What is a Testamentary Trust?

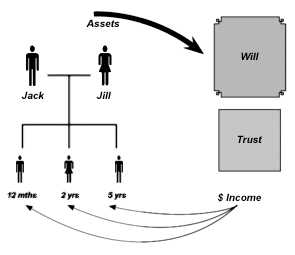

A testamentary trust is a trust established through a will, which becomes effective upon the willmaker’s death. The estate’s assets fund the trust, which offers an alternative to outright gifts to beneficiaries.

The terms of the testamentary trust are defined within the will, including:

- The appointment of trustees (who legally manage the assets).

- The class of beneficiaries entitled to income or capital.

- The distribution rules (fixed or at the trustee’s discretion).

- Timeframes for trust existence, which may last up to 80 years.

Benefits of Testamentary Trusts

1. Flexibility for Minor Children:

– Allows gradual access to inheritance based on age or control milestones.

– Assets are safeguarded until children reach legal capacity.

2. Asset Protection:

– Shields beneficiaries from creditors, legal claims, or personal challenges (e.g., gambling or substance abuse issues).

People in financially high-risk occupations, such as professionals, business owners, and company directors, often prefer not to receive inherited assets directly in their own names.

3. Support for Special Needs:

– Provides structured care for disabled beneficiaries or dependents.

4. Succession Planning:

Trusts can serve as multigenerational estate planning tools, ensuring that wealth is transferred to children, grandchildren, or other heirs.

5. Tax Advantages:

– Testamentary trusts can enable tax-effective income splitting.

– Income distributed to minors under the trust is taxed at standard rates, without the penalty rates applied to most unearned income for children.

Tax Efficiency of Testamentary Trusts

One key advantage of testamentary trusts is their ability to minimise tax liability through income splitting and more favourable tax treatment for beneficiaries, including minors. This makes them a powerful tool for estate planning, especially in cases where beneficiaries have varying incomes or dependents.

1. Income Splitting

Income splitting involves distributing the trust’s income among multiple beneficiaries to ensure that each individual’s income stays within lower tax brackets or tax-free thresholds.

- Tax-Free Threshold: In Australia, each resident individual beneficiary is entitled to a tax-free threshold of $18,200 annually.

- Income Allocation Strategy: If the trust earns income, distributing it equally among multiple beneficiaries can reduce the overall tax burden by ensuring each share remains under the tax-free or lower income brackets.

Example of Income Splitting

Jack included a testamentary trust in his will, earning $72,000 annually. If the trust distributes the income equally among four beneficiaries (e.g., a spouse, Jill and three children), each will receive $18,000.

– Since $18,000 is below the tax-free threshold of $ 18,200 for each person, no tax will be payable.

Without a trust, if the same $72,000 were paid directly to one individual, they would incur a substantial tax liability based on their higher income tax bracket.

2. Tax Benefits for Minors

Typically, minors in Australia are subject to penalty tax rates on unearned income above $416 to prevent income-splitting abuses. However, testamentary trusts are treated differently.

- No Penalty Tax Rates: Income distributed from a testamentary trust to minors is taxed at ordinary income tax rates, just like an adult’s income.

- This allows minors to benefit from the standard tax-free threshold ($18,200) and lower marginal rates on income beyond that amount.

3. Multi-Generational Tax Planning

Testamentary trusts can also accommodate multi-generational income splitting. The trustee has the discretion to distribute income among not only immediate beneficiaries (e.g., a spouse) but also children, grandchildren, or other dependents, thereby maximising the tax-saving potential across generations.

4. Capital Gains Tax (CGT) Management

Testamentary trusts can efficiently manage capital gains tax (CGT) by timing asset disposals or distributing capital gains to beneficiaries with unused CGT concessions or lower tax rates. This ensures that gains are taxed more favourably, reducing the estate’s overall tax burden.

5. Flexibility with Income Distribution

Trustees can adjust income distributions annually based on changes in beneficiaries’ financial circumstances, tax law changes, or family needs. This year-by-year flexibility ensures the trust operates efficiently and aligns with both the willmaker’s intent and the beneficiaries’ changing financial situations.

Potential Drawbacks and Considerations

1. Complexity:

– Testamentary trusts require clear and precise drafting of wills.

– If provisions are unclear or overly complex, the willmaker’s intent may be misunderstood, leading to challenges or disputes.

2. Beneficiary Preferences:

– Some beneficiaries may prefer a direct inheritance rather than a trust-based distribution. In such cases, the willmaker can include a clause to offer beneficiaries the option to receive their share outright.

3. Administrative Burden and Costs:

– Trustees are responsible for maintaining proper accounting, lodging tax returns, and meeting legal obligations, which can result in ongoing administrative costs. The trustee/executor can get assistance with these obligations from experts in the field (such as AustAsia Group). While the structure provides significant benefits, the costs of such obligations may outweigh the benefits and so should be considered when the beneficiary decides to implement the testamentary trust for their share of the estate.

4. Professional Advice Recommended:

– Due to the complexity of testamentary trusts, legal and financial advice is essential to ensure the will is appropriately structured and aligns with the willmaker’s wishes.

Conclusion

Testamentary trusts are tax efficient, making them valuable estate planning tools, particularly for families with minors or multiple beneficiaries. Through income splitting, favourable minor tax treatment, multi-generational planning, and capital gains management, the trust helps reduce the overall tax burden, ensuring beneficiaries retain more of their inheritance. However, trustees must carefully manage distributions and seek professional advice to maintain compliance and optimise tax outcomes year after year.

Need more information?

If you have any questions or need more information, please contact us.