Like most prices, the economic laws of supply and demand dictate where prices go.

That is, when demand is greater than supply, then prices go up. When supply is greater than demand, prices go down.

There are differing views right now on whether the property market will continue to rise, or it is heading for a cliff in the next 12 to 18 months.

As usual, we adopt a middle of the road approach, but also review the underlying metrics that usually drive property markets.

We’ll review the availability of property by looking at the supply side first.

The supply side

It has been widely publicised that the current residential property market is being driven by a lack of supply.

There are a number of factors that drive supply, which include:

- Lack of materials, due to production levels lower than usual during the COVID pandemic and leading to a shortage in many areas (similar to the car industry where there are some components and some materials which are in short supply, leading to delays in vehicles being able to be made).The Ukraine situation has added to this as raw materials for items like insulation and similar fibrous materials are sourced from Ukraine, and other areas in Europe, which are now affected by the war;

- Lack of labour, due to not enough people to do the work.We are still sitting at a record unemployment rate, and more workers in part time work, with many people going back into the workforce to make ends meet (due to inflation and rising rates);

- Lack of funding for people wishing to develop.Through our finance arm of AAG, we have seen clients struggle to obtain finance for a development, or for their own house to be built. This does not help with being able to fund for builders to be guaranteed payment. While this is relating to the user side, it does mean that it is more difficult to complete houses and to have more stock on the market available;

- A number of Australians moved back to Australia, and took back their rental properties to live in, therefore taking rental stock off the market; and

- Builders usually have fixed price contracts, which means that they cannot pass on price increases from materials or labour. So, a number have closed the doors as they are no longer financially viable to stay in operation.

The above have all led to the so called “housing crisis” which is due to a lack of supply.

The demand side

There are three major issues that have exacerbated demand :

- Increased immigration, which has been sanctioned by the government in an attempt to fill the labour shortage gap, and allow for more construction to be completed;

- More people post pandemic moved back home to Australia; and

- As we mentioned above a number of larger companies have brought home their call centres and data processing to Australia post the pandemic.While this is marketed by companies (like Telstra) as them doing us all a favour, the facts remain that they were unable to provide a working from home option in many places like Bangladesh and India, as they do not have the same communication facilities and infrastructure like Australia.

Immigration is something that should not be ignored.

Immigration generally adds 1% to property prices for each 100,000 new migrants that settle in Australia (as stated by CoreLogic and other media sources).

The Australian newspaper stated on 23 June 2023 that:

“For every 100,000 arrivals in Australia, average house prices increase by 1 per cent. Many analysts underestimated immigration last year…”

