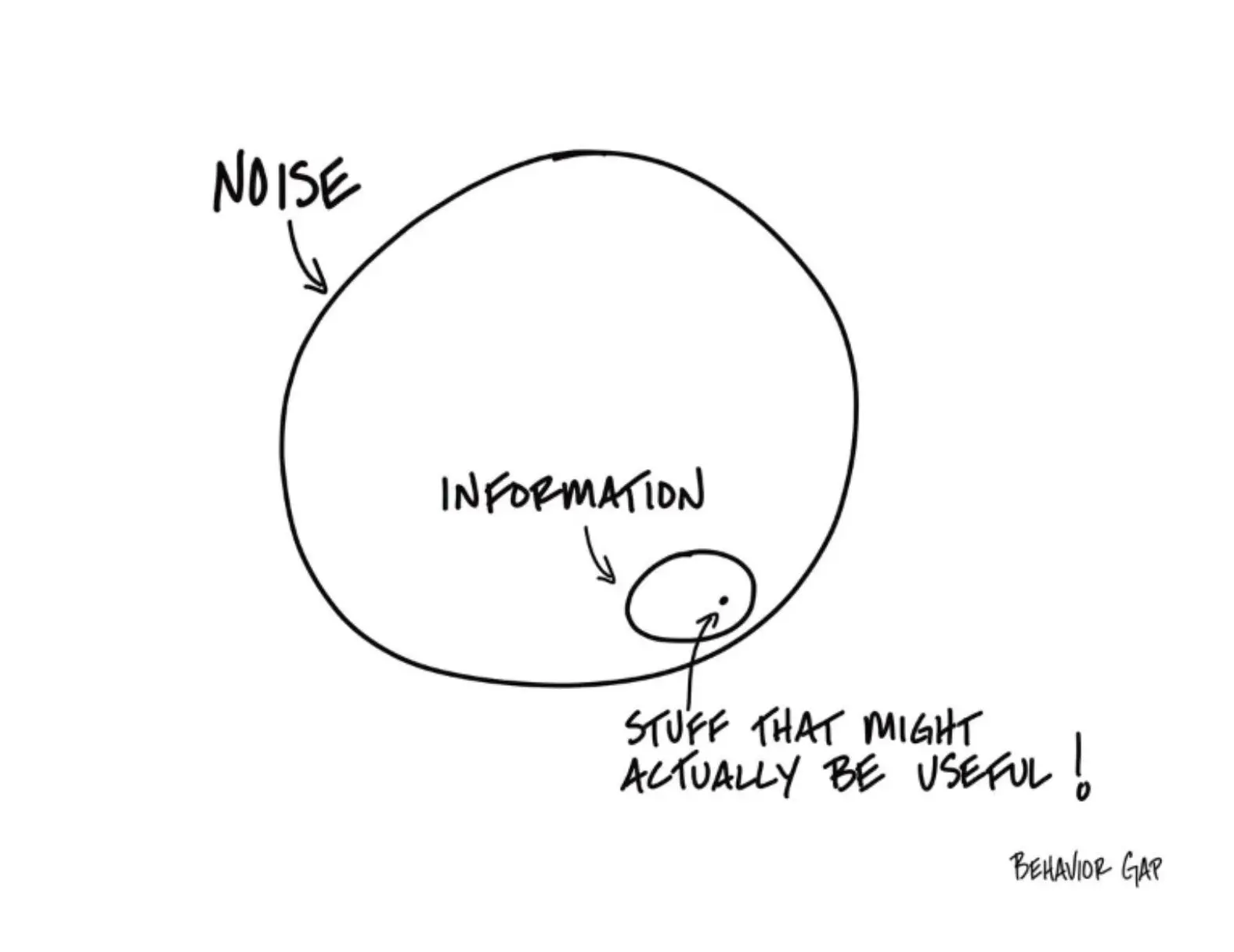

More on the noise

Here’s another picture of what the noise actually looks like:

Some people tell us that the dot is too big!

That’s why we say, “turn down the noise”. It will lead to a shorter life.

It’s normal to feel uncertain or frightened; that’s why we set our investment goals when emotions are stable (relatively).

The noise can echo and feed on itself. But ultimately, it’s just that…noise.

So, we need to trust and stick to our long-term investment strategy with our long-term financial goals clearly in sight.

Chart 7

In conclusion

If we are slaves to our emotions and other people’s words, we hand over our reasoning and logic to others.

Words are designed and used to try to make us feel a certain way.

But we don’t act on it; why? Because separating emotions and money decisions is the gold standard, otherwise you’ll always buy high and sell low.

What keeps human beings alive as a species is that we adapt, not just react.

So, give yourself a break and understand what “normal” is.

When scary things happen around us, sit with it, breathe and say, “This too shall pass”.

So, are these Investing Lessons, Life Lessons, or both?

We’ll let you decide.

And finally, always remember that you have us. If you have any queries or need our help, please contact us

We have many articles on our website relating to markets. Here are just a few:

What to do when the next market correction happens and what not to do

Scary Markets, and you’re all familiar with our