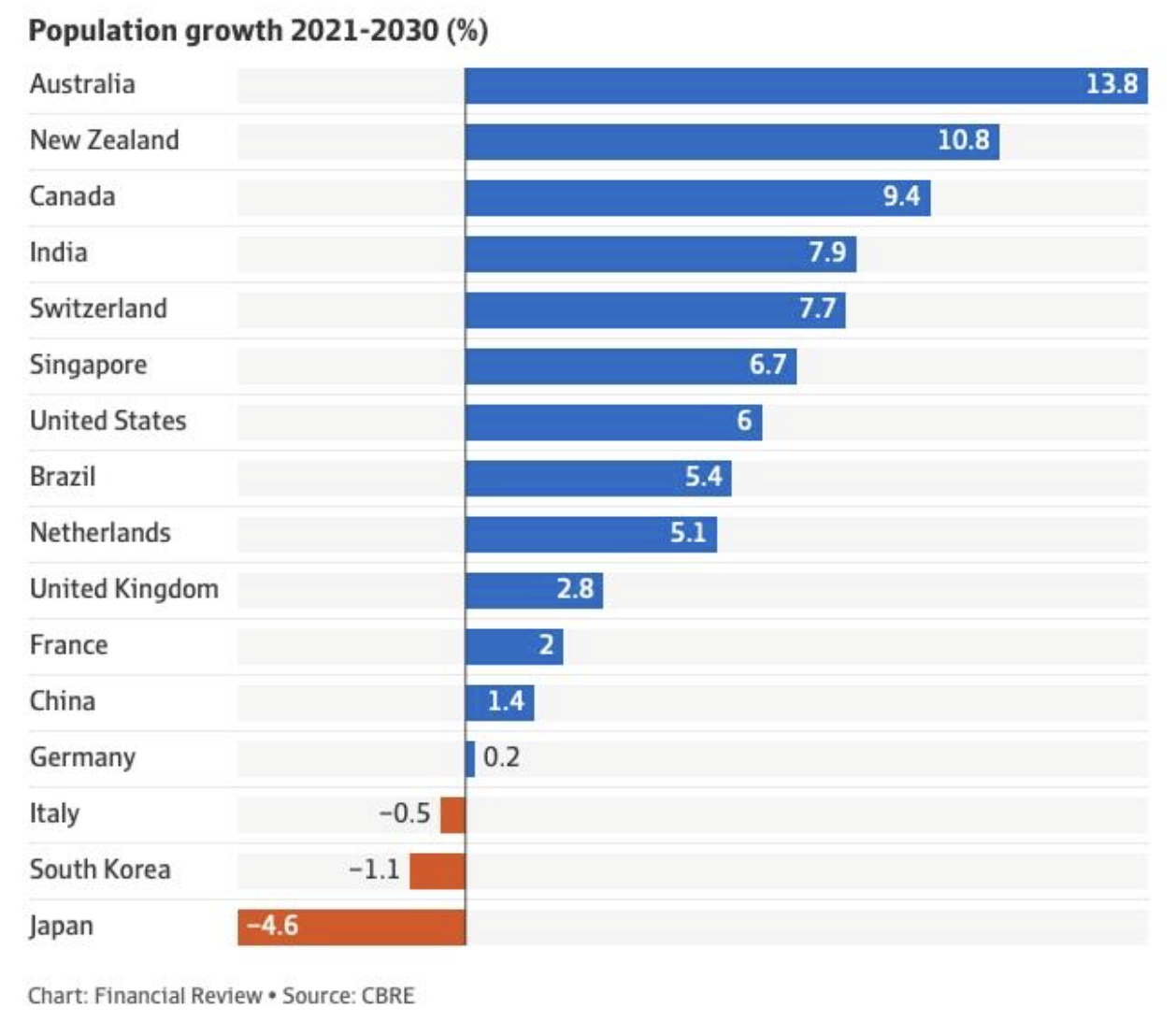

This is where population growth (mainly via migration) is heading:

Even the ABC had commentary on the population growth in early June 2023:

“Overwhelmingly, commentators are calling for governments to release more land, ban NIMBYism and force local councils to rush through housing approvals.

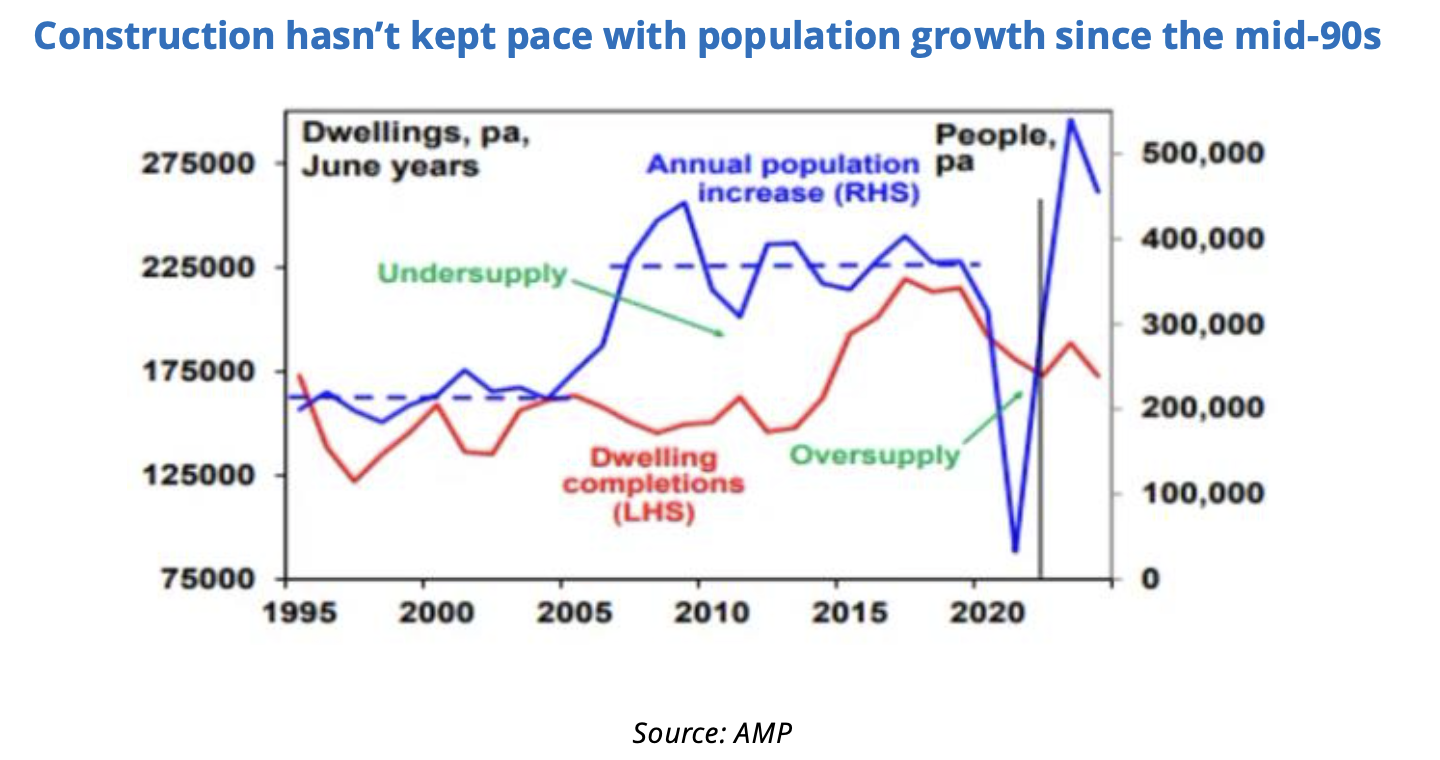

But as the graph below shows, construction hasn’t kept pace with population growth since the mid-90s. Population growth completely overwhelmed new construction from 2005 until the pandemic and once again has blitzed new housing completions.

As anyone who has ever been involved in construction knows, it takes at least a year to build a house and far longer for units, even after approvals have been granted.

And the idea that you could expect entire, well-established neighbourhoods to submit to wholesale demolition to pave the way for new development is completely unrealistic.”

So, on the back of the lower supply and increased demand, the natural position is for house prices, and rents to increase. Rents have been increasing at a larger rate than what has been reported.

The question is now where to from here?

Again, there are differing views, with the two extremes as follows (sourced from Forbes and The Australian Financial Review):

From Forbes dated 22 June 2023

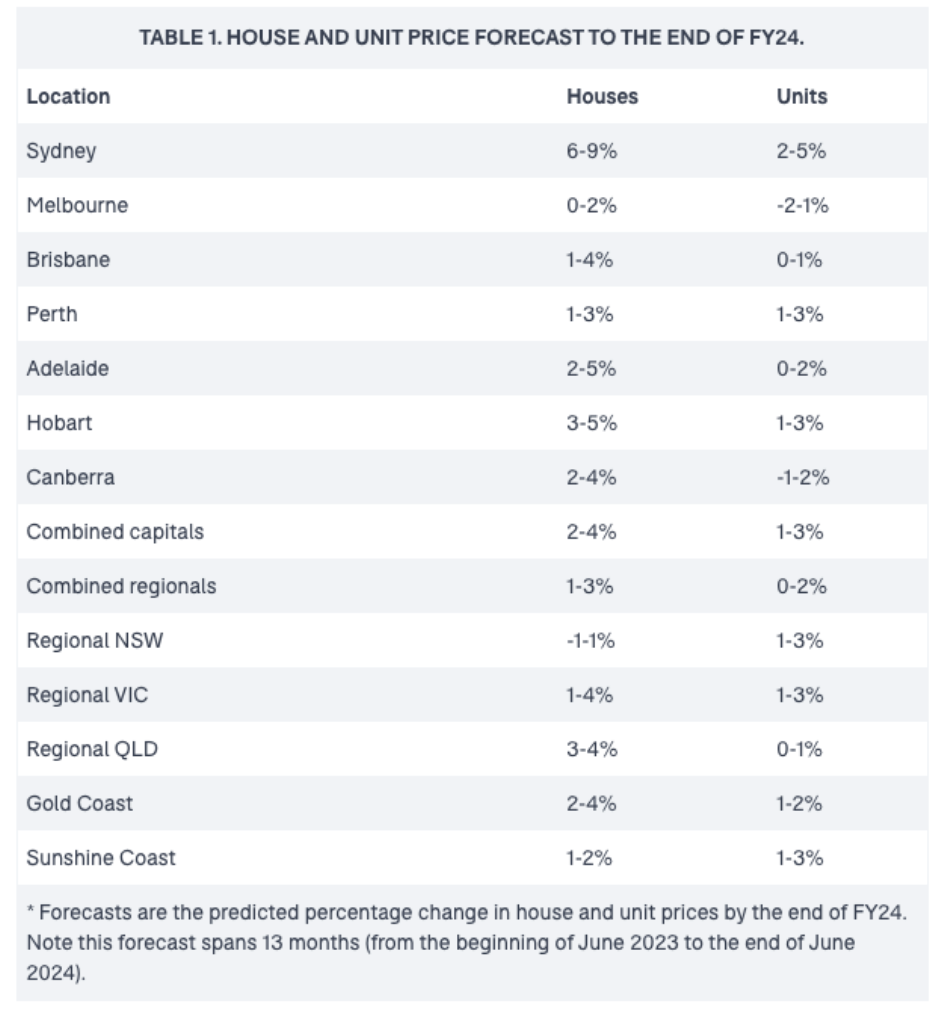

“The Australian property market will continue to shrug off inflationary pressures and the threat of recession to rise in value over the next 13 months, with Sydney house prices rising by 5% to 9% in value.

That’s the prediction of property listings site and research company, Domain, which argues that an influx of migrants between now and the end of June 2024 would act as an accelerant on property values, especially in Sydney, Hobart and Adelaide.

Typically, overseas migrants rent on arrival, but, with a tight rental market Australia-wide, we may see some arrivals transition to home ownership sooner as they seek more stable housing alternatives” the report noted.

“The rise of migrant numbers will also make rentals seem like a better investment option, and the shift to home buying from migrants will exert upward pressure on property prices, particularly in the current under-supplied market conditions.”

Domain forecast prices to rise in Hobart by 3% to 5%, while in Adelaide they will grow by 2% to 5%. Surprisingly, Melbourne, Australia’s second largest city, was tipped to grow by between zero and 2%:

The “centre of positive price gains” will be concentrated in the combined capitals, with a slower pace of growth in units and combined regional house prices.

“House prices in Sydney, Adelaide, and Perth, and unit prices in Brisbane, Adelaide and Hobart, could have fully recovered from the 2022 downturn by the end of the next financial year,” the report states.

“Adelaide and Perth house prices are predicted to rise slowly and may avoid a downturn— but see a period of modest or sideways growth (for which Adelaide is renowned).”

From The Australian Financial Review in May 2023 (post the budget)

Australia’s housing crisis has widened beyond homes being too expensive for first home buyers and young families into a fully blown rental emergency in which only four rental listings – out of 45,895 nationally, by charity Anglicare’s count – are affordable to a single person on JobSeeker.

Of course, migration is playing a role. The federal government’s National Housing Finance and Investment Corporation in March predicted that a slump in new housing construction and growth in migration would widen the shortfall of homes to 106,300 by 2027 from 62,900 last year.

Last month, the agency said the deficit could deepen as a result of bigger-than-expected predictions of migrants.

“We estimate a gap of about 106,000 is going to emerge over the next five years, but … if we do get net overseas migration in the realm of 650,000 over this year and next year, we could see this gap grow to about 175,000,” NHFIC head of research Hugh Hartigan said.

“So, if anything, our numbers are an underestimate.”

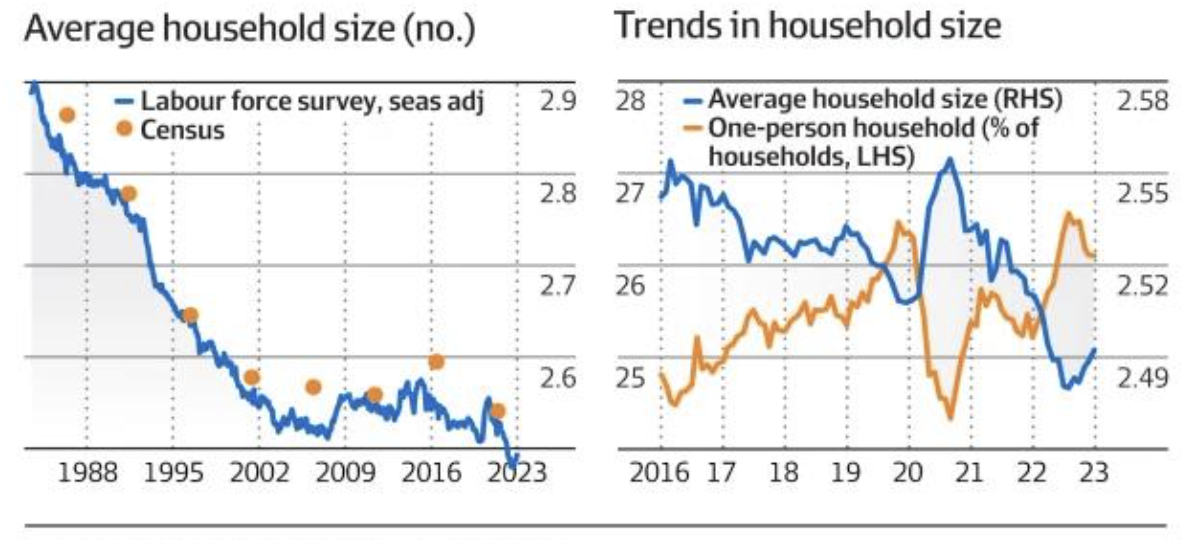

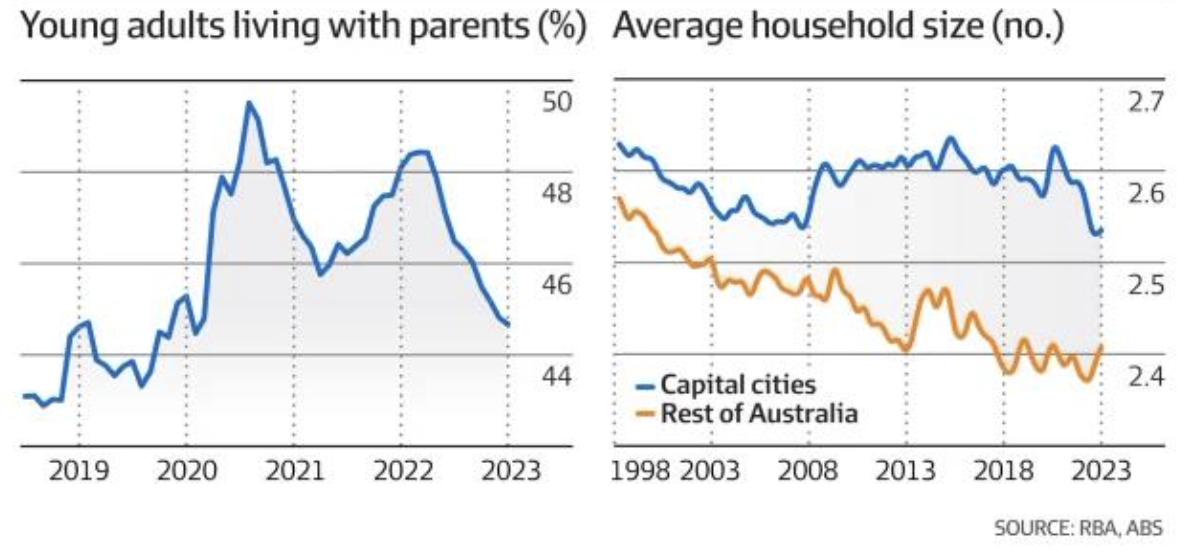

But despite the pick-up in migrants, NHFIC says the fastest-growing type of household over the decade to 2033 would comprise single people, with an additional 533,300 of these created.

Developers are seeing the changes – and responding.

“Housing demand has changed rapidly since the start of COVID,” Andrew Whitson, developer Stockland’s head of residential, told The AFR.

With working from home cutting commute demands, ASX-listed Stockland identified that 20 per cent of its customers who would have bought homes in middle-inner ring suburbs opted for areas further out than they would have previously considered, as it afforded them a bigger home with more space.

People also reconfigured the homes they bought. In the company’s larger off-the-plan houses, home theatres were replaced quickly by more productive uses, Mr Whitson said.

“The media room changed to become a home office,” he said.

Student accommodation operator Scape found demand grew for single-person studio and ensuite apartments during the pandemic and the company, which recently announced an expansion into build-to-rent housing, said changed workplace patterns were also making people demand more space.

“The demand for flexibility in the workplace seems to have reached a new cultural zeitgeist and therefore working from home does mean needing an extra room for the ‘home office’,” said Scape CEO Anouk Darling.

That was likely to remain for some time, Ms Darling told AFR Weekend.

“Until we address the infrastructure issue of the commute – slow and lack of public transport, employees will probably argue greater productivity is enabled by working from home,” she said.

In conclusion

We understand that this doesn’t give any real forecast in resolving the current crisis.

Will housing come to a grinding halt in the next two years or is this is just the beginning of a new bull market?

With the labour shortage likely to continue for some time, being driven by the export markets for Australian natural resources (including forward facing metals), clients should consider all options before making a decision to sell their house without seeking advice first from real estate agents or advisers to be comfortable with their decision(s).

In other times we have seen clients sell out of property to sit on the sidelines and hope that they can get back in and time the market. We usually recommend clients to buy and sell in the same market to reduce the risk of loss.

And finally, always remember that you have us. If you have any queries or need our help, please contact us

See also our other articles on our website relating to markets:

What to do when the next market correction happens and what not to do

Scary Markets, and you’re all familiar with